The US dollar is treading water against the Turkish Lira currency on Friday, after a hugely volatile four-week period, whereby the USDTRY pair moved in an extremely large trading band between the 7.20 and 8.50 levels.

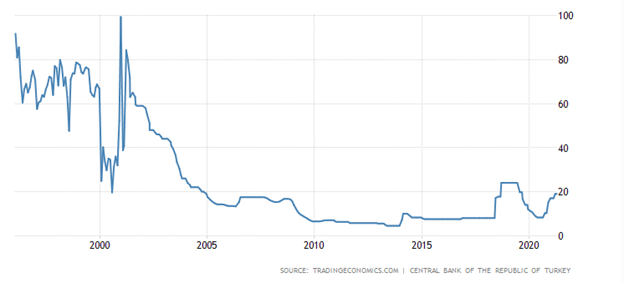

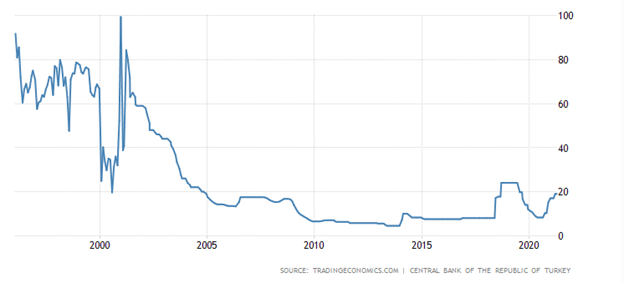

Yesterday, Turkey’s central bank left its benchmark interest rate steady at 19 percent. The lira subsequently fell against the dollar, although the move was relatively short lived on the foreign exchange market.

The central also removed policy key dovish language yesterday. New Turkish central bank Governor Sahap Kavcioglu is known to be an advocate of high interest rates, in line with President Erdogan.

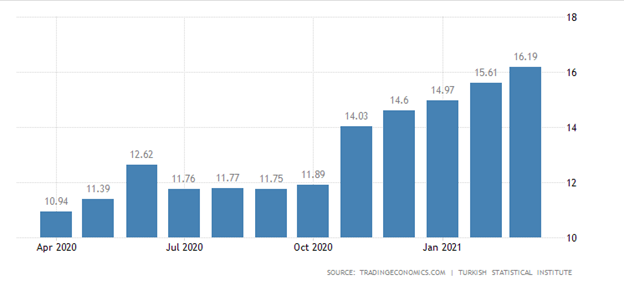

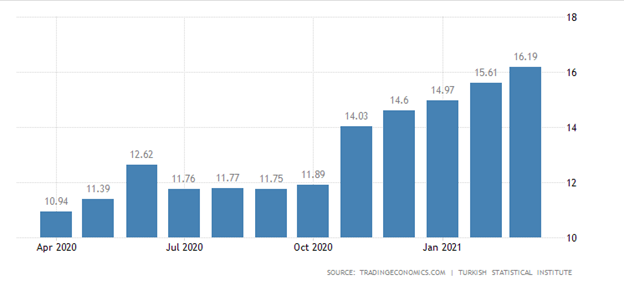

It must be noted that inflation gained 16.2 percent last month, which was up from the 15.6 increase in February. Fears about hyper-inflation have been a constant fear for the Turkish economy over recent years.

The trouble for the central bank, and Turkish economy in general, is that the central bank has a very limited number of tools available, as rate cuts will harm the nation’s currency.

Turkey’s central bank also went one step further today, and banned the use of cryptocurrency payments, citing significant risks due to volatile market values, irrevocable transactions and are used in illegal actions.

An official statement from the Turkish central bank earlier today said “It is considered that their use in payments may cause non-recoverable losses for the parties to the transactions due to the above-listed factors and they include elements that may undermine the confidence in methods and instruments used currently in payments,” the central bank said in a statement.

The move came a week after Turkish authorities demanded user information from cryptocurrency trading platforms, which front run what was potentially coming down the pipeline for Turkish crypto users.

Bitcoin was often used a payment alternative by the youth of Turkey as the nation’s currency is hugely volatile, amidst huge spikes in inflation, and geo-political and economic uncertainty.

This latest move from the central bank may be an attempt to shore-up the nation’s currency, and drive demand for the Turkish Lira. It remains to be seen if it works.

USDTRY Technical Analysis

Higher time frame analysis shows two possible outcomes for the USDJPY pair right now. The first scenario, which is bearish, shows that a potential double-top pattern may be forming. Double-tops are considered extremely bearish price patterns.

The other scenario shows that a bullish reversal pattern could be forming. Bulls need to breach the October 2020 trading high, in order to ignite the price pattenr. This could ignite a huge rally towards the 10.00 level.

See real-time quotes provided by our partner.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.