Market Brief

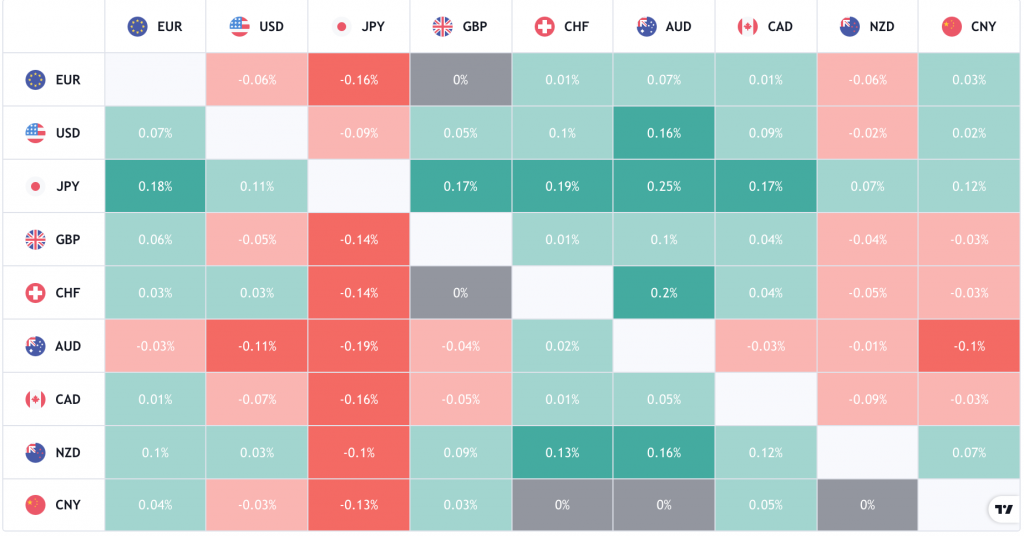

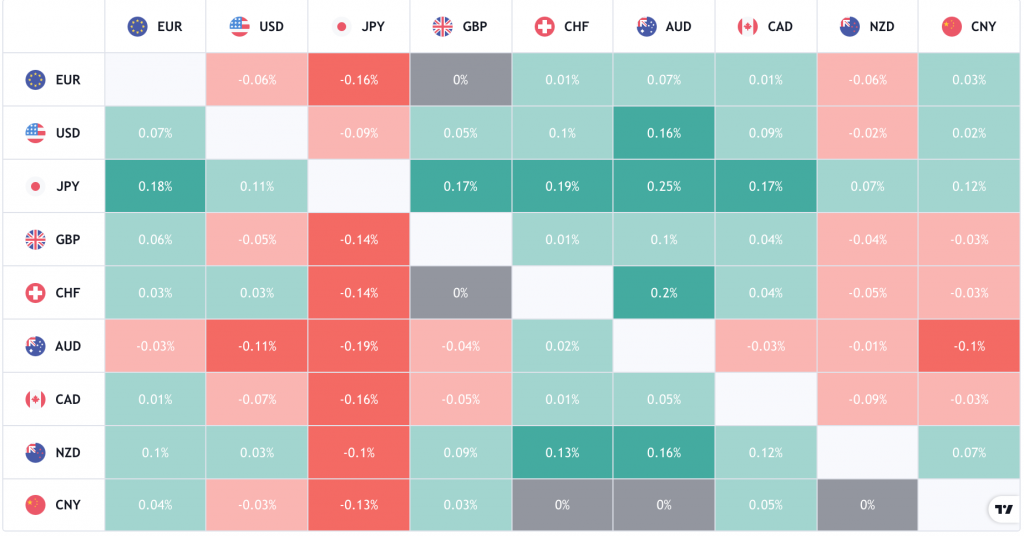

The overnight session has been busy with data coming from New Zealand, Australia and Japan. At the time of writing the yen is the strongest currency going into the London open but once again it is not a clear risk-off day. Yesterday started off bearish for the US equities markets but a rebound that lasted into the close failed to follow through into the Nikkei225 and Hang Seng which are down -0.52% and -1.84% respectively. Worries around the debt troubles of Evergrande may have pushed Asia-Pac markets lower with the founder’s wife reported to have invested $3mln for wealth management products to ease investor concerns. Small potatoes when you consider the company is trying to refinance hundreds of billions of debts. The investors in Evergrande could be liable for a 75% haircut to stop millions of Chinese homeowners from financial ruin. This is all coming about as the Chinese authorities have been cracking down on industries, adding regulation and breaking up companies in a bid to limit risks and to change the broader corporate operating environment. Ant group’s Alibaba and Alipay are inline to be broken up into different companies which will weigh on the stock markets if this comes to fruition.

See real-time quotes provided by our partner.

The Australian dollar is one of the weakest currency pairs this morning with the yen the clear leader in strength. Looking at the AUDJPY chart the retracement is coming into some key fib areas, which buyers may be lingering at. If they do step in at say the 61.8% Fibonacci retracement level, there is a possibility that the inverse head and shoulders pattern plays out, which would be a bullish reversal.

See real-time quotes provided by our partner.

The Australian dollar is struggling to get above the moving averages on the daily chart as they continue to offer dynamic resistance. The US dollar index is holding up well ahead of next week’s FOMC meeting, and the Australian data out overnight did nothing to move the needle for the bulls. The Australian jobless rate is at the lowest level for nearly 14 years and Australian new home sales pushed higher by 5.8% month-over-month.

See real-time quotes provided by our partner.

The weekly New Zealand dollar chart looks like a bull flag which could be nearing a breakout to the upside. New Zealand GDP data came in better than expected but after the initial pop higher on the news, the Kiwi drifted back lower.

The ActivTrader sentiment indicator shows that an extreme number of traders on the platform are bearish the NZDUSD with 81% thinking the Kiwi should come lower, which is a reason to look for longs.

Later today ECB President Lagarde is to speak at an event in Paris where she is likely to re-iterate what was said around the recalibration of PEPP into December 2021. Then in the US session there will be important US data from the Philly Fed Business Index, Retail Sales and the Initial Jobless Claims.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.