During the upcoming trading week the economic calendar is once again jammed packed with central bank action and top-tier economic data points. The main events this week will be the release of PMI manufacturing data from the eurozone, scheduled speeches from both Federal Reserve Chair Jerome Powell and ECB President Christine Lagarde, and a key rate interest decision from the Bank of England.

Other key macroeconomic releases to watch out for this week to watch out for this week include United States Growth Domestic Product, Michigan Sentiment, and Durable Goods Orders.

This week will also see the release of the Bank of Japan meeting minutes, United Kingdom Service PMI data and Retail Sales numbers from the Australian and Canadian economies.

FED Powell Speech

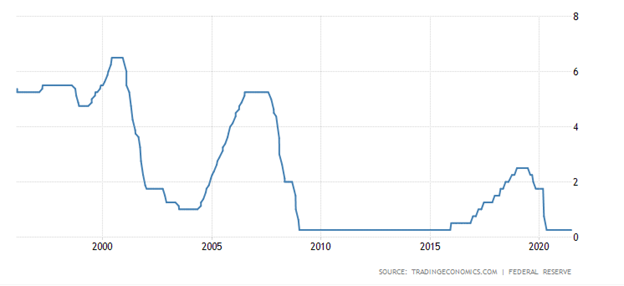

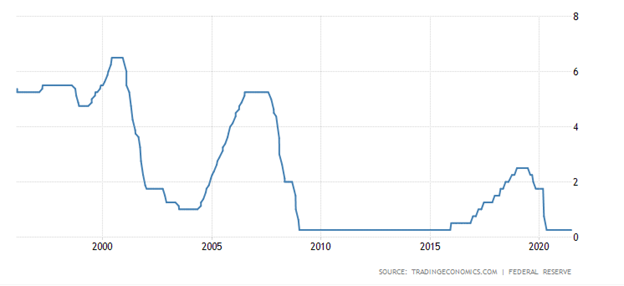

The highlight on the economic docket this week is going to be a scheduled speech from Federal Reserve Chair Powell after last week’s policy address, which left financial markets in no doubt that the US central bank is closely watching inflation and becoming more hawkish.

So far the market reaction has seen the US dollar rising, gold tumbling, and stocks coming under selling pressure. Market participants will be closely observing Powell’s every word in case he backtracks on any of last week’s comments.

It is very unlikely that he will undo last week’s comments, especially since sufficient data has noy been released in the meantime in order for the US central bank to change their policy stance from last week.

Powell may be slightly cautious that the market is getting ahead of itself already. Expect plenty of trading action and volatility in the US dollar currency, gold, and stocks in the lead up and aftermath to Chair Powell’s scheduled speech.

EU Preliminary PMI Data

Last month the eeurozone Manufacturing PMI was revised higher to 63.1 from a preliminary of 62.8, which was above 62.9 reading in April. The number essentially pointed to fresh record growth in factory activity.

Purchasing activity rose at a fresh survey record rate but faced showed that factories delay in delivery. Firms once again utilised their existing stocks wherever possible.

On the price front, average input costs again rose substantially, with the rate of inflation hitting an unprecedented level. Widespread product shortages and output inflation was the fastest in more than 18 years in May. Manufacturing employment also went up for the fourth month in a row.

Analysts expect that the preliminary June eurozone PMI will come in at 62.5 this week, which is still a very solid number. Just for the record, the closely watch German PMI manufacturing number is expect in at 65.9 this week.

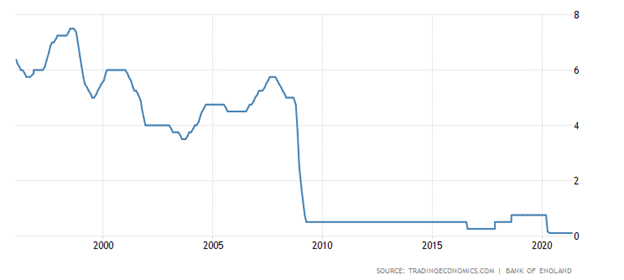

Bank of England Policy Meeting

The Bank of England policy meeting should be very interesting this week with most economists giving the central bank zero chance of hiking rates, although cutting back on QE is on the table.

It is still up to debate whether the British pound will start to rally on potential QE news, given that the US dollar index is racing higher, and the FED and the US economy is stronger than the United Kingdom’s at the moment. The FTSE100 may be another matter, at a time when the index hit a 2021 trading high last week, and then swiftly dumped back under the 7,000 level.

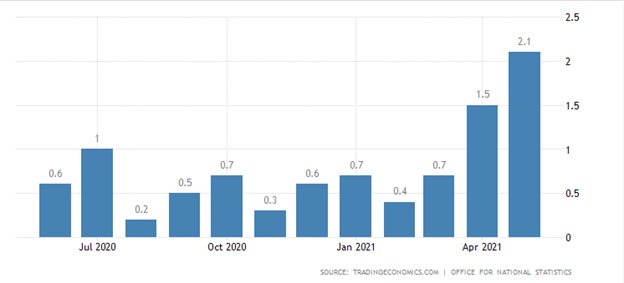

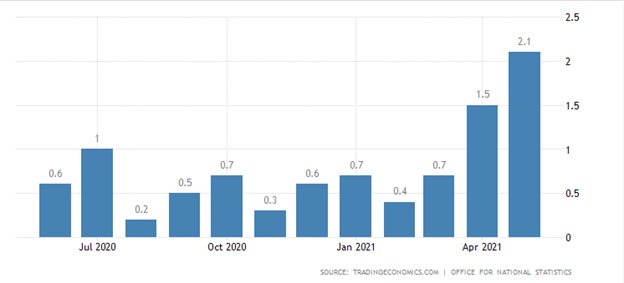

Inflation is going to be a hot potato this week for financial markets. The consumer price inflation rate in the UK climbed to 2.1 percent year-on-year in May 2021, from 1.5 percent in the previous month and comfortably above market expectations of 1.8 percent.

Just to underscore how significant the rise was last month, it was the highest rate since July 2019, which largely reflected the ongoing economic recovery and re-opening efforts and the potential supply chain problems the UK faces after Brexit.