Market Brief

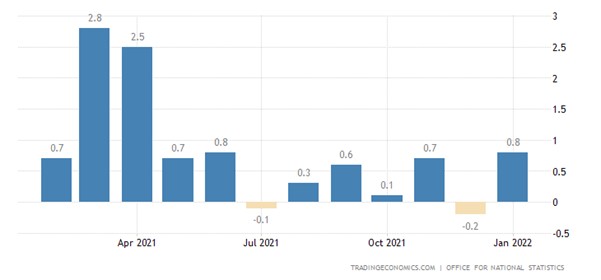

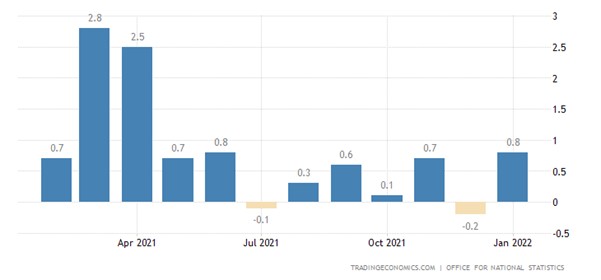

According to a preliminary report published this morning by the Office for National Statistics (ONS), the United Kingdom’s gross domestic product (GDP) increased by 0.8% in January compared to December 2021. GDP was 0.8% higher than pre-pandemic levels and was above expectations. Production increased by 0.7% and construction by 1.1%, respectively, while the services sector grew by 0.8%. In addition, manufacturing grew by 0.8%. In the three-month period ending in January, the UK economy grew 1.1%.

See real-time quotes provided by our partner.

The UK FTSE100 had swept the levels of support around 6800 and bounced from the imbalance formed in April 2021. Technically this chart is bearish on the daily time frame until we start making higher highs and higher swing lows. With the FOMC and BoE likely to start and add to their rate hike cycle respectively my worry is that the market will react poorly to the lack of accommodation within the monetary policy during times of uncertainty. There could also be a flight to safety and the Bonds which will be yielding a higher interest rate than before, meaning the riskier equities look less favourable.

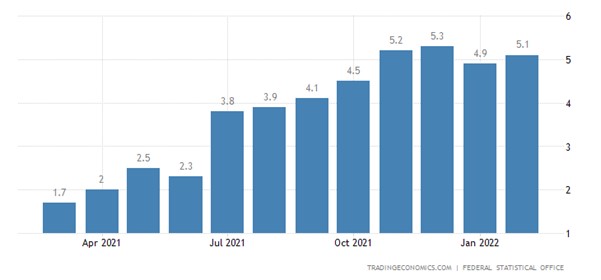

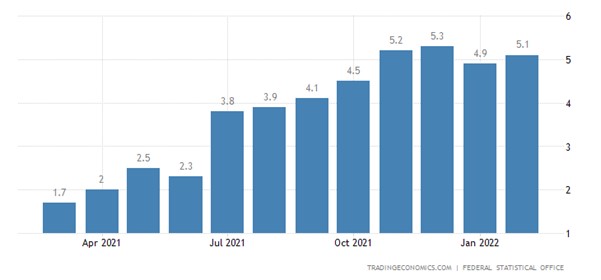

Germany’s inflation rate in February was 5.1% year-over-year, according to a report released by the Federal Statistical Office (Destatis). As expected, the figure outperformed the Consumer Price Index (CPI) for January, which stood at 4.9%. In February, the harmonized index of consumer prices grew 5.5% year-over-year, while it grew 0.9% over January.

See real-time quotes provided by our partner.

The DAX had dropped over 20% from its highs, which means a deep correction could have completed. Much like the FTSE100, I am not bullish this index until we see some buyers confirm they are in control with higher swing highs and higher swing lows.

See real-time quotes provided by our partner.

The EURUSD having trapped retail traders long following the announcement from the ECB yesterday which MSM said was more hawkish for the euro, I am now waiting to see if there is a bullish rejection off Tuesdays high. My base-case scenario is that the euro collapses further but we must respect that this is being moved on sentiment around the developments in Ukraine.

See real-time quotes provided by our partner.

President Biden said that increasing crude oil production within the United States is a priority for the US administration. By the end of 2022, he said, the country would have generated more oil than it has “any time in the last number of years.” Biden also rejected the criticism of his decision to ban purchases of Russian oil, gas, and coal due to Moscow’s military operation in Ukraine. “War is not the time to make profits,” Biden said. Recent analyses by the US Energy Information Administration (EIA) forecast domestic production in 2022 at 12.3 million barrels per day, an increase of 60,000 barrels compared with last month’s estimate.

The US could stop exporting oil to ensure they are energy independent too and traders are now caught in the headlights of two opposing forces. Will there be demand destruction from a prolonged war and a change in monetary policy that leads to a global recession, with also the possibility of new supply coming from the US domestic producers, UAE, Iran, and Venezuela. Or will the time it takes to get more oil online in the US be too long and the ban on Russian fuel, the lack of will from OPEC+ to increase production lead to tighter supplies and rise in fuel prices?

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.