During the upcoming trading week, the economic calendar is heavily dominated by the United States, as the world’s largest economy releases inflation, retail sales, and consumer sentiment data.

Other key highlights on the economic docket this week include the release of United Kingdom jobs data, at a time when the Bank of England is warning that the nations growth prospects are starting to flatten.

This week will also see the release of monthly jobs data from Australia economy, a key speaks from Reserve Bank of Australia Governor Lowe, and CPI inflation data from the Canadian economy.

Something else to watch is sentiment. US and global stock market look frothy at current level, as the growth prospects of the US and China worsen stocks could take a big hit.

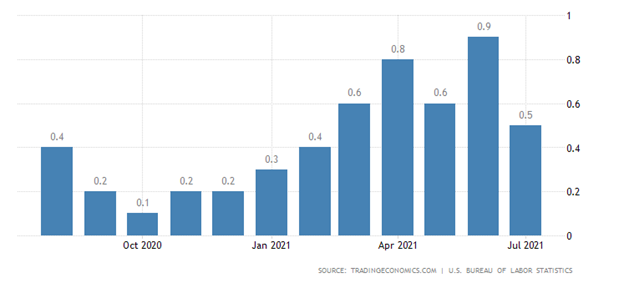

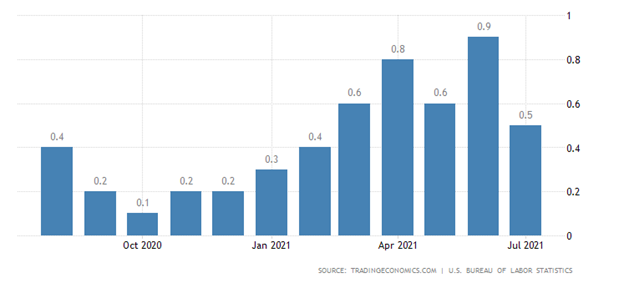

US CPI Inflation

The Consumer Price Index for the month of August is expected to show that inflation rose at a moderate 0.3 percent last month, which would be welcomed change from recent high CPI readings.

Last month US CPI increased 0.5 percent in July on a seasonally adjusted basis after rising 0.9 percent in June, the U.S. Bureau of Labour Statistics reported today. Over the last 12 months, all items index increased 5.4 percent before seasonal adjustment.

The closely watched food index increased 0.7 percent in July as five of the major grocery store food group indexes rose, and the food away from home index increased 0.8 percent. The energy index rose 1.6 percent in July, while the gasoline index increased 2.4 percent and other energy component indexes also rose.

A red-hot inflation number would likely see the US central bank thinking hard about raising rates, although the Federal Reserve would struggle to pass this through in a low growth and weakening jobs environment.

US Retail Sales

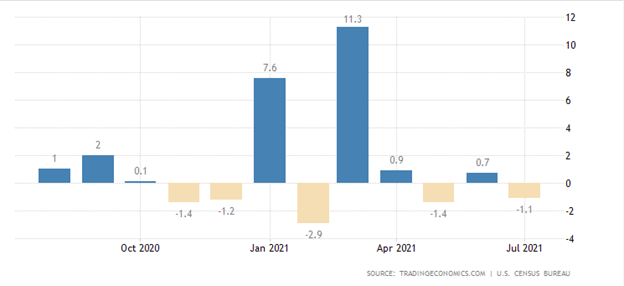

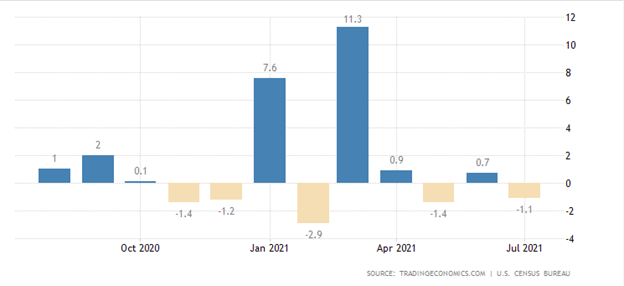

Retail sales data is also set for release this week, with most economists expecting a -0.7-headline number. The market reaction could be quite severe as retail sales are starting to show a clear downtrend.

Last month US retail trade fell 1.1 percent from a month earlier in July 2021, following a revised 0.7 percent growth in June and compared with market consensus of a 0.3 percent drop, led by a decline in auto purchases and as a resurgence in COVID-19 cases hit consumer demand.

A major drop in retail sales, which would mean greater than last month’s -1.1 percent headline number could see the market going into meltdown, with the US dollar and the Dow Jones Industrial Average bearing the brunt of the selling.

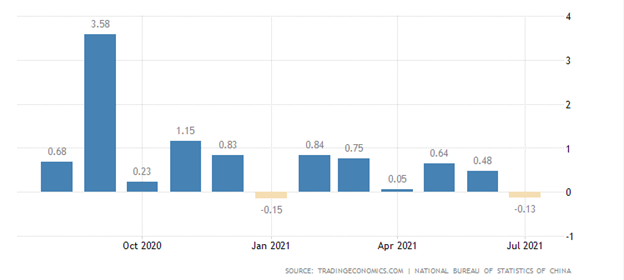

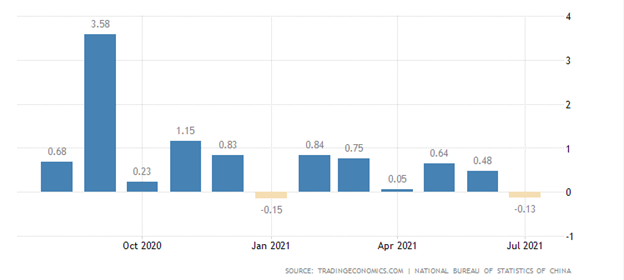

Chinese Retail Sales

This week Chinese retail sales is worth paying attention to since serious signs of stress are starting to emerge in the world’s second largest economy, which is often considered the engine of global growth by market participants.

A 7.1 percent year-on-year increase is expected, which marks a notable downtick from last month. China’s retail trade rose by 8.5 percent year-on-year in July 2021, easing from a 12.1 percent gain in the previous month and missing market expectations of 11.5 percent.

This was the weakest rise in retail sales since December 2020, as consumption moderated during the latest COVID-19 outbreaks in some provinces. Sales rose at a slower pace for most categories, meaning that this week’s report is going to be ultra-important for market sentiment.