During the upcoming trading week, the release of the United States Non-farm payrolls job report is set to be the main focus for financial markets, following last month’s multi-month record-setting 900,000 plus headline number.

Other key highlights on the economic docket this week include the closely watched ISM manufacturing report, UK PMI services report, and key retail sales numbers from the eurozone economy.

This week we also see GDP data from the Swiss and Australian economy, plus traders and investors will be reacting to the outcome of the recent Jackson Hole Economic Symposium.

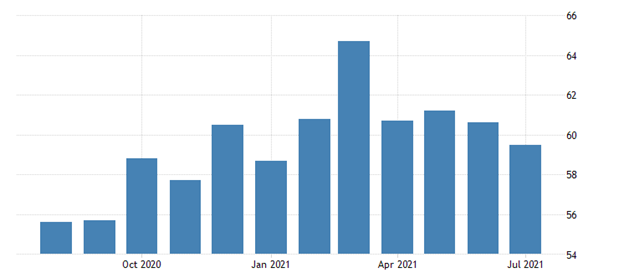

ISM Manufacturing Report

Analysts are expecting another weaker ISM manufacturing report for August, with a 59.1 number, providing further evidence that the US manufacturing sector is now starting to slow.

Last month the ISM Manufacturing PMI fell to 59.5 in July of 2021, marking the weakest ISM survey in 6 months, compared to 60.6 in June and below forecasts of 60.9. The reading pointed to the second consecutive month of slowing factory growth as new orders 64.9 vs 66 in June.

It should be noted that the survey did show that employment rebounded last month 52.9 vs 49.9 as prices pressures eased, while companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and retaining direct labour. According to Timothy Fiore, Chair of the ISM “Labour challenges across the entire value chain and transportation inefficiencies are the major obstacles to increasing growth.” A weak number could set the tone for more US dollar weakness and the pushing back of tapering expectations.

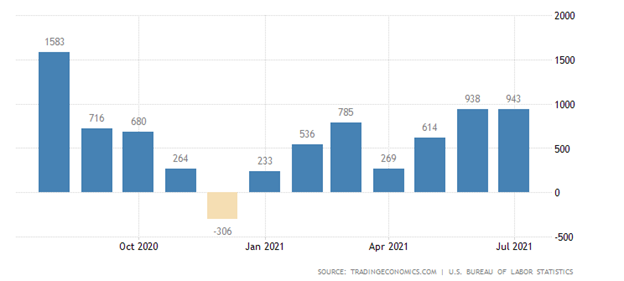

Non-farm Payrolls Job Report

Traders will be highly anticipating the Non-farm payrolls job report this week, with many analysts predicting that the United States economy created 700,000 new jobs in August, marking a substantial downturn from last month.

The US economy added 943,000 jobs in July 2021, which was the most in eleven months and above market expectations of 870,000. This obviously set the bar high for the FED tapering sooner rather than later, but those expectations are now being pushed back after Jackson Hole.

The July jobs report highlighted that the rapid pace of COVID-19 vaccinations allowed the country to continue its re-opening efforts and prompted businesses to hire more workers to respond to growing demand.

The labour market recovery is expected to continue in the coming months, even as COVID-19 cases rise, and firms continue to complain about a shortage of available workers. While other economic data points misfire, jobs data does appear to be on track.

Eurozone Retail Sales

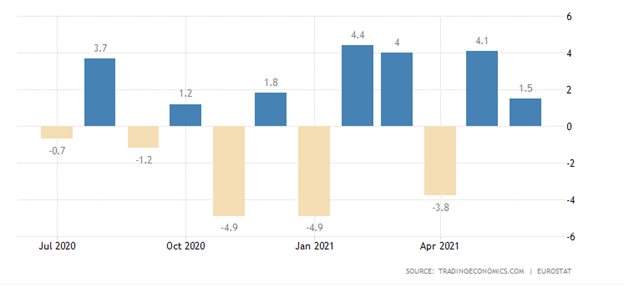

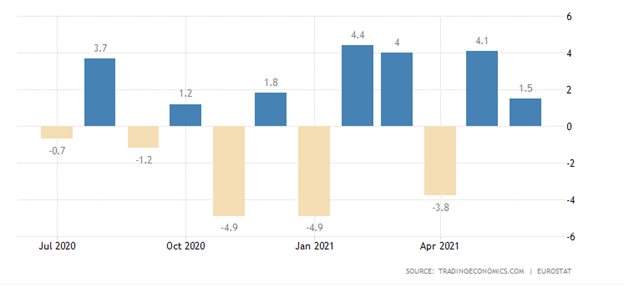

Eurozone retail sales could be a big focus for the market this week as a number of signs emerge that COVID-19 is causing some economic pain across Europe, and markets will be watching closely to see how the European consumer is being affected.

Last month EU retail sales increased by 1.5 percent from a month earlier in June 2021, following a downwardly revised 4.1 percent growth in May and compared with market expectations of a 1.7 percent increase.

Among the bloc’s largest economies, Germany reported the largest monthly increase, with sales growing 4.2 percent. Sales in France, Italy and Spain also rose. On a yearly basis, retail sales rose 5.0 percent in June, beating market expectations of 4.5 percent.

The euro currency and the many of the big indices in Europe, such as the GER30, CAC40, and ITA40 are likely to stage a big reaction if EU retail sales fall sharply. The trend in retail sales is very shaky, so we probably need to see a clear pattern emerges.