During the upcoming trading week the FOMC meeting minutes and a scheduled speech from Federal Reserve Chair Jerome Powell headline the economic docket. Both events could have a significant impact on financial markets and set the overall tone for the trading week ahead.

Other key highlights on the economic docket include the Reserve Bank of Australia interest rate decision and policy statement, and the release of the Canadian monthly report jobs and monthly unemployment rate.

This week will also be a shortened trading week due to the Easter Bank holiday. Market volatility could therefore be increased, as traders that have been away from their desks will react to last week Non-farm payrolls jobs reports, and the events they have missed over the holiday period.

FOMC Minutes & Chair Powell Speech

Traders will be looking for a more hawkish FOMC meeting minutes this week, following February’s largely dovish and downbeat FOMC meeting minutes release. In February, the FOMC said that the United States economy was still “far from their goals”. Things have got considerably better since then.

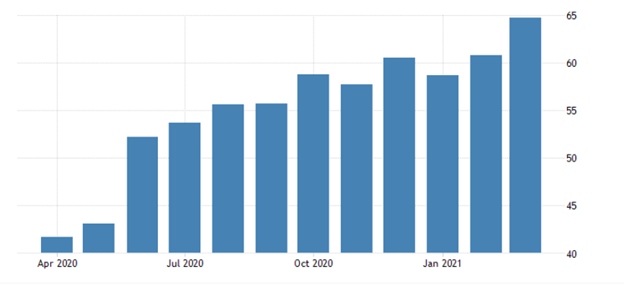

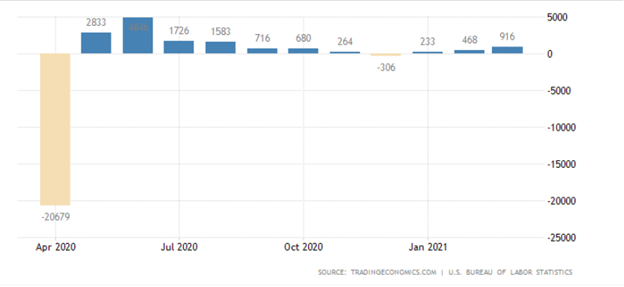

The incredibly strong 916,000 Non-farm payrolls jobs number and the multi-decade high ISM manufacturing report are all reason for more optimism. However, because financial markets, and especially the bond market, are ultra-sensitive to overly hawkish commentary, some cautious optimism should be expected.

Chair Powell is set to speak this week as well, following his recent set of testimonies before US Congress. The FED Chair is likely to play down inflationary expectations, but talk up the future economic prospects, due to the vaccine rollout and the round of $1,400 stimulus checks to US citizens.

FED Chair Powell will likely take this opportunity to reiterate that the US economic recovery is on-track, however, he will more than likely stop short of discussing any type of policy tightening.

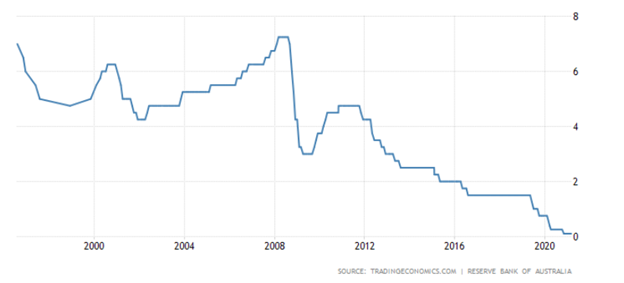

RBA Rate Decision

The RBA are likely to keep rates on hold this week and strike a more positive tone towards the Australian economy, due to recent strength in the Australian jobs market, and solid domestic consumption numbers.

Last month, the unemployment rate in Australia fell to 5.8 percent, which is a very encouraging sign. The RBA is unlikely to change its bond buying programme, however, watch out for a more upbeat tone from the central bank towards the economy this week than we have seen over previous months.

Traders have turned more bearish towards the US dollar recently, sending the AUDUSD pair lower. The RBA has had a notable dislike for rapid appreciation in the Australian currency, so the Australian central bank will be particularly happy about the pullback in the Aussie.

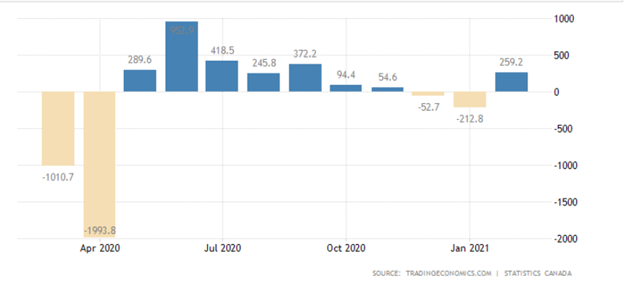

Canadian Jobs Report

Hot on the heels of the Non-farm payrolls jobs report the Canadian jobs report is due for release this week. Most economists are expecting that the Canadian economy created 90,000 jobs during the month of March.

The official Canadian unemployment rate is also expected to drop towards 8.0 percent this week. If these data predictions come to pass then it will probably be seen as a positive, however, the pace of job creation in Canada would have slowed significantly in March, following February’s blockbuster 259,000 headline number.

Given the relative outperformance of the US economy, the USDCAD pair could start to push higher. Traders do have to consider that ongoing strength in oil price could slow down any notable gains in the USDCAD pair this week.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.