Morning Brief: 12/04/2021

The market has had a quiet start to the new trading week, with most FX major pairs confined to relatively narrow trading ranges and Asian bourses turning into the red. US futures are performing better, as the Dow Jones Industrial Average looks set to open nearly one percent in the green.

In terms of FX, the DXY is slightly higher at the start of the week, the USDJPY pair is suffering due to a decline in the Nikkei225. The EURUSD pair is trading around its key 200-day moving average, while sterling remains under pressure following another bearish weekly price close last week.

See real-time quotes provided by our partner.

Bank of America Merrill Lynch has put out a note this morning that is capturing a lot of market buzz. The bank has noted that the ongoing dovish tilt from the Federal Reserve and the European Central Bank is not sustainable.

More broadly, Bank of America Merrill Lynch noted that they are “Getting concerned that a sudden shift could shock markets.” The bank also said that “The US economy is already booming, with the NFP and ISM well above expectations, while the vaccination programme is also accelerating even faster than expected”.

See real-time quotes provided by our partner.

US Federal Reserve Chair Jerome Powell has also been out on the wires this weekend. Chair Powell, speaking during a TV interview, said “We feel like we’re at a place where the economy is about to start growing much more quickly and job creation coming in much more quickly, so the principal risk to our economy right now really is that the disease would spread again.”

Gold is on many traders watch list this watch. The yellow-metal failed to gain traction above the March swing-high last week and has been smacked down below $1,740. Gold and silver are notable lower this morning.

Both WTI oil and Brent oil are confined to extremely narrow ranges this morning despite news that there has been an explosion at an Iranian nuclear facility over the weekend. Iran has attributed it to a terrorist attack.

See real-time quotes provided by our partner.

Bitcoin has had an impressive weekend and traded as high as $61,300 and continues to hold above $60,000. Optimism over this week’s Coinbase IPO on the Nasdaq is certain helping sentiment.

Data Watch

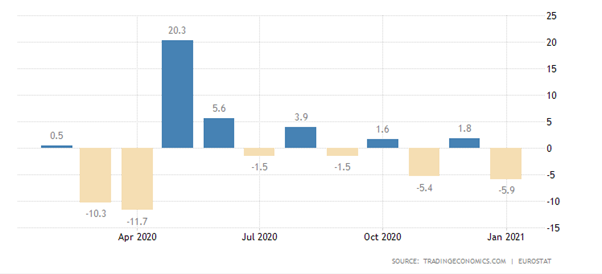

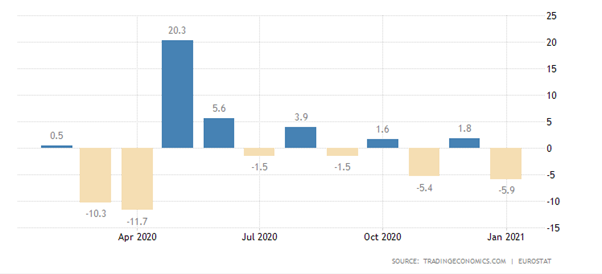

The economic calendar during the European session is dominated by the release of European retail sales data. Most economists are predicting that retail sales in the eurozone increased by one percent.

During the United States trading session a scheduled speech from Federal Reserve member Rosengren and a 10-year US bond auction are set to be the main event. Shorter dated bond auctions in the US are also set to take place.

Market participants may be holding back until the release of US consumer price index inflation data tomorrow, and Federal Reserve Jerome Powell’s scheduled speech on Wednesday.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.