Market Brief

Rising Covid cases in China and a false start in the reduction in US-China trade tariffs being unwound has put a stop on the bounce back in the major equites’ indices. Those trying to keep the bullish momentum going at the start of the London session include the Nasdaq futures and the German DAX. The FTSE is lower as news comes out the UK government plans to introduce a bill to override the Northern Ireland protocol in the Brexit deal within three weeks.

See real-time quotes provided by our partner.

The pound is still relatively string against the US dollar despite the Brexit/N.I. uncertainty as GBPUSD trades around yesterday’s high and near the liquidity above 1.2630. This morning’s early UK data included UK government borrowing for April. This came in close to expectations and down from £23.4bn at the same point a year ago.

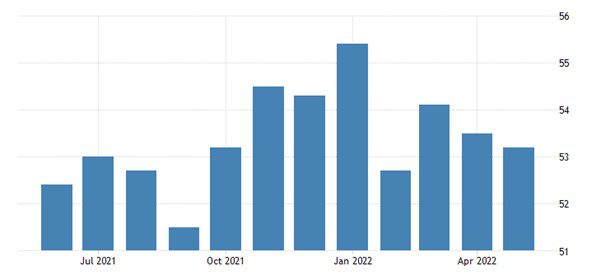

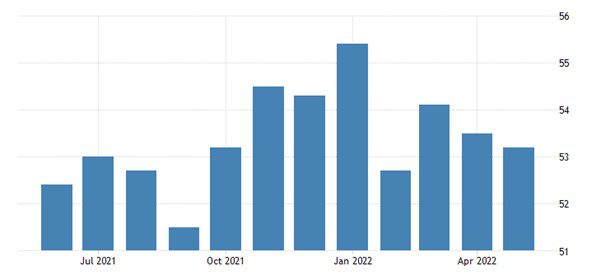

Yesterday we highlighted today as being all about new information that will come from the Flash PMI’s. We have European, UK and USA flash data today, so I am expecting some volatility at the data release. However, tomorrow the markets focus will be on the FOMC meeting minutes, so we must prepare for a spike and retrace in most major forex pairs today. The May readings will again be impacted by the Ukrainian crisis and by Covid restrictions in China but, overall, expectations are for some good numbers.

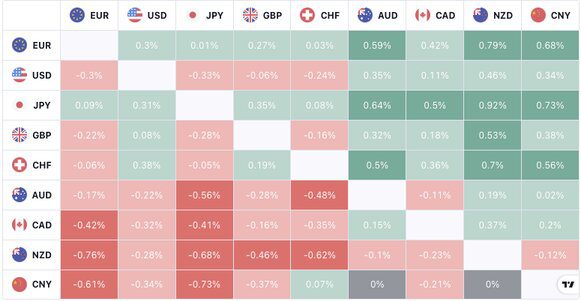

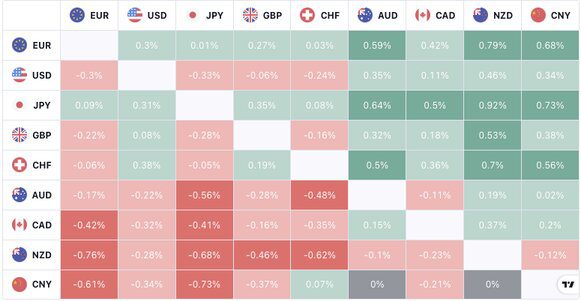

The NZDUSD is trading inside yesterday’s range ahead of the upcoming RBNZ rate decision. The worry is that the RBNZ don’t deliver on the expected 50bps and maybe drop down to 25bps. The forex heatmap also shows that the commodity pairs are losing out to the safe havens of the Japanese yen and Swiss franc, while the euro gains ahead of the days coming data. The euros move seems to be stemming from the publication of a blog post by European Central Bank President Lagarde, which pointed to interest rises of 50bp by late September.

The yen’s rise despite the drop in Japanese Jibun Manufacturing PMI data signals that the market is worrying about other geopolitical concerns, which will include the war in Eastern Ukraine and Chinese lockdowns.

Today is going to be full of Flash PMI data but also central bankers speaking at different events. The last to speak will be ECB President Lagarde at 7pm (BST) but before that we have Fed Chair Powell providing a pre-record statement at 5.20pm (BST).

See real-time quotes provided by our partner.

The US dollar index is now trading below $102 having found resistance from the previous market structure low. This opens a move lower towards $100 and the March-April balance area. A lower US dollar will help lift the commodity pairs assuming the Flash PMI’s from around the world come in as expected, so I am hoping the late London session, into the US session becomes more risk-on.

See real-time quotes provided by our partner.

I’ll be keeping an eye on yesterday’s low in the S&P500 as that may be the early signal that the bullish sentiment, or relief rally is fully over in the US equities. If we can trade above yesterday’s high without breaching the low this will be the 3rd consecutive day of higher highs and higher lows but will be running into the 4004.16 key resistance level from the 17th of May.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.