Market Brief

See real-time quotes provided by our partner.

In today’s London session, global equities are mixed, although Hang Seng leads the Asian equity markets higher. The Hang Seng index is rising towards the significant swing high of 22663, which had been a reaction level in April when price met old support that became resistance. Yesterday the World Bank revised its growth forecasts for the global economy yesterday, citing concerns about high energy and food prices, supply-side disruptions, and increased monetary policy tightening. The Australian ASX dropped the most overnight and is trading at the London open lower by -1.53%. Out of hours, the Nasdaq, which has been affected by inflation worries, is the only major US large-cap index that is higher.

See real-time quotes provided by our partner.

UK stocks fell on reports the UK government will propose legislation to override the Northern Irish protocol in the Brexit deal. It has been reported that this will be introduced to parliament today or tomorrow, but others claim it will be delayed until the following week. Once again, the UK is under a cloud of uncertainty, and this is the one condition guaranteed to keep the UK markets down.

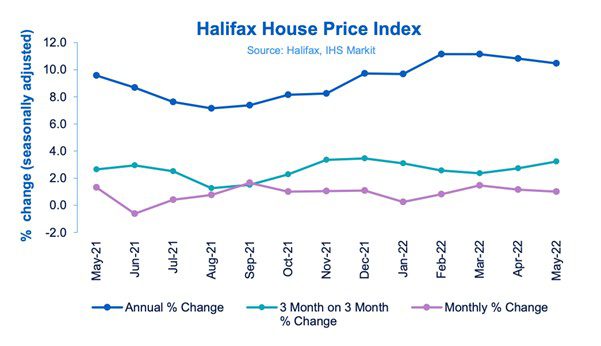

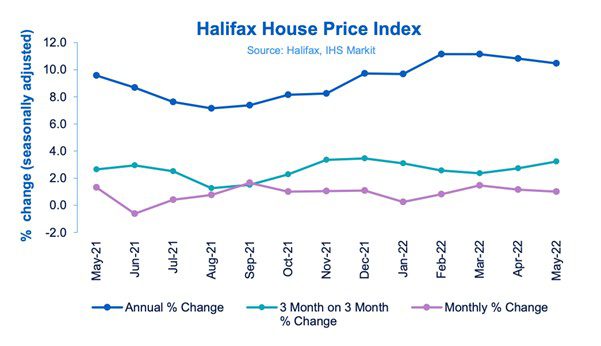

There is little data scheduled for today. This month’s Halifax House Price Index (HPI) for the UK came in higher than expected. May 2022 saw house prices 10.5% higher than May 2021. PMI construction for May will provide an update on an economy that is highly cyclical and sensitive to interest rate changes. The survey showed, as of April, that activity in the sector was still high, but that growth was slowing.

In the Eurozone, German industrial production came in lower than expected and the previous months data was downwardly revised. The silver lining is that this month’s data point was positive at 0.7 after the -3.7 reading a month prior. Later today we receive the European revised Q1 GDP.

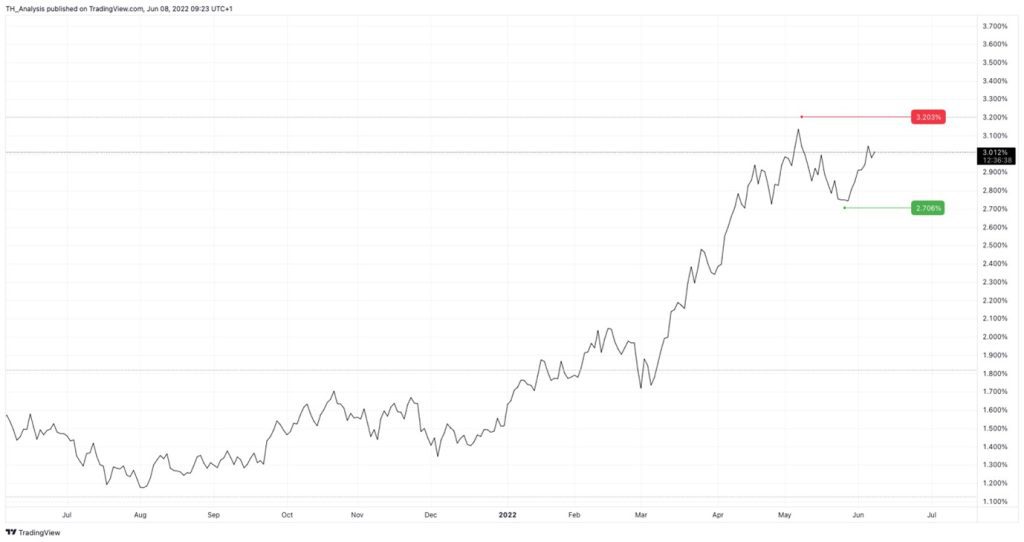

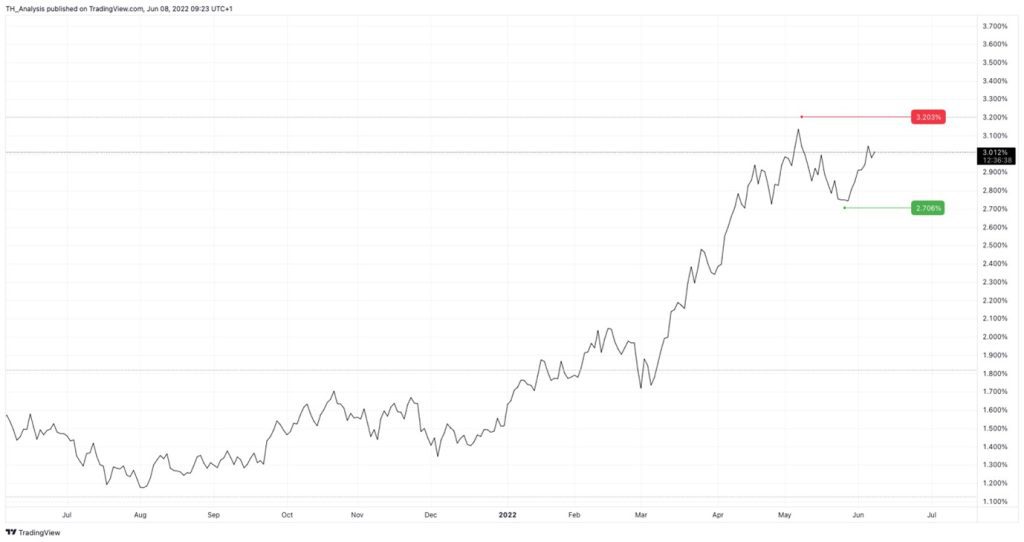

In the wake of the policy update from the European Central Bank tomorrow, the yields on US Treasury bonds have rose again overnight. I am expecting a slow day today in the major forex crosses while we await tomorrow’s news update from the European Central Bank and Friday’s US inflation report. The Bank of Japan’s Governor said that the rapid weakening of the JPY as seen recently “is undesirable”, and that various macroeconomic models show that a weak JPY is positive. From that I take it that a weaker JPY is the way things are supposed to go but the central bankers would prefer a steady fall. Not a collapse.

See real-time quotes provided by our partner.

The US benchmark yield strength, combined with the higher prices in energy are keeping the USDJPY moving higher. There is a US 10-year Bond auction tonight and this has been a catalyst in the past for the US indices as they react to the fixed income markets. It could also be a turning point for the USDJPY. So something to lookout for.

The last two weeks in USDJPY has seen a basing around 126, and I have an upside target of 135.10 which is the January 2002 swing high. Being short the yen is the only trade that is really working out currently, so buying the dips in the GBPJPY, EURJPY or USDJPY is they occur is one strategy. The other is to wait for a consolidation and then take the breakout trade higher.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.