There is a lot of expectation for a quick global economic recovery but is this supported by real fundamental reasons or more linked to expectations for continued interventions by the Fed and the ECB? This is probably the real question surrounding stock markets as well as the oil market. The oil price has recovered the threshold of $40 after falling negative – for a couple of hours only – on the 20th of April. This only involved the May expiry of WTI, due to a temporary and extraordinary situation in which all tanks and stocking structures were completely full in Cushing, Oklahoma, where many oil pipelines converge.

What can we now expect from the price? For sure we have a weaker market compared to the pre-pandemic situation, even if it seems that OPEC+’s intervention and central banks’ quick reactions has managed to lift the price up again.

The biggest risk is linked to the possibility of a second wave of the virus and particularly to further closures of economy, which could generate temporary collapses of economies reducing movement of people and fuel demand from the car and airplane sectors. Moreover, in the face of a global recession oil demand will decline, with consequent effects on the price of the barrel. This is definitely another significant risk, as the oversupply scenario seen in recent months could re-emerge if economies slow down.

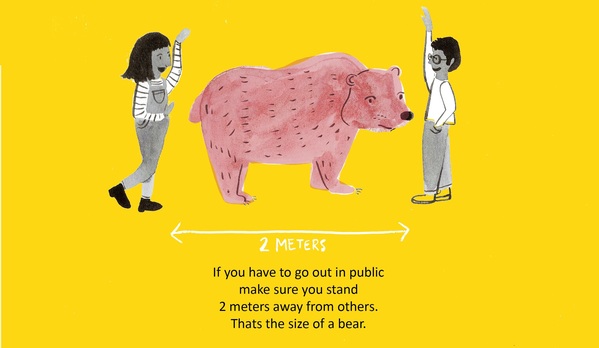

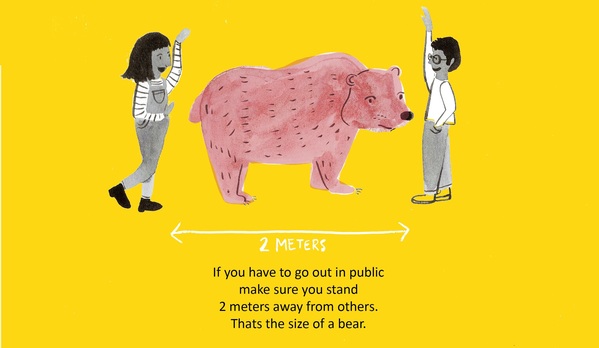

Photo by United Nations Covid-19 Response.

Another element to be considered is the agreement between OPEC+ countries, which is a crucial support to the price. Moreover, it will also be very interesting to see the reaction of US producers and the percentage of structures which can survive a sustained low-price environment (and of course, the intervention of the US Government to sustain them). In a few words, investors are betting on a quick recovery, but risks remain and could be just around the corner.

Chief analyst at ActivTrades and technical analyst for Italian newspaper 'La Stampa'. Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a weekly commentator for CNBC Italy and a columnist for La Stampa. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a 250-pages book on gold and the gold market, followed in 2018 by a new updated edition.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.