During the upcoming trading week, central bank action dominates the economic docket for traders and investors, as the Federal Reserve Open Committee, Bank of England, and Bank of Japan are all scheduled to deliver interest rate and policy decisions.

Aside from the big central bank meetings, the release of the ZEW sentiment data from Germany and the eurozone is also due. This could impact the euro currency as the market has been particularly sensitive to ZEW releases over recent months.

Australian dollar traders will also be on high alert this week as the Reserve Bank of Australia meeting minutes is revealed. The release of the February employment report from the Australian economy, GDP, retail sales data this week will also have consequences for the Australian dollar, given the Reserve Bank of Australia’s stance on consumption and jobs.

Other highlights on the economic calendar include consumer price inflation and retail sales from the Canadian economy, and a raft of data points from the United States economy including weekly jobs, housing, and manufacturing numbers, which could affect the greenback.

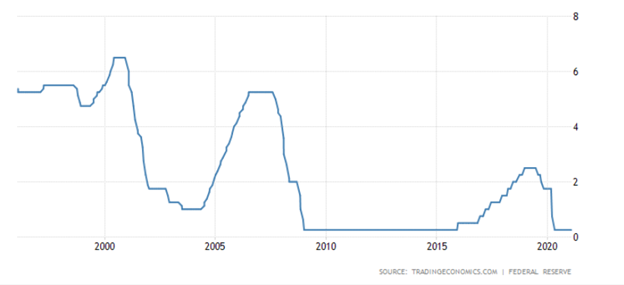

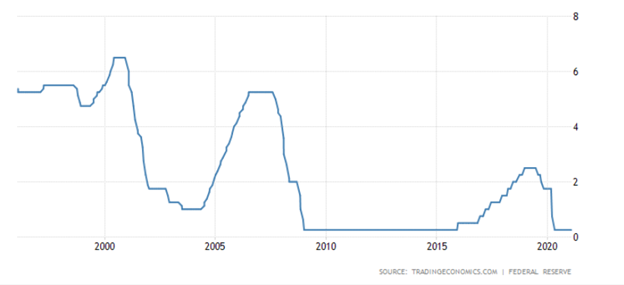

Federal Reserve

This week’s FOMC rate decision is likely to set the overall tone for financial markets, especially the central banks official policy statement to market participants. The economic projection from members of the Federal Reserve is probably going to be the most contentious part of this week’s meeting.

Assuming that the Federal Reserve leaves policy unchanged, the FED economic projections will give a key insight into whether members of the US central bank truly believe that the US economy is in recovery mode or. FED members will probably be careful and strike a fine balance between positivity and not sounding too optimistic.

Given the recent moves in the bond and equity markets, this meeting could set the overall tone for the rest of the month. FED members will be factoring in the boost new stimulus package into their projection, so a slight hawkish tilt could be on the cards.

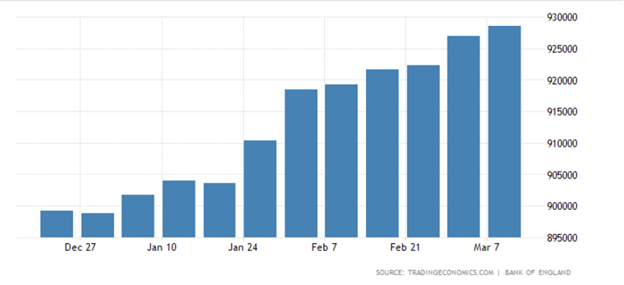

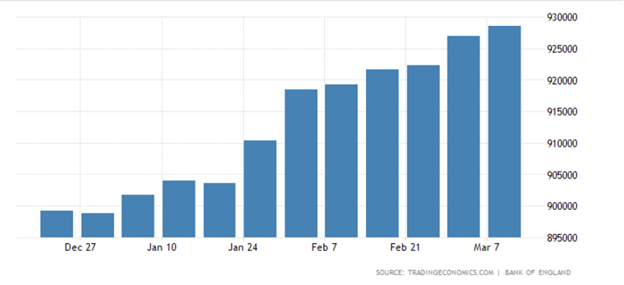

Bank of England

The United Kingdom economy has no notable economic data point releases this week; however, the Bank of England interest rate decision could be a big market mover for the British pound and the FTSE 100.

Market participants will be look to the central banks view on inflation, QE, and the overall economic outlook for the United Kingdom economy, now that negative interest rates have more or less been put to one side.

A clear case exists for a slight hawkish tilt during the March Bank of England meeting, given that the UK economy is close to coming out of lockdown. However, the central bank will be sure to spell out the economic risks that COVID-19 still poses.

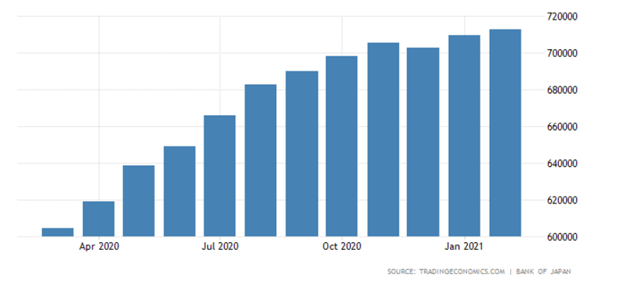

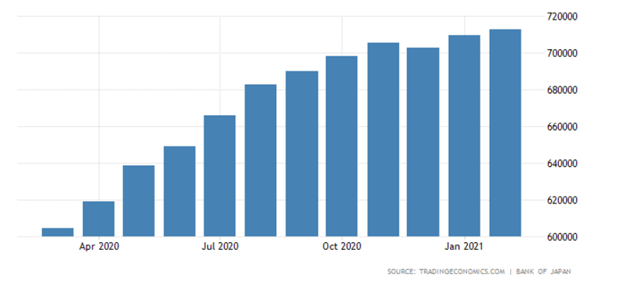

Bank of Japan

The Bank of Japan policy decision is set to be a significant event for the yen and the Nikkei 225 this week. It is unlikely that the central bank will change policy, and that the recent review of policy was more of a verbal threat to weaken the yen currency. Whether the verbal intervention continues or not remains to be seen.

In fact, the Japanese central bank appears to have achieved its mission through verbal intervention, as the yen has been on a one-week journey lower since the central bank announced that they would reviewing central bank policy last month.

Traders should also note that the Japanese economy will be releasing industrial production and inflation data this week. Both of these metrics are of major importance to policy members of the Japanese central bank.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.