The markets opened today with a bullish commodities theme and a lower US dollar. We are into the Chinese New Year holiday period which comes to an end at the end of February and today is also a holiday day in the U.S. as it is their Presidents Day. This means the two largest economies will be away from their trading desks and we should expect lower volumes in trading. The trading into the end of last week was bullish for the major US indices as we saw equity futures record new highs.

With lower volumes today can come increased volatility and expansion of trading ranges as the markets are less liquid and in this morning’s session the price action at the London open has seen bullish momentum for the energy sector and a strong rise in the GBPUSD.

Oil has punched through the $60 price level as the economic environment of low interest rates, rising inflation expectations and higher stimulus, is boosted by a global covid-19 vaccination rollout. The global reflation trade reflected by higher oil prices and growing demand as the economies begin to grow is also happening at a time when transportation costs are also higher due to a shortage in shipping tankers. The energy sector is reaching levels close to 2020 highs and has undone all of the negative price action that we saw after the Saudi/Russia opec+ meeting price war. The weaker US dollar is helping to support the price of Oil and is also reflected in the weaker USDCAD.

The G10 economic and policy normalisation will be dependent on how well the governments inoculate the vulnerable across the globe and therefore how swiftly their economies can fully re-open. GBPUSD is stronger as the UK emerges as the covid-19 vaccination winner as it has reached its self-imposed target of inoculating around 15mln of its most vulnerable citizens against the disease. The hope now is that the number of patients in hospitals across the UK will vastly reduce, easing the pressure on the NHS and allowing lockdown restrictions to reduce. As cable moves higher, traders will have an eye on the 2018 swing high and the price target of 1.4300 – 1.4400, support comes in at around 1.33 on the weekly chart and the 20-period moving average.

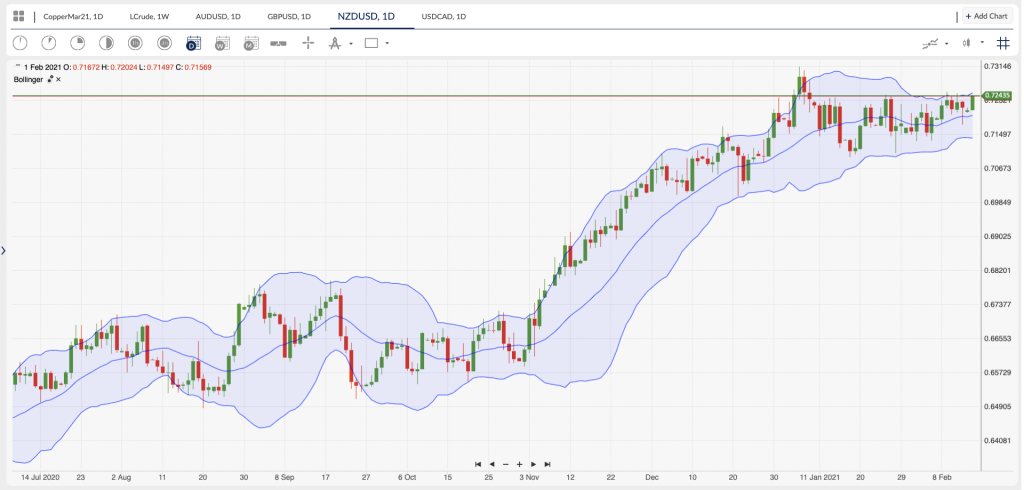

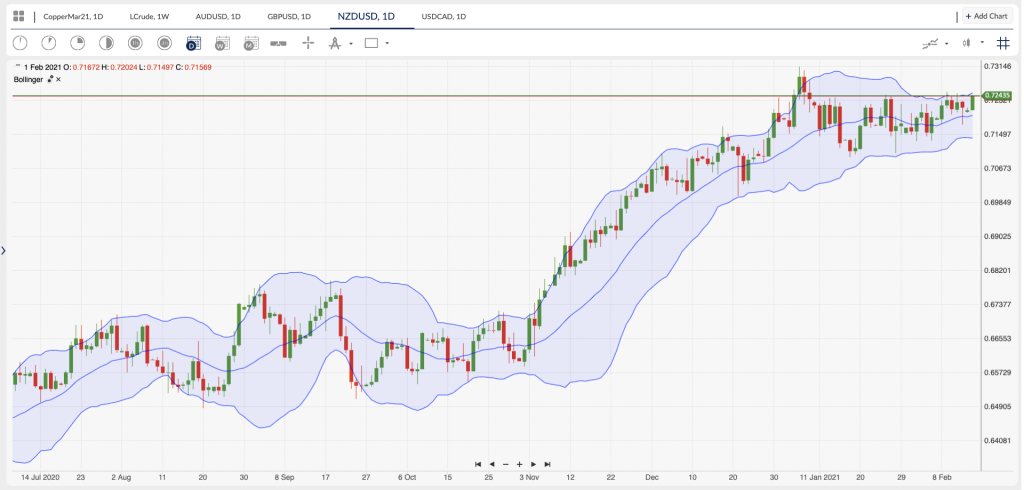

Copper has signalled that things are optimistic for the future as it has continued to rip higher. We are at prices not seen since 2012 and the commodity boom as a whole has been beneficial for the commodity pairs like AUDUSD and NZDUSD. Copper prices are expected to rise further on the news of stimulus packages from the USA, higher demand from the global bounce back but also the increased demand from Green technologies. The Electric Vehicle industry will be a growth market and will be dependent on more copper production.

A leading indicator into when this bull run may be running out of steam, will be seen in data out of China, and in particular traders should keep an eye on Chinese credit growth. China’s economy grew 2.3% last year and that was fuelled by increased infrastructure spending, strong manufacturing and increased exports. All eyes will be on their policies going forward for signs of this massive economic driver being reduced in any way.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.