During the upcoming trading week, the economic calendar is heavily dominated by the inflation releases, as we see the United Kingdom, Japan, China, and Canada all release Consumer Price Index inflation data. The UK CPI release will be the one that traders will be watching most keenly.

Other key highlights on the economic docket this week include the release of the Manufacturing PMI numbers from Europe. This will give investors their first look at how manufacturing activity in Germany, France, Italy and Spain during the month of October is currently shaping up.

This week will also see the release of the RBA minutes, as at the time when the Aussie is gaining upside traction. We also see Retail Sales and GDP numbers from the Chinese economy. on tapering QE after the September policy meeting.

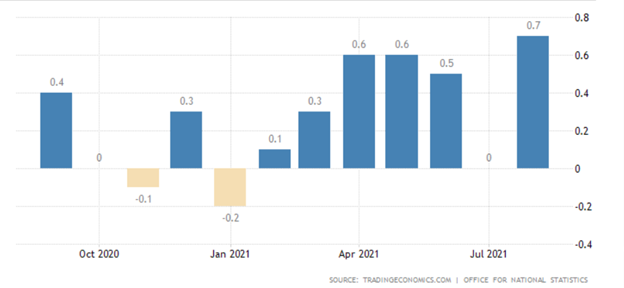

UK CPI Inflation

The Consumer Price Index release from the UK economy this week is going to be interesting on many levels. Perhaps the most significant CPI release that the markets have been awaiting in some time.

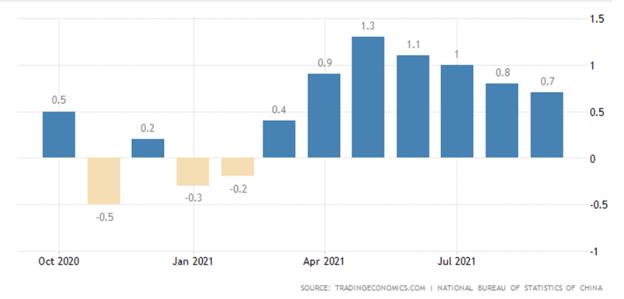

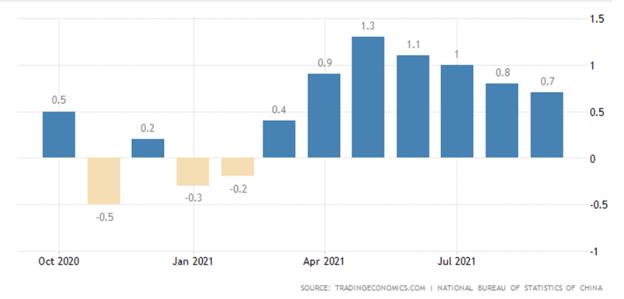

Month over month inflation hit 0.7 percent, however, with the energy crisis raging in Europe and the UK suffering food and petrol shortages it is likely that monthly CPI may be significantly higher.

Watch out for big reactions in sterling to a hot CPI number as it could mean that the Bank of England will implement a rate increase much sooner than markets had been anticipating.http://bit.ly/2Zn4HaM

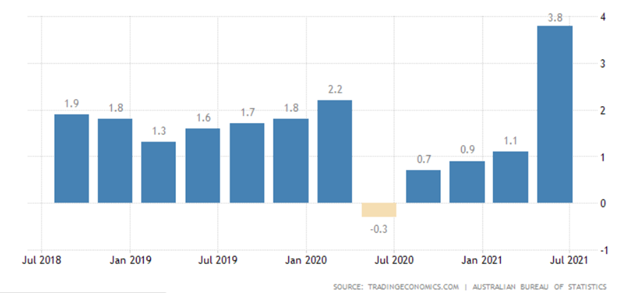

RBA Minutes

The Reserve Bank of Australia meeting minutes are going to be very interesting this week as commodity prices surge, CPI inflation spikes, and the Aussie stages a much-needed recovery after falling below the 0.7200 handle.

Markets are not pricing in a hawkish statement, which is probably unlikely at best. Far more interesting will be how the RBA view QE as COVID-19 restrictions are lifted in the capital Sydney.

It is likely that the AUDUSD pair will rally on any good news due to the fact that a rebound is well underway at present. With commodity prices surging the ASX and the Aussie are worth watching this week for sure.

Chinese Data

The release of GDP and Retail Sales data from the Chinese economy is going to be a big deal for financial markets this week, as most experts believe the world’s second-largest economy is slowing dramatically.

Should we see a soft GDP print then risk-sentiment could take a major hit, and Asian stock markets will act accordingly. The release of retail sales will also be important as China attempts to transition to a consumer economy.

Watch out for reactions in the Nikkie225, Iron ore, and Gold prices if we see worryingly low numbers this week. Market rumours persists that a PBOC rate cut may be looming.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.