During the upcoming trading week, the Federal Open Market Committee and Bank of Canada interest rates decisions and monetary policy statements are set to be the main focus for financial markets.

Other key highlights on the economic docket this week include the release of the key Gross Domestic Product data from the United States, German, and eurozone economies. US earnings seasons also gets in full-swing this week, with many heavyweight tech companies releasing company earnings.

This week will also see inflationary data points being released from the United States, Canadian and Europe. Manufacturing data from the Chinese economy and Durable Goods Orders will also be closely watched by market participants.

FOMC Rate Decision & Policy Statement

Traders looking for a hawkish tilt from the Federal Reserve similar to the Bank of Canada last Wednesday could be left sorely disappointed this week. The FED will be acutely aware that a major market tantrum would likely follow if the mention that a taper is going down the line.

Recent policy speeches from Federal Reserve members have noted that inflation in the United States is only going to be transitory, and that they expect that inflationary pressure may spike, but is unlikely to be sustained at a strong level.

Whether you agree with the Federal Reserve or not, this is the line that they are likely to take this week, although they could at least acknowledge that the near-term growth prospects for the US economy have significantly improved.

In terms of market reaction, I would expect the US dollar to weaken if the FED remain of the fence, and they fail to hint at a coming taper. Stocks are also likely to remain on positive price path if they keep this line, and indeed maintain a dovish tone.

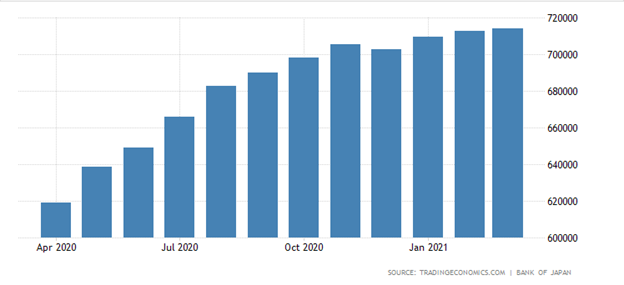

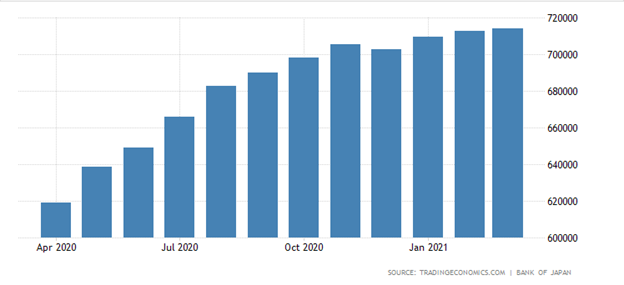

Bank of Japan Rate Decision

The Bank of Japan meeting this week is hugely interesting after the central bank recently abandoned its inflationary target of 2 percent, and also ruled out negative interest rates.

The Bank of Japan also have another dilemma to face, in that many of Japan’s states have announced emergencies due to the COVID-19 pandemic, which further complicates the picture for the central bank, at a time when global economic growth is looking brighter.

In terms of market reaction, the Japanese yen is likely to strengthen if the central bank sounds more hawkish which is unlikely. Japan is a major export economy, so they do favour a weaker yen, so QE is likely to stay in place, especially amongst a back of increasing infection rates of COVID-19 in the land of the rising sun.

Earnings Season

The release of earnings from many of the top global companies is set to shake-up stock market this week, especially as we see many of the top tech heavyweights and banks releasing profit forecasts.

In the first half of the trading week we see earnings data coming out from the likes of Tesla, BP, UBS bank, HSBC bank, Visa, Nomura bank, Boeing, Sainsbury, UPS, Facebook, and Apple.

See real-time quotes provided by our partner.

A huge amount of focus will be on Tesla, Apple, Facebook, and Nomura. Nomura’s stock price is one to watch in particular, due to the huge losses the bank recently suffered from the blowing up a trading focused fund on Wall Street.

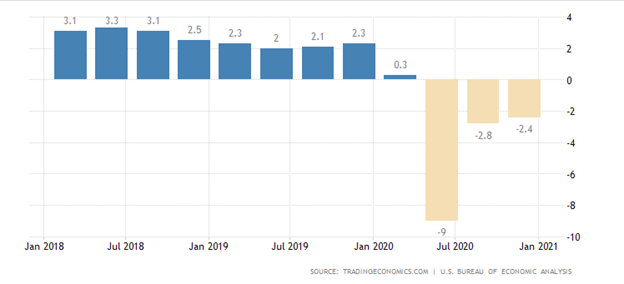

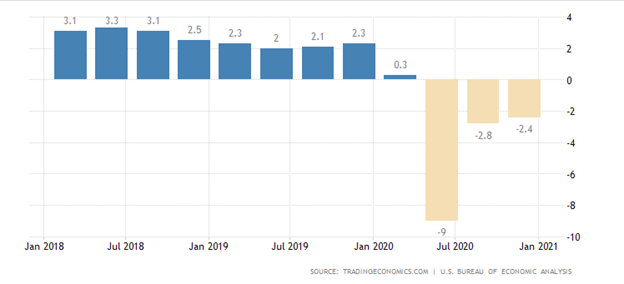

Growth Data

The GDP numbers coming from the United States and Europe will be closely watched this week. Many banks are predicting that the US economy is going to grow by more than 6 percent this year.

Estimates from most economists are for year-on-year growth to come out at 6.3% this quarter compared to the same period last year. Markets are expecting this number in advance so some of the euphoria is take away from the number.

Sub-par growth is expected from Europe this week, which is likely to further underscore the obvious economic divergence that is going on between the eurozone and the United States right now.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.