During the upcoming trading week, the release of the United States Non-farm payrolls job report is set to be the main focus for financial markets, following last month’s multi-month high 850,000 headline number.

Other key highlights on the economic docket this week include the closely watched ISM manufacturing report, UK PMI manufacturing report, and key retail sales numbers from the eurozone economy.

This week we also see a large emphasis being placed on central banks, with both the Bank of England and the Reserve Bank of Australia delivering monetary policy statement and interest rate decisions.

ISM Manufacturing Report

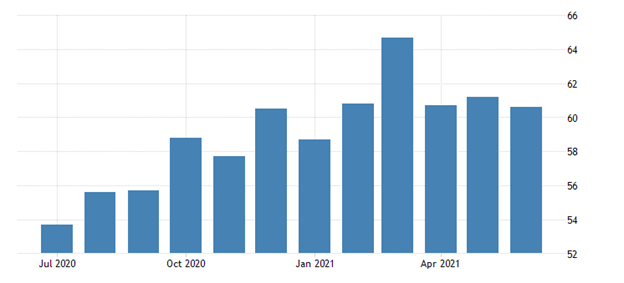

Analysts are expecting another weaker ISM manufacturing report for July, with a 60.5 number being touted as the most likely headline number this week. The ISM Manufacturing PMI fell back to 60.6 last month, which was some way away from highs of the year, as highlighted by the chart below.

If we look at last month’s reading, the data still pointed to robust growth in factory activity although a slowdown was seen for new orders, and supplier deliveries, while employment contracted slightly, and price pressures intensifies.

This month the ISM survey is expected to show more record-long raw-material lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products.

Non-farm Payrolls Job Report

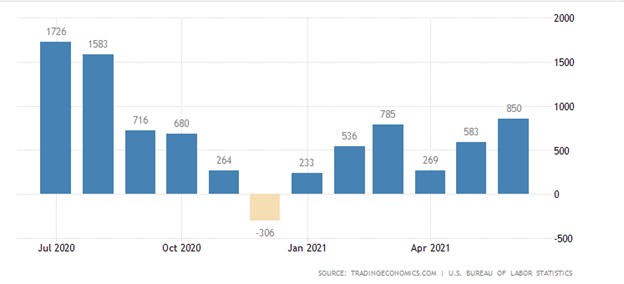

Traders will be highly anticipating the Non-farm payrolls job report this week, with many analysts predicting that the United States economy created 925,000 new jobs in July, marking a solid improvement on last month.

Last month the American economy added 850,000 jobs, which was the strongest job growth in 10 months, and well above market forecasts of 700,000. Notable job gains in June occurred in leisure and hospitality as pandemic-related restrictions continued to ease in some parts of the country.

This month’s job number should be strong as many companies are forced into raising salaries to cope with the absence of workers due to COVID-19. Watch for an improvement on last month’s wage earnings data. Average hourly earnings increased fell below forecasts of 0.4%, we should see hourly earnings rising this week as companies are forced to raise wages to retain workers.

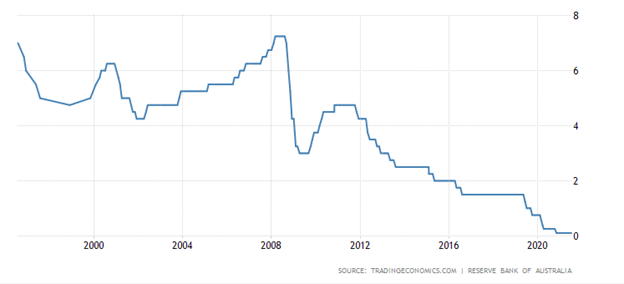

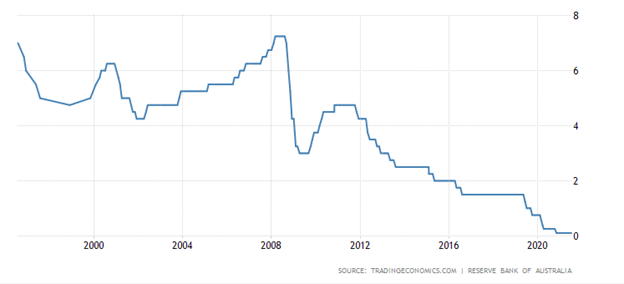

RBA Rate Decision

The Reserve Bank of Australia is widely tipped to keep the cash rate unchanged at a record low of 0.1% during its August meeting, and actually talk back taper talk and any potential decrease of QE.

Last month the central bank reaffirmed its commitment to achieving full employment and inflation consistent with the target. Due to COVID-19 shutdown in major cities in Australia the RBA may become more aggressive to protect the job situation.

Policymakers are also expected to reiterate that they will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range. The RBA’s ongoing scenario for the economy is that this condition will not be met before 2024.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.