Market Brief

According to GfK’s survey for March, consumer confidence came in under analysts’ expectations. Consumer Confidence sank to -31 points, a decline of 5 points over the previous month to levels last seen in late 2020 during Coronavirus lockdowns. The data shows that consumers feel a sense of crisis now, according to GfK’s client strategy director Joe Staton. It stands to reason those consumers are going to be more defensive, as existential threats that could lead to World War 3, a nuclear escalation, and diminishing fuel supplies pumping up inflation are going to affect the mindset of the average person. Not only that the Bank of England is in a rate hike cycle and payments on debt are increasing. Consumers are going to pull back from big-ticket item purchases as they worry about how to buy the essentials.

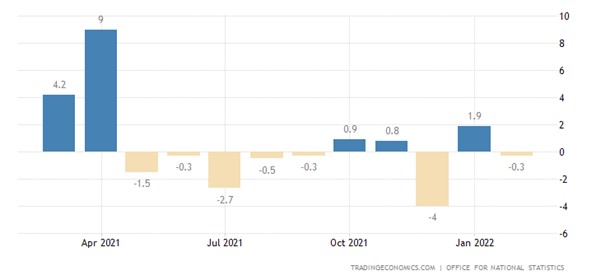

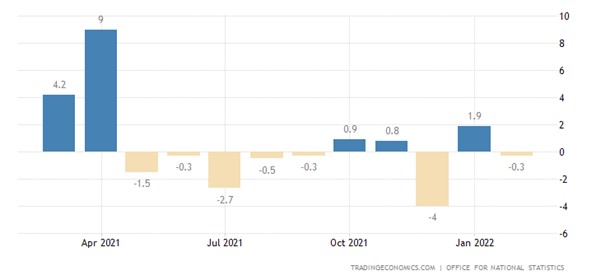

According to the Office for National Statistics on Friday, retail sales in the United Kingdom decreased 0.3% in February from the previous month. Retail sales fell short of expectations. Though sales in the United Kingdom increased 7.0% year over year.

See real-time quotes provided by our partner.

The UK FTSE is trading within a consolidation pattern and a break either above or below the high and low of the 23rd of March could signal the direction of the next leg. In the run-up to this pattern, the move was impulsive and bullish, so I am now expecting a continuation higher.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

The pound is still clearly within a downtrend but we’re waiting on further directional moves from the US dollar crosses. The US dollar broke lower through the rising channel as expected but found support at the $98.40 level and a demand zone from the 23rd of March. We’re waiting to see if the intraday structure from yesterday holds as resistance as the greenback tests $98.60. Central bank speakers today include the Fed’s Williams and Barkin. The possibility of a 50bp hike at the Fed’s next meeting in May has not been ruled out. This forward guidance is likely to support the benchmark yields and keep the dollar from falling too far.

See real-time quotes provided by our partner.

There was a comment this morning about a softening in the Russia/Ukraine negotiations, with a chance of a breakthrough. On this, the price of oil fell nearly 1%, with WTI crude futures around $111 a barrel and Brent crude at $118 a barrel. The US and its allies are discussing a possible further coordinated release of oil from storage to help calm markets roiled by the Russia-Ukraine conflict and Europe is closing in on a deal with the US to import Liquified Natural Gas (LNG) from them as the trading block turns away from Russian supplies. If the price of LNG can come down in Europe this would pull some of the bids from under Brent as power producers could afford to go back to using gas.

See real-time quotes provided by our partner.

For the avid reader and watcher of our content, you may already be in the USDCAD long trade off the test of 1.2517 as it was a daily high and obvious support level. If we were to see USDCAD rise back up to the highest imbalance area and test the 1.2760 level, that would be a RRR of 3.5 assuming your SL is below the double bottom at 1.2450 from early 2022.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.