During the upcoming trading week, the Federal Open Market Committee policy meeting is set to headline the economic docket as traders await the FED’s latest thoughts on the United States economy, QE, and rates.

Other key macroeconomic releases in a very US data centric week include the release of the United States GDP and inflation data, and a slew of heavyweight tech companies releasing Q2 earnings results.

This week will also see the release of German IFO data, and a raft of Consumer Price Index inflation data from important G7 nations such as Germany, Canada, Australia, and France.

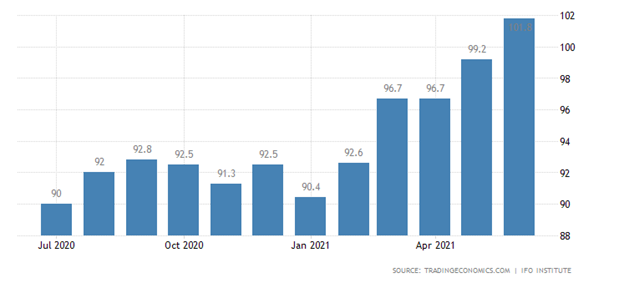

German IFO

The July readings for the German IFO survey are expected to tick down slightly from the previous month, largely due to concerns about the new COVID-19 Delta variant, and the potential effects it may have on the German economy.

Last month the Ifo Business Climate indicator for Germany rose by 2.6 percent from a month earlier to 101.8, marking the highest Ifo Business Climate level since November 2018 and comfortably above market expectations of 100.6.

German companies assessed their current business situation as being much better last month, while optimism regarding the second half of the year also grew. Sentiment among manufacturers improved to an over three-year high, which may have marked an important peak if the new COVID-19 variant proves to be a problem again.

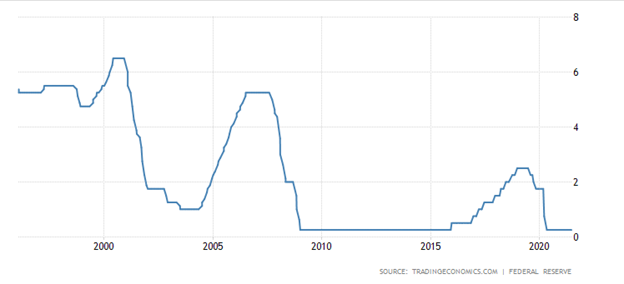

FOMC Policy Decision

The Federal Reserve interest rate decision will be fascinating on many levels this week as inflation remains high and the central bank will have to address rising COVID-19 cases from the new Delta variant.

Last month the central bank said the benchmark standard of “substantial further progress” toward full employment and price stability was still a way off, although progress was happening.

Fed Chair Powell said that the Fed is ready to intervene if inflation spirals out of control pointing that price rises are notable substantially and will likely remain elevated in the coming months before moderating.

Powell and his team at the FED have a difficult job this week to appease everyone as the central bank will need to sound mildly bullish to stop a US dollar sell-off. They will likely have to note that downside and lockdown risks have increased amidst rising new Delta variant cases.

US Q2 Gross Domestic Product

Economists are giving estimates as high as 7.9 percent for the second-quarter US GDP release, which would be a major milestone for US economy, given the scale of the problems the economy has faced during the pandemic.

Last quarter the US economy grew by an annualized 6.4 percent in the first quarter, matching the second estimate and following a 4.3 percent expansion in the previous three-month period.

Upward revisions to non-residential fixed investment, private inventory investment, and exports were offset by an upward revision to imports. Analysts have even predicted that the economy could expanding by as much as 9% in Q2 as the recovery continues although rising price pressures are already weighing on some sectors, such as the housing market.

Earnings Season

This week we see second quarter earnings seasons releases from some of the largest tech and financial companies. Traditionally, both sectors capture the markets focus as the tend to hold the most market cap amongst the major averages and fund managers tend that invest in both sectors.

Apple, HP, ALPHABET, TESLA, AMAZON, and Facebook will release second-quarter results on the tech front. All these companies are expecting solid Q2 results, which is not secret to the market. Forward guidance and the earnings call will likely be key, as this is the unknown segment to market watchers. Overall, watch out for huge market volatility this week.