Market Brief

The UK unemployment rate dropped in March to 3.7% just as average earnings rose above expectations. A tight job market and rising inflation is going to support a higher wage spiral unless the Bank of England can do something to destroy demand in the same way that the Fed Chair Powell said the FOMC would be targeting demand, as they have no control over supply.

See real-time quotes provided by our partner.

The GBPUSD intraday chart shows how after the FOMC and Bank of England rate decisions the pound dropped against the dollar. The rise that started yesterday could be targeting the liquidity above the 1.2400 level, but should it accelerate through that zone and get back above the 1.2600 we could have a lot of trapped short sellers closing out which will then keep the rally going. The downside has been fuelled recently by higher inflation, which has been causing slower economic growth. If we get a couple of quarters with negative GDP this could then lead to a more dovish central bank, thus weakening the currency. There will be UK inflation data out this week which is likely to push double digits and MPC member Cunliffe will have his speech picked over today for signals of whether he supports a 5th consecutive rate hike in June, having been opposed to the March rate hike.

See real-time quotes provided by our partner.

The AUDUSD broke out of the descending channel and now that the market has had a chance to digest the latest RBA meeting minutes, we are just waiting to see what the US dollar does following Fed Chair Powell’s speech later today. Because there is not a lot in this week’s economic calendar, todays Fed speeches will most probably be the biggest market moving event and set the tone for the rest of the week. The RBA meeting minutes stated that the members agreed further rate hikes would be required to ensure inflation returns to target and that the Australian economy is showing resilience which is particularly evident in the labour market. With both the RBA and Fed raising in the future we could get a sideways move in the AUDUSD until a noticeable divergence in policy emerges.

See real-time quotes provided by our partner.

The USDCAD has dropped to 1.28179 as the cost of Brent has risen to $113.11. Oil is being supported by the uncertainty in Ukraine and due to the Finish and Swedish moves to join NATO. The worries around global energy demand are diminishing as China COVID cases outside of the quarantine zones remains at 0.

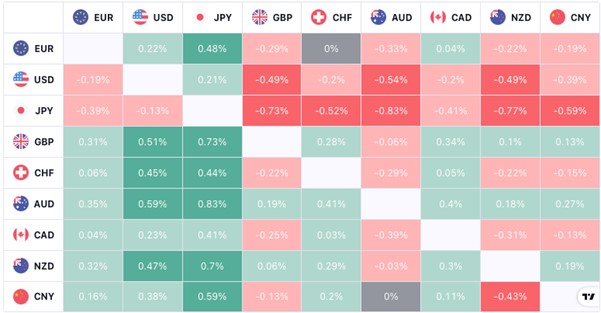

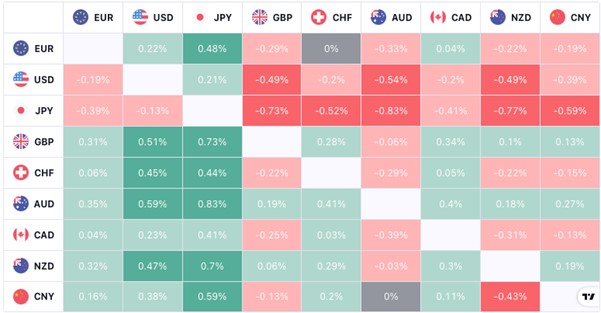

The forex heatmap is showing the London session starting with a green lower left corner and a relatively red top right corner. The yen is the weakest currency at present, but the Swiss franc is not backing up the risk-on sentiment just yet. I would expect the market to stay at current levels until after the Fed speakers today, but if we do get some moves the problem will become the choppiness and reversion to the mean trades, which tend to trap traders on false breakouts.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.