During the upcoming trading week the European Central Bank policy meeting is set to headline the economic docket as traders await the latest thoughts from the Governing Council on eurozone economic activity and whether the central bank is set to change its dovish policy stance.

Other key macroeconomic releases to watch out for this week to watch include the release of the RBA and Bank of Japan meeting minutes and eurozone manufacturing PMI readings.

This week will also see the release of the People’s Bank of China interest rate decision and US earnings seasons as it starts to release second quarter earnings for tech, retail, and financial companies on the United States.

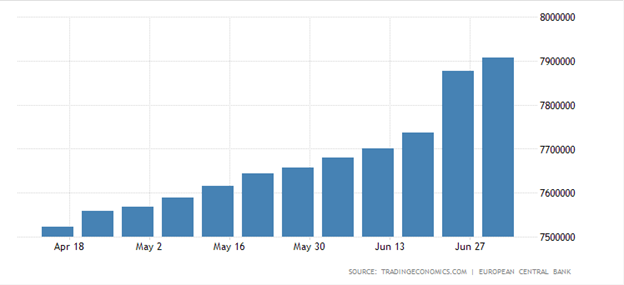

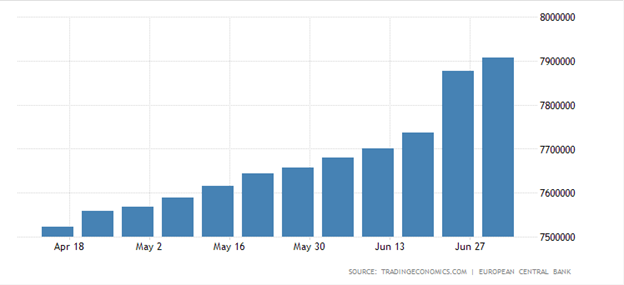

ECB Rate Decision

The highlight on the economic docket this week is without a doubt is going to the ECB policy decision, with inflation, growth, and progress on the central banks digital currency likely to feature heavily during the ECB press conference.

Last week the ECB announced that they are expected growth to pick up, so a more bullish stance is likely to be taken this meeting, however, the central bank is expected to stop well short of tapering QE.

CPI inflation is on the rise across Europe, so expect plenty of discussion about the central banks 2 percent mandate, and what the Governing Council expect inflation to do over the coming months.

The ECB have also increased development activity and research into a central bank digital currency. The crypto market could become volatile as the ECB lay out further plans.

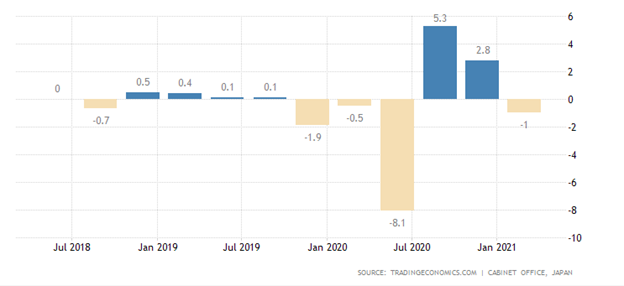

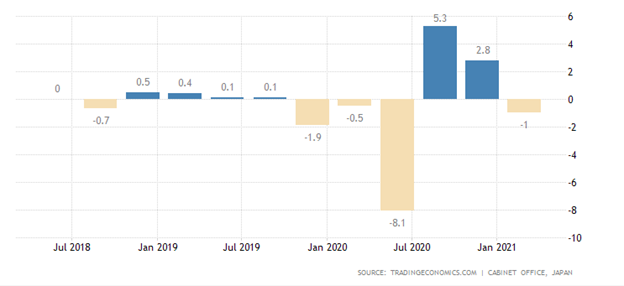

Central Bank Meeting Minutes

The meeting minutes from both the RBA and BOJ are set to be released this week with both central banks unlikely to show any significant changes since their respective July policy meetings.

Japanese economic activity remains extremely low and is unlikely to expand during the third fiscal quarter, while the Australian economy is just starting to show tentative signs of recovery.

However, many Australian states have been put back into lockdown, which is likely to further weaken the growth prospects of the Australian economy and dent jobs growth.

Eurozone PMI Manufacturing

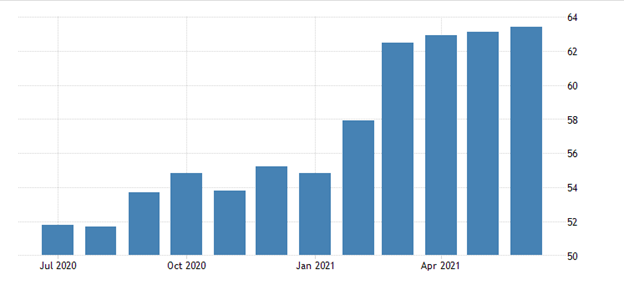

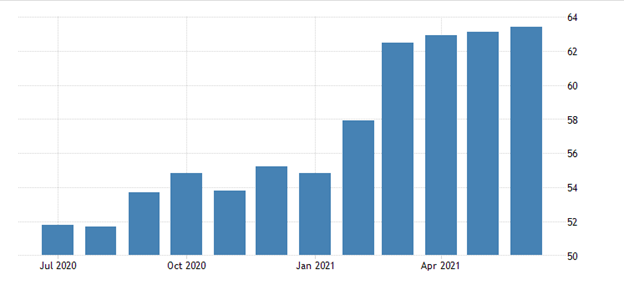

The preliminary IHS Markit Eurozone Manufacturing PMI is expected to show a slight drop took place compared to last month, however, on an historical basis the expected 62.5 reading is still very high.

Last month’s new record high of 63.4 in June 2021 marked a twelfth successive month of expansion in the sector, although it failed to ignite the euro currency from the doldrums in the FX market.

Overall, production growth, new orders experienced their third-fastest ever reported increase, and new export orders are expected to show increasing sharp rise this month due to season effects and the COVID-19 lockdown rebound.

Supply-side constraints are widely expected in July, and confidence about future output, bearing in mind the latest IFO data, is will likely to remains close to record highs.

Earnings Season

This week we see earnings seasons start to heat up as heavyweight companies in the US such as Coca Cola, Netflix, AT & T, Goldman Sachs, and Bank of America release second quarter results.

It should be said that signs of inflation inside these reports will be closely scrutinized, and exactly what the companies are doing to counter multi-decade high levels of food and energy price inflation.

Stock traders can expect increased price volatility over the next few weeks. Next week could be one of the most volatile trading weeks of the year as Apple, ALPHABET, TESLA, AMAZON, and Facebook all release second-quarter results.