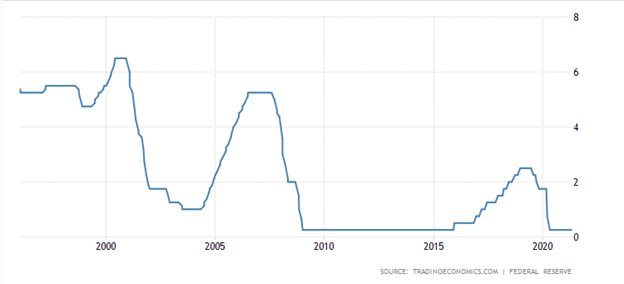

During the upcoming trading week, the release of the FOMC meeting minutes is set to take centre stage as market participants focus on the latest thoughts of the United States central bank.

The impact of the FOMC minutes on financial is likely to be diminished as the central bank will not release any comments on the latest Non-farm payrolls job report and the April CPI inflation report, as the minutes are focused on recapping the FED’s thoughts when the last policy meeting took place.

Other key highlights on the economic docket this week include the release of eurozone and Japanese third-fiscal quarter gross domestic product and the release of Chinese retail sales.

Market participants will also be focused on PMI preliminary manufacturing data from the eurozone, CPI inflation numbers from Canada, and monthly jobs number from the Australian economy.

FOMC Minutes

Traders looking for excessive market volatility may be left disappointed at the release of the FOMC meeting minutes. The transcripts of the last FOMC meeting are unlikely to reveal any significant findings that the market does not already know.

Furthermore, the FOMC minutes are lagging the recent releases of the Non-farm payrolls monthly jobs report and the US CPI inflation report, which showed the highest increase in US inflation in over a decade.

Overall, markets are likely to shrug-off the meeting minutes from the US central bank. Any market shocks are highly unlikely this week, hence, attention may be other economic releases and market developments.

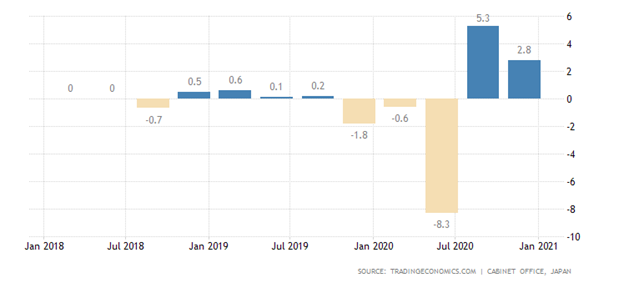

Eurozone & Japanese Gross Domestic Product

Quarterly EU GDP is expected to show that the eurozone economic shrunk by 0.6 percent during the first fiscal quarter. The weak number is expected because the eurozone has basically remained in lockdown for most of the first-fiscal quarter, and some countries still have restrictions.

Looking at the Japanese economy this week, Quarterly GDP is expected to show that Japan’s economic shrunk by 1.2 percent during the first fiscal quarter.

The market is expecting a sub-par number, so the market reaction will likely be not impactful. Japanese inflation data will be far more meaningful this month that Q1 GDP numbers.

EU PMI Manufacturing

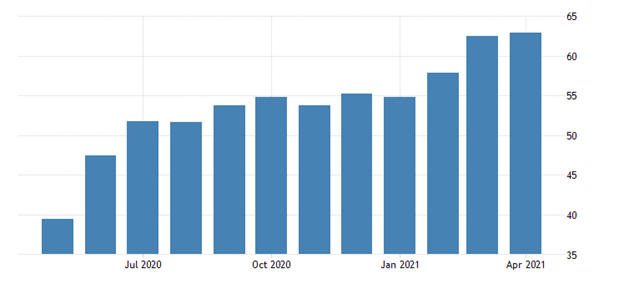

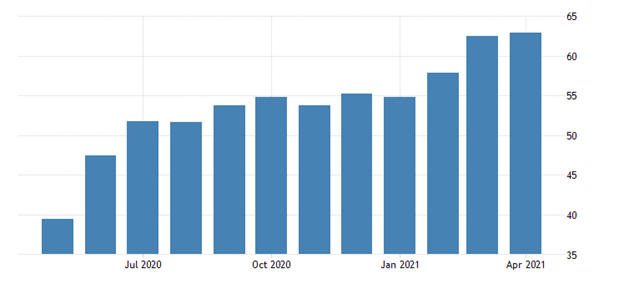

The release of preliminary eurozone PMI data this week will be closely watch, and indeed it could be a market mover if the numbers come in much weaker or stronger than predicted.

The trend for PMI’s has been up for many months globally, however, the USA saw a significant downtick last month. It will be interesting to see if many of the eurozone top economies follow the United States.

Most economists are predicting robust numbers above 60 in May as many of the lockdown restrictions start to ease. Overall, PMI readings above 60 should be considered very bullish for the euro and European equities.

Canadian & United Kingdom CPI

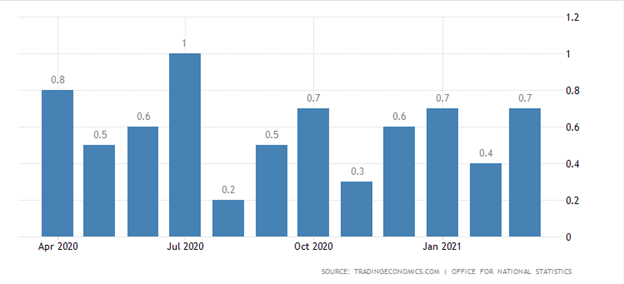

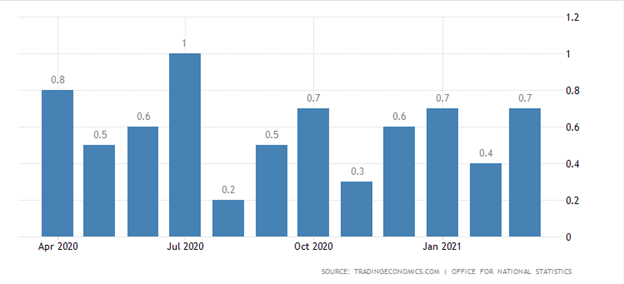

Markets will be intensely focused on CPI inflation data from Canada and the United Kingdom this week, following last week’s decade high CPI inflation print from the United States economy.

The Canadian CPI number is not predicted to come in hot last month, with economists expecting core CPI to actually decrease. The year-on-year CPI print is predicted to come in at 3.0 percent, which could tip the hand of the Bank of Canada to hike rates sooner rather than later.

Sterling is worth watching this week as the United Kingdom CPI could follow the recent United States CPI number come in much stronger than expected.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.