Sentiment towards a number of FX pairs is increasingly interesting as the FX starts to break higher against the US dollar. Now is a great time to check out some of the most extreme sentiment traders who look for contrarian trading signals via sentiment readings.

The trading sentiment is most effective when retail traders are running counter-trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd is being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some of the strongest sentiment biases amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking points and big moves may be nearing.

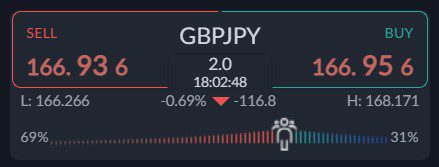

GBPJPY – More Upside

According to the ActivTrader Market Sentiment tool a large majority of traders are now bearish towards the GBPJPY pair as it starts to move above the 167.00 level.

The ActivTrader Market Sentiment tool shows that only 31 percent of traders are expecting more upside in the British pound against the US dollar. Given that bearish bias we usually see the market heading higher under these conditions.

It should be noted that sentiment is very crucial for the GBPJPY pair as we typically look to fade extreme sentiment biases in the stock trading industry.

USDCHF – Still one-sided

The ActivTrader market sentiment tool shows that only 19 percent of traders are bullish towards the USDCHF pair as it continues to race higher on the FX market.

The sentiment bias certainly alludes to more upside trading, however there is now huge one-sided sentiment so more than anything an explosion higher is likely.

I think we are about to see the USDCHF pair tackle the 0.9600 level given the extreme sentiment bias currently in play.

EURUSD – Gains likely

Market sentiment towards the EURUSD pair is slightly bearish, which is a bad sign for bears as one-sided sentiment skews tends to mean the opposite in terms of what traders are expecting.

The ActivTrader market sentiment tool showing that only 45 percent of traders currently bullish towards the shiny metal. This is a big increase since last week.

I think it is worth noting that the more traders turn bullish then the downside should only accelerate onwards.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.