Morning Brief: 22/04/2021

Global stock markets are on the rise again following increased optimism over United States growth due to the proposed US infrastructure plan. A survey from Reuters showed that many top economists predicted that the US economy will grow by 6.2 percent today, marking the fast period of annual growth in over thirty years.

The upgraded outlook from US economists comes from the belief that the proposed $2 trillion infrastructure plan and the already passed $1.9 trillion pandemic relief plan. Over 100 economists surveyed believed that another COVID-19 surge was the biggest risk to the global economy.

See real-time quotes provided by our partner.

The major indices in the United States are all trading in the green this morning, following a major reversal during yesterday’s US session. Traders still believe to be in buy-the-dip mentality, as the Nasdaq, DJIA, and S&P 500 trade back towards their respective all-time-highs.

The USDCAD pair is consolidating around the 1.2500 level after a wild day on the foreign exchange market yesterday. Optimism is still high after yesterday’s Bank of Canada meeting, where the central bank announced taper, following stellar data over recent weeks. Traders and investors are hopeful this could a new trend, and other central banks will follow.

This brings us to today’s ECB policy meeting. The ECB are not expected to change economic policy today, further highlighting the divergence between the BOC and ECB. The EURCAD will be in focus.

See real-time quotes provided by our partner.

Asian stocks are taking their cues from the United States, with the Nikkei 225 close to reversing all of Wednesday’s losses, despite many Japanese states announcing a state of emergency.

Risk sentiment can also be seen in antipodean currencies, with the AUDUSD and NZDUSD pair riding highs, alongside the typical risk-on proxy yen related pairs, namely the AUDJPY and NZDJPY pairs.

See real-time quotes provided by our partner.

Oil is treading water today, while gold and silver continue to hold onto their strong weekly gains. The yellow metal is pressing against the $1,800 level, after bulls smashed through the $1,780 barrier on Wednesday.

Bitcoin has fallen back towards the $51,000 support level once again today. Bitcoin transaction fees are spiralling, amidst a slump in the cryptocurrencies hash rate. Ethereum is breakout against Bitcoin.

Data Watch

The economic calendar in the European session is focused almost exclusively on the European Central Bank policy meeting today. Today we see an absence of low, medium, and high-impacting data points from the eurozone.

It is certainly noteworthy that preliminary eurozone PMI data is set to drop tomorrow. This is potentially going to be a bigger market mover, as the ECB is expected to stick to script today and remain dovish, and last months PMI data hit multi-year highs.

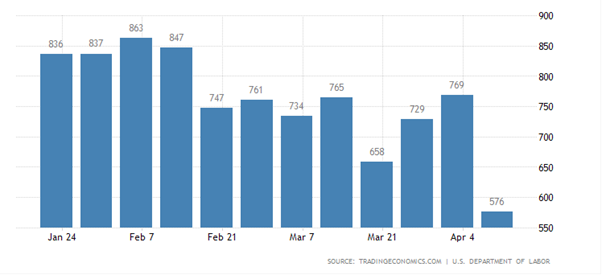

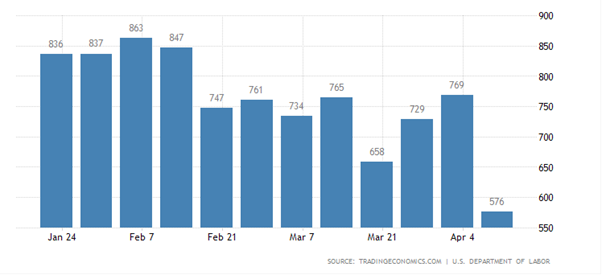

During the United States trading session we see the release of US jobs data. Last week’s initial jobless claims dropped by nearly 200,000 to 576,000, which really prompted market hopes that we are going to see big NFP jobs number. Today’s jobless claims are expected to come in slightly over 600,000.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.