During the upcoming trading week global central banks and jobs data are set to be will play a big role in how the market is positioned at the start of the third fiscal quarter. The main events this week will be the release of the FOMC meeting minutes, the Canadian monthly jobs report, and the RBA interest rate decision.

Other key macroeconomic releases to watch out for this week to watch include US weekly jobless data, which the market is likely to focus on after last week’s big drop in jobless claims, and Retail sales data from both the eurozone and Australian economies.

This week will also see the release of the CPI inflation numbers from the Chinese economy, United Kingdom Manufacturing data, and the ISM services report from the United States economy.

FOMC Minutes

The highlight on the economic docket this week is probably going to be FOMC meeting minutes. Very simply put, the Federal Open Market Committee Meeting Minutes are a detailed record of the committee’s policy-setting meeting, which is typically held around two-week earlier.

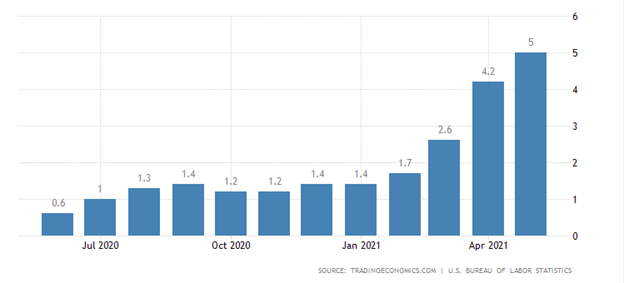

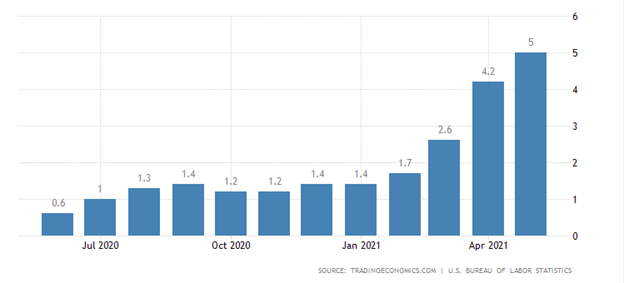

A big focus of the FOMC meeting minutes is going to be on the central banks thoughts on inflation and also jobs after the June policy meet. Last month the annual inflation rate in the US accelerated to 5 percent in May of 2021 from 4.2 percent in April, which was way above market forecasts of 4.7 percent.

The US CPI reading was actually the highest reading since August of 2008 amid low base effects from last year when the coronavirus pandemic hit the US economy very hard. Rising consumer demand as the economy reopened, soaring commodity prices, supply constraints and higher wages all took place as companies grappled with a labour shortage.

No major surprises are expected this week, and it will particularly be interesting to see what the FX and bond market does after the FOMC release, especially after last Friday’s reaction to the NFP headline number.

RBA Rate Decision & Policy Statement

Aside from the ongoing lockdown going on in certain parts of Australia, the RBA is largely expected to sound more bullish towards the ongoing recovery in the Australian economy and the falling AUDUSD exchange rate.

Employment in Australia increased by 115,200 to 13.12 million in May 2021, easily beating market forecasts of a 30,000 gain, despite COVID-19 restrictions in several states and an acceleration in coronavirus vaccinations. The June jobs report should provide fascinating reading when it is released.

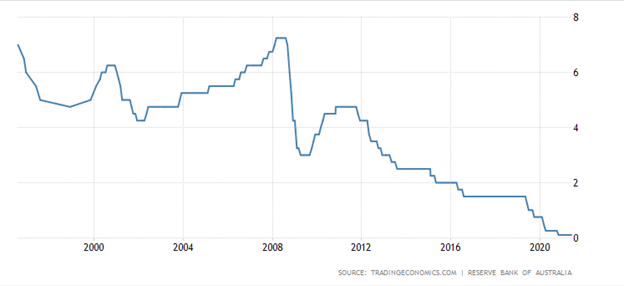

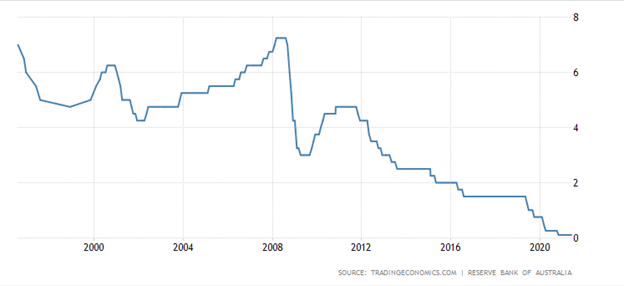

The Reserve Bank of Australia kept the cash rate at a record low of 0.1% during its June meeting, as widely expected. This week policymakers are likely to reaffirm their commitment to maintaining highly supportive monetary conditions until at least 2024 when actual inflation is within the 2 to 3% target.

Traders are expecting more of the same during the July policy meeting, albeit with a more positive tone attached, which could support the AUDUSD pair.

Canadian Monthly Jobs Report

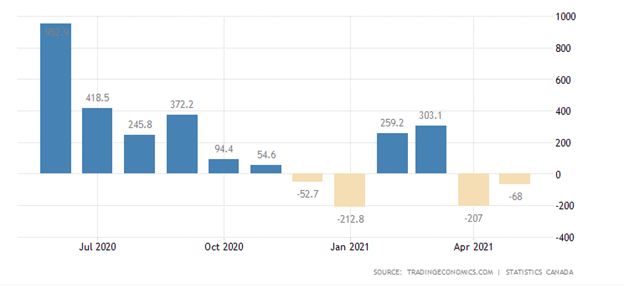

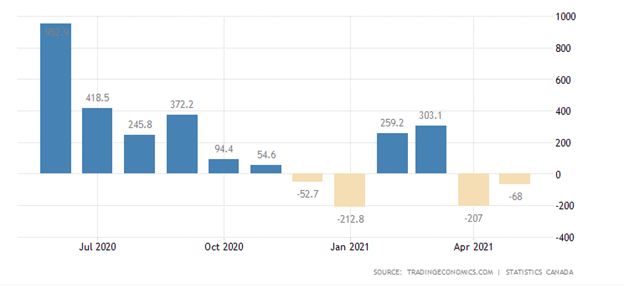

The Canadian economy unexpectedly shed 68,000 jobs in May of 2021, making this week June jobs report even more important for future Bank of Canada policy decisions.

Most top-rated economists are expecting a net employment change of -20,000 in the Canadian economy this week, with the Canadian unemployment rate to hold steady at 8.2 percent.

Canada’s economy is heavily reliant on services and also the oil industry. As oil prices surge above $70.00 this could be soon as a boon to the economy, making oil and petroleum focused companies more likely to hire than not.