During the upcoming trading week, the economic calendar is heavily US-centric, as the world’s largest economy releases a series of top-tier data points, while a host of Federal Reserve speakers are due to communicating their current thoughts on the American economy.

United States President Joe Biden is also due to deliver a scheduled speech this week. President Biden will outline his infrastructure plan for the US economy this week, as recent reports are suggesting that the Biden administration could be about to unveil a massive $3 trillion spending package, which would the largest in US history.

Aside from the US economy, market participants look to retail sales data from the German and Australian economy, and UK Gross Domestic Product data. UK GDP data from the fourth-fiscal quarter is expected to show that the UK economy narrowly missed falling into a double-dip recession.

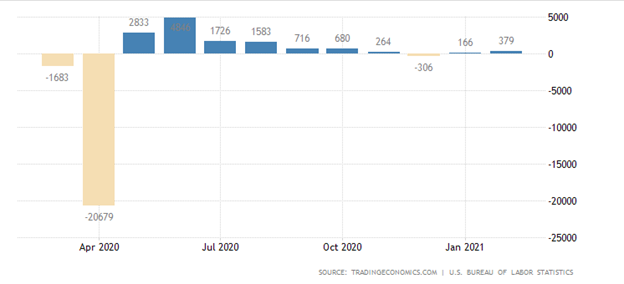

US Non-farm payrolls

The United States economy is expected to have added over 600,000 jobs during the month of March as the slowdown of the COVID-19 infection rate, and the pace of the US vaccination programme boosted the US jobs market.

Recently, weekly jobless claims in the United States have been trending lower, which has provided a solid indication that the US jobs situation is starting to improve, following months of volatile weekly jobs data.

The US unemployment rate is expected to fall back to 6 percent, which is down from the previous unemployment rate number of 6.2 percent. To give some context, the US unemployment rate spiked to 14.7% last April.

As usual, wage inflation will be closely watched by market participants, at a time when the reflation trade is the talk of Wall Street. If the March jobs number comes in strong on all fronts it will be seen as a strong sign that US growth is set to return during the upcoming fiscal quarter.

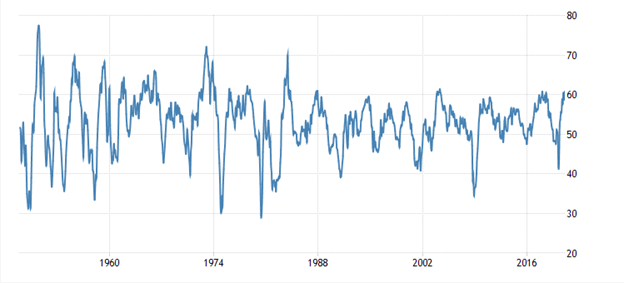

ISM Manufacturing

The ISM manufacturing report is expected to come in at a fresh three-year trading high this week, as United manufacturing activity remains on a roll, following a massive plunge lower during the height of the COVID-19 pandemic.

According to economists, the ISM reading is going to come in around 61.2 this week, which is the best reading since 2018. Traders should note that any number above 60.0 is considered an extremely bullish reading.

Looking at a chart of ISM manufacturing activity, we are approaching make or break levels. A move above 62 means that the reading will be edging close to a 30-year high.

From a pure chartist perspective, it could be argued than an explosion towards 70 or a sharp reversal from 60 could be about to take place due to the critical juncture that the ISM reading find itself at.

Market Reaction

In terms of market reaction, the US dollar could make more significant progress this week if the US jobs number comes in as expected. US stock markets are also expected to benefit from the brightened outlook in the US jobs market.

The Dow Jones Industrial Average probably stands to gain the most if the Non-farm payrolls number comes in hot, as the index is closely linked to the real economy.

Commodities such as oil and copper could gain on the report as well, however, gold and silver could tumble if market participants start to think that the US Federal Reserve are closer to ending its QE programme.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.