Market Brief

During the overnight session the RBNZ raised its Official Cash Rate (OCR) by 50bps taking the rate up to 2.00% as expected. The highest projection for the rate hike cycle is OCR @ 3.95% in September 2023 before a reduction into June 2025. The RBNZ monetary committee is targeting a range for CPI between 1%-3% and are using monetary policy to constrain demand, much like the Federal Reserve. Stabilising prices through controlling inflation is the central bank’s main priority but they acknowledge higher OCR does put pressure on some household spending decisions.

See real-time quotes provided by our partner.

The NZDUSD daily chart is showing price pushing higher to test the previous resistance level of 0.6529 and has broken higher than Monday’s trading range and the inside day chart pattern that formed yesterday. Because the market reaction was initially to the upside and we have overhead resistance, I am mindful that there could be a test of the stops below todays current low and possibly a correction back into the daily 20-period EMA. If however the US dollar continues its move lower, we could see the NZDUSD accelerate through the stops that will be sitting above the swing high from the candlestick reversal pattern that formed between the 4th and 5th of May.

See real-time quotes provided by our partner.

The US dollar index is still trading below the previous market structure and current resistance level of $102.40. There is a common pattern which has the price action go back into to test the median line of a prior trading range and that would also be confluent of a retest of the daily 20 EMA. The market is going to be focused on the FOMC meeting minutes that are released later today, so for the first half of the day I am not expecting much in terms of volatility and price movement.

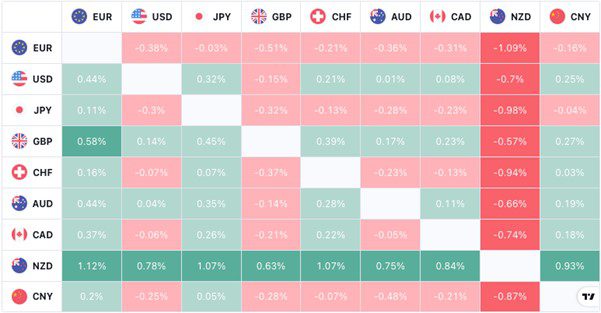

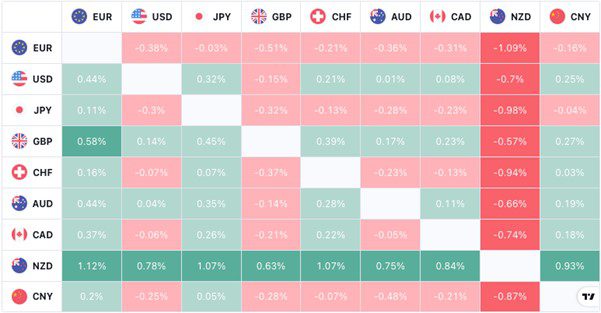

The forex heatmap shows that the NZD is the strongest currency relative to the other currencies following the RBNZ decision. The euro is the weakest which is helping to lift the US dollar at the London open along with the pound. The flows are not indicating a strong risk bias and that is to be expected ahead of key data. Global indices are marginally higher bar the US Nasdaq which is currently trading -2.20% in the Globex session. German GDP data came in as expected and the ECB speakers haven’t rocked the markets yet. ECB’s Panetta has been less Hawkish with comments on normalising monetary policy ‘gradually’, which is against the grain of the recent calls for expediting rate hikes by other ECB members. This was reiterated by ECB’s Rehn who also called for a 25bps rate hike.

See real-time quotes provided by our partner.

As the pound strengthens this morning the UK FTSE100 has broken above a previous market structure level, indicating that there could be a bullish case developing as we’re now seeing higher highs and higher lows in price action and the momentum is bullish above the daily 200-period EMA. An intraday close below the 7470 level would be problematic for FTSE100 traders but there should be some support dynamically below especially at the 20-period EMA. Financial service and mining are helping the bullish start today in the FTSE with Anglo American up 1.61% and Airtel Africa up 2.69% in the first 30 minutes of trading.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.