During the upcoming trading week, the market will be heavily focused on the US Federal Reserve November policy meeting as the central bank is widely tipped to finally announce QE tapering.

Other key highlights on the economic docket this week include the Bank of England interest rate decision and the October Non-farm Payrolls job report from the US economy.

This week will also see the release of the US ISM manufacturing report and the Reserve Bank of Australia policy statement. Traders will also be focused on news surrounding the US infrastructure bill.

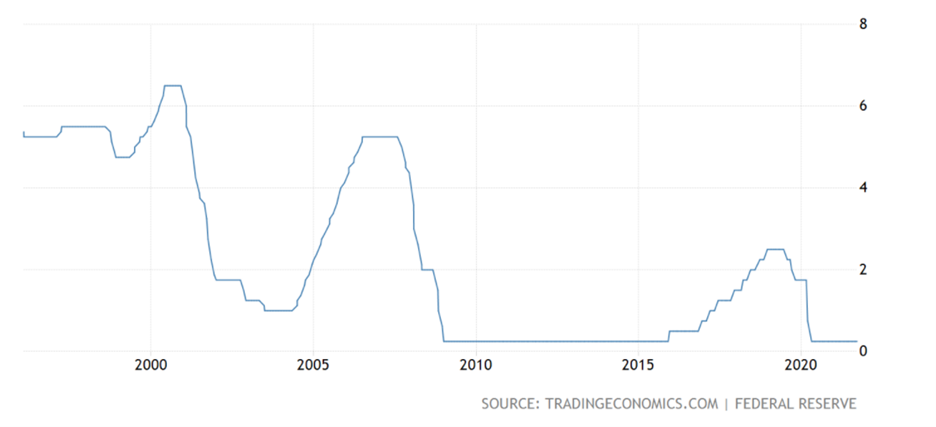

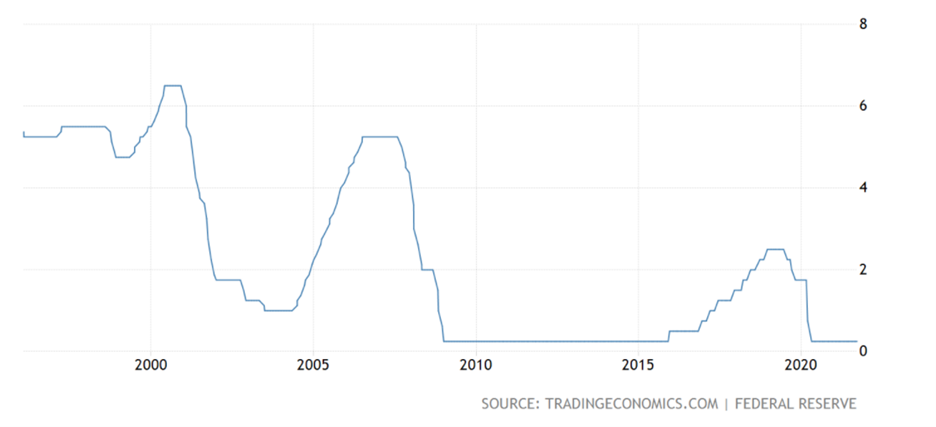

Federal Reserve Policy Meeting

This week could have huge implications for financial markets as the US FED is widely tipped to start pulling back on stimulus for the first-time since the COVID-19 crisis.

For all intents and purposes, the Fed is on track to begin tapering although it is highly unlikely that they will raise rates. Any mention of a pending rate increase would massively heighten market volatility.

Failure to implement QE this would be a huge upset for financial markets. Bond-buying is currently at a $120 billion monthly pace. During the September meeting policymakers agreed that the tapering emergency pandemic support should start either mid-November or mid-December.

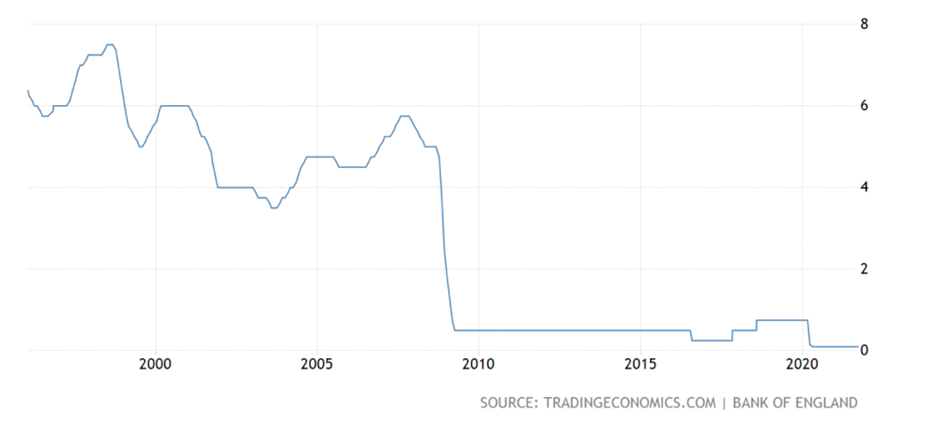

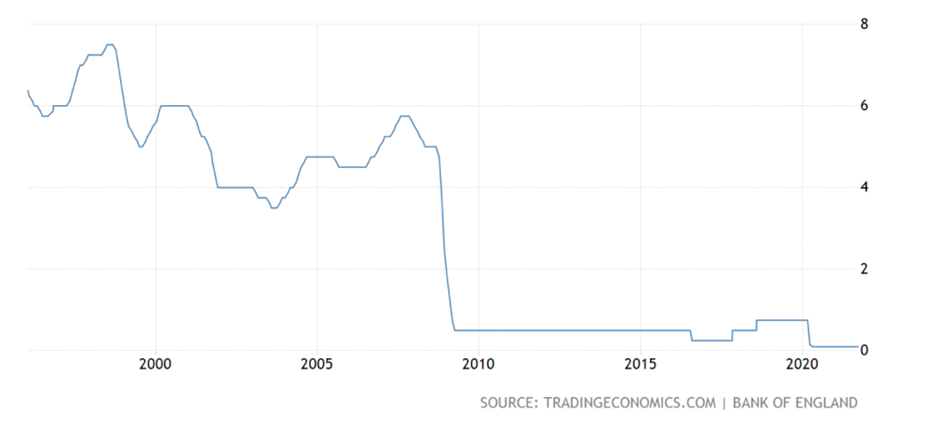

Bank of England

The Bank of England is set to raise rates this week as inflation, and particularly food and energy prices start to skyrocket in the United Kingdom, amidst supply chain constraints and Brexit after effects.

The main question will be how much the BoE chose to raise rates. A 0.25 hike will be seen as aggressively, while a 0.10 hike will probably leave the market very disappointed.

The UK central bank left its benchmark interest rate at a record low of 0.1% and also said that the case for modest tightening strengthened from August, as inflation could persist above 4% well into 2022.

Non-farm Payrolls

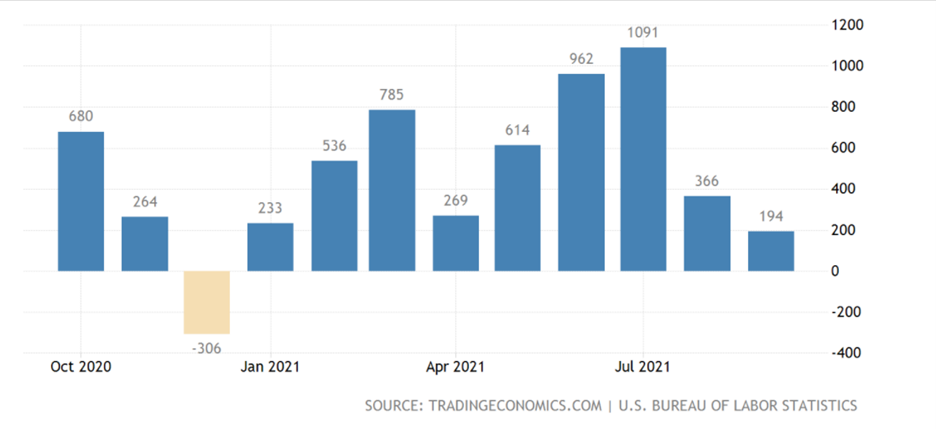

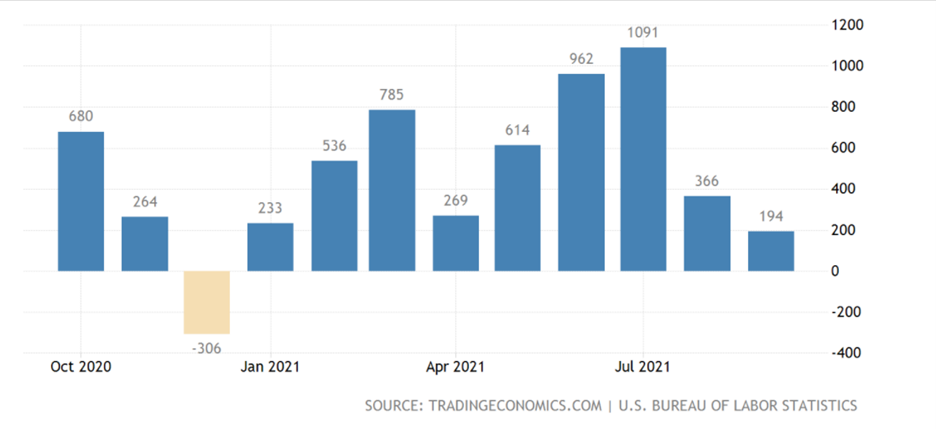

The US economy is expected to have added 380,000 jobs last month, at a time when the labour market in the US is starting to look shaky heading into the end of the year.

Last month the US added a meagre 194,000 jobs, marking the lowest number so far this year and well below forecasts of 500,000. A worse number than the September headline number this week could cause a big market reaction.

The Bureau of Labour Statistics said about last month report, “Recent employment changes are challenging to interpret, as pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns”.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.