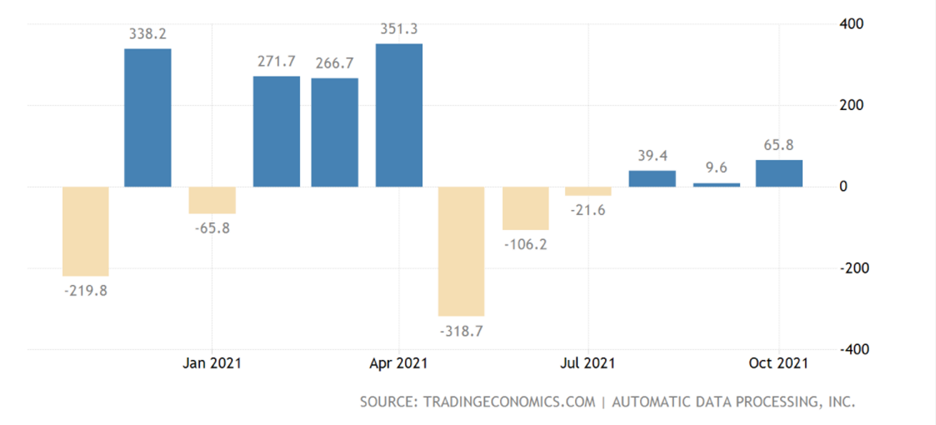

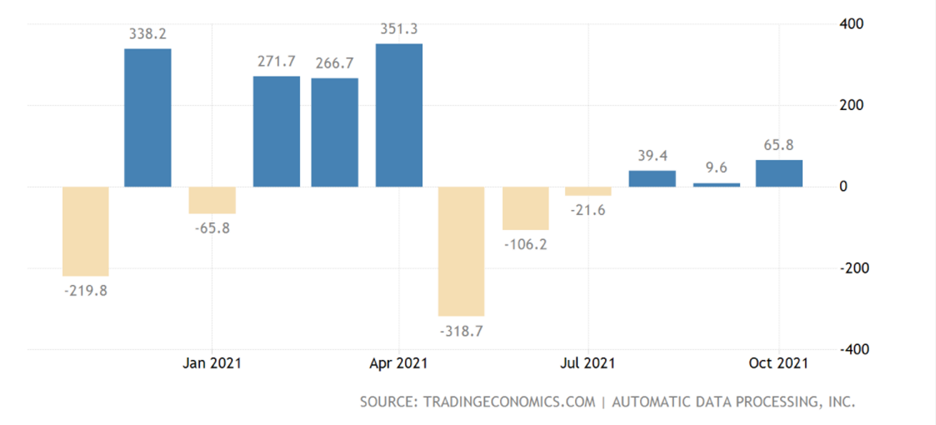

The US dollar hit a new monthly high against the Canadian dollar yesterday, following a much better-than-expected ADP jobs report from the Canadian economy, with 65,800 new private sector jobs created.

On Wednesday after the release of slighter softer than expected inflation data from Canada the USDCAD pair had started to correct lower, however, the recent uptrend never looked dully done.

We have seen a slight shift in thinking this week, with some scaling back of rate hike expectations due to core CPI not hitting analysts targets, however, headline inflation did still accelerate to 4.7%, so there is pressure on the BoC to continue normalizing policy after bringing QE to an end last month.

USDCAD bulls have reason to be nervous as crude oil fails to take meaningful dive and is returning to the $80.00 level. The risk is the Loonie could take a further hit if crude take a shot at $90.00 for oil prices into year-end.

The US dollar index is equally as interesting. The US dollar index is not yet starting to show signs of upside exhaustion, and after breaking to new 2020 high highs.

If we see a move above the 1.2640 level this should cement more gains, however, failure hear, and we could see the USDCAD pair faltering. Much will depend on oil price and the US dollar index.

Relatively high levels of positive sentiment are still seen towards the USDCAD pair, with some 61 percent of traders holding a bullish view towards the USDCAD pair. This bullish sentiment is a warning of mild losses ahead.

USDCAD Short-Term Technical Analysis

The four-hour time frame shows that a large head and shoulders pattern continues to form, with the latest rejection from the 1.2650 area helping to form the bearish price pattern.

Significant amounts of bearish MACD price divergence have formed during this recent price rise and extends towards the 1.2300 support area. Watch out for further losses if the head and shoulders pattern play out.

See real-time quotes provided by our partner.

USDCAD Medium-Term Technical Analysis

A bearish double-top continues to loom over the USDCAD pair, with the recent series of upside failure above the 1.2900 resistance levels helping to shape the bearish double tops.

Much will depend on oil prices and the breakout in the US dollar index over the coming days to determine whether the bearish double-top pattern holds or is actually broken. Keep your eyes on the 1.2690 level.

See real-time quotes provided by our partner.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.