Sentiment towards a number of forex pairs is starting to change as markets finally price in the Federal Reserve’s QE decision, whereby the US central bank tapered its huge bond program as widely expected.

Additionally, yesterday’s CPI reading was the highest in thirty years from the United States, placing further pressure on the US central bank to act and raise rates this or later next year.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment trades amongst the retail crowd right now, just hours before the hugely consequential and market impacting policy decision from the US economy next week.

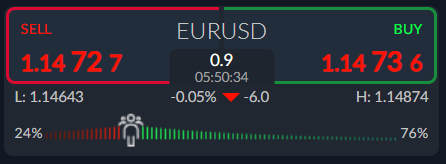

EURUSD – Still Long

According to the ActivTrader Market Sentiment tool traders remain worryingly bullish towards the EURUSD pair, even in the aftermath of the FOMC interest rate decision. This is a warning sign of more losses.

The ActivTrader Market Sentiment tool shows that 76 percent of traders are bullish towards the EURUSD. The large sentiment bias is a red flag that the euro can continue to get sold-off this week.

We probably need to see traders turning wholesale bearish towards the EURUSD pair before a meaningful price reversal can take place. As things stand, things look very bleak for EURUSD bulls.

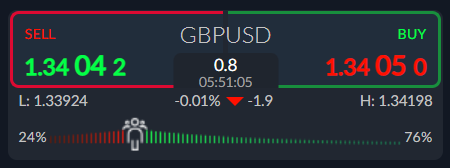

GBPUSD – Bearish Reversal

The ActivTrader market sentiment tool shows that traders are 76 percent of traders are bullish towards the GBPUSD pair, despite a breakout in the US dollar index and sterling moving to a new yearly low.

Traders are on the wrong side of the trade right now, and sterling breaking to a fresh yearly low could spell big problem for bulls as the US dollar index appears to be in revenge mode and could target the 98.00 level.

While we see sentiment this extremely bullish sentiment we need to consider why. If the FED are tapering QE and the Bank of England are not hiking rates, it is difficult to see bulls logic towards being long sterling.

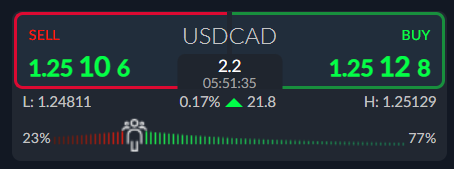

USDCAD – Traders Are Right

Market sentiment towards the USDCAD is very bullish at the moment, which is great because retail traders are on the right side of the trade and the US dollar index is currently in breakout mode.

The ActivTrader market sentiment tool showing that some 77 percent of traders currently bullish towards the USDCAD pair, despite the fact the pair has failed to rally much this year and has largely remained under pressure due to rising oil prices.

With market sentiment in favour of the US dollar gains, I suspect that we might see retail traders booking profits too early as this is a habit of the retail crowd. Watch out for the USDCAD pair to overextend to the upside.