Tesla Investment Idea

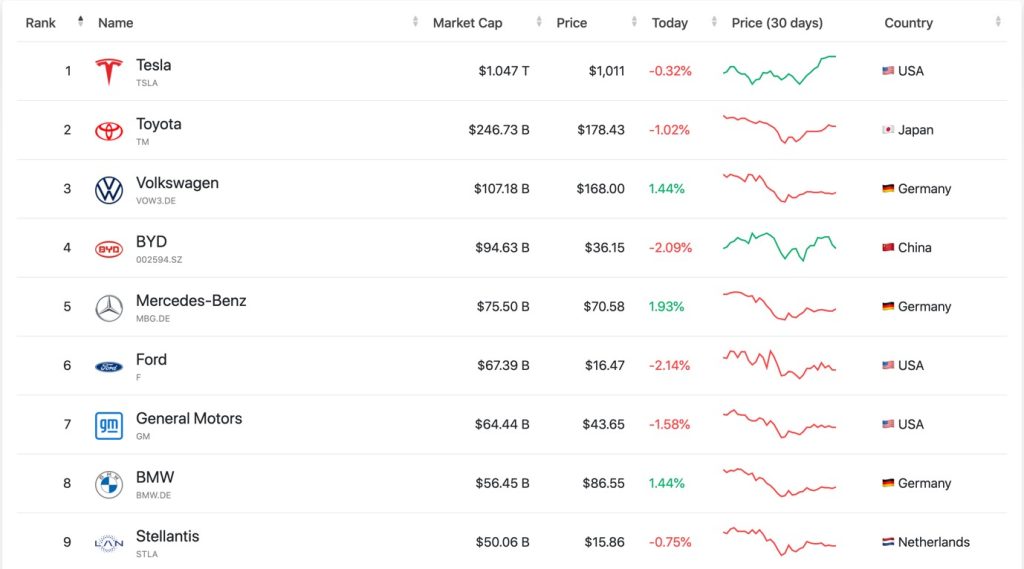

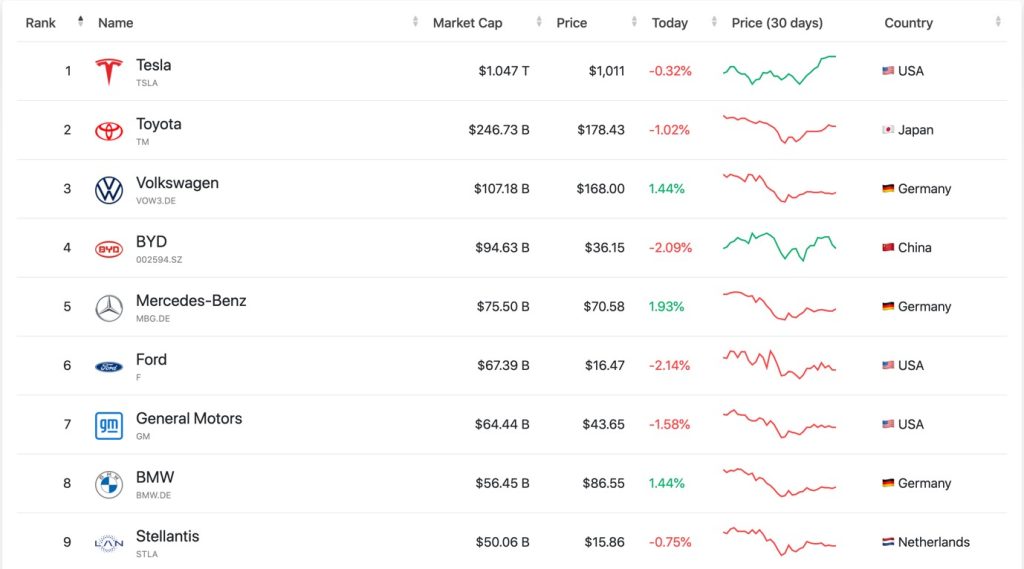

I have written about the proposed stock splits by Alphabet Inc (GOOGL) and Amazon.com Inc (AMZN) following a pandemic-induced rally in technology shares. My attention now turns to the mighty Tesla. Tesla, who debuted in 2010 at $17 per share, continues to be regarded by many critics as a failure despite currently trading above $1,000 per share again. After the stock split in 2020, the share price jumped 128%, boosting the market capitalization to $1 trillion once again and making the company the biggest automaker in the US. The market cap of Tesla dwarfs that of the total incumbent car manufacturer sector, which includes Ford, GM, and Volkswagen.

Tesla Inc. (TSLA) shares rose by 5% in pre-market trading today on the news that it will increase its number of shares to enable a dividend stock split. The proposal has been approved by the company’s board, and shareholders will vote on it at the annual meeting. Should the stock split be approved, it will be the latest stock split after a five-for-one split in August 2020 made Tesla shares more affordable to employees and investors.

See real-time quotes provided by our partner.

As Elon Musk opened Tesla’s first manufacturing facility in Europe last week, the shares of Tesla also soared. Musk made the front page of financial media when he was seen dancing as he presided over Tesla’s first German-made cars being delivered to 30 clients and their families at the 5bln euro ($5.5 billion) production plant.

Its electric cars are among the most popular and the company has delivered nearly a million annually while ramping up production in the U.S. and Europe. Nevertheless, competitors like Ford (F) and Rivian (RIVN) are entering the market, giving consumers several new choices.

It is not all good news today though. The factory in Shanghai is to be closed for several days as China lockdown areas that are affected by the latest wave of COVID-19. Tesla’s factory is in the Lingang district of Pudong, which is part of Shanghai’s first lockdown stage.

Lockdown began early today and is expected to last until Friday morning. This is the second time a shutdown has occurred this month. After Shanghai implemented strict movement controls and carried out mass testing in mid-March, Tesla suspended production at its Shanghai factory for two days.

The start of 2022 for Tesla wasn’t great for investors who saw their holdings diminish as the price action came down to test $700. This also happened to be a deep retrace on the Fibonacci retracement tool so traders would have been anticipating a buying opportunity there. And now there is very little resistance on the monthly chart to stop the price from reaching all-time highs and beyond.

The overall market sentiment is mixed though as uncertainty still lingers following Russia’s invasion of Ukraine. The S&P500 contrarian signal is to go long, which would support buying Tesla and the Nasdaq of which Tesla is a major part of, is currently showing a contrarian signal to sell. The American Association of Individual Investors show as many members are on the fence as they are bearish or bullish, so it will be interesting to see which way the neutrals swing.

See real-time quotes provided by our partner.

Knowing that share prices do very well after a stock split gives me hope that the share price of Tesla once again comes back down to a discounted price level. Somewhere between 800 & 900 would be a great bullish buying opportunity with the break of a daily swing low price as a signal that the market is not quite ready yet.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.