During the upcoming trading week, the economic calendar is heavily dominated by central banks, as the US Federal Reserve, Bank of Japan, and Swiss National Bank all decide on interest rates. The FED will be laying out its economic projections at this week’s meeting, so plenty of volatility should be expected in financial markets.

Other key highlights on the economic docket this week include the release of United States monthly retail sales and producer price index data from the world’s largest economy.

This week will also see the release of the Reserve Bank of Australia meeting minutes, German CPI inflation data, and the United Kingdom employment and unemployment numbers. Market participants will also be closely watching the release of CPI inflation data from the Canadian economy.

FOMC Policy Meeting & Economic Projections

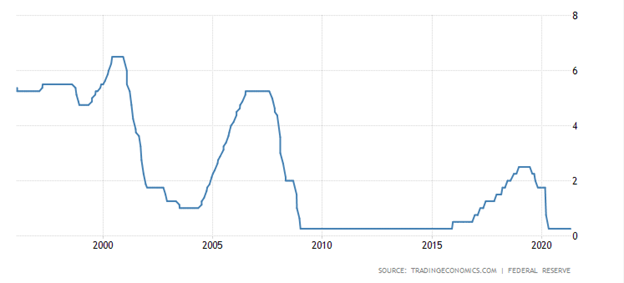

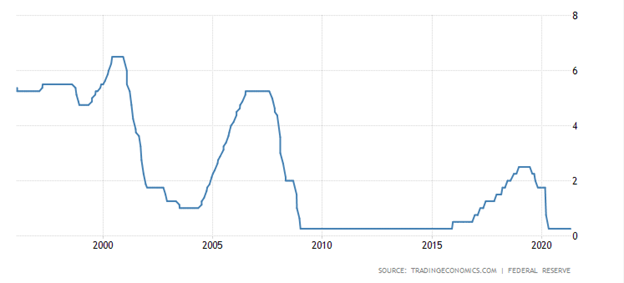

The undoubted highlight on the economic docket this week is the FOMC rate decision. It is entirely plausible to say that financial markets have been in limbo over recent weeks as they await this important event.

Most economists are expecting the United States central bank to hold rates and policy unchanged and continue with the ongoing guidance to market participants that inflation is only transitory. However, the economic projections and overall tone of the policy language will be the major focus of the meeting this week.

Key asset classes to watch after the Federal Reserve’s rate decision and economic projections will be usual suspects, namely the US dollar, stocks, bonds, and of course gold. I tend to believe that gold may start to benefit as traders and investors hedge against high and possibly rampant inflation.

Should the Federal Reserve upgrade economic projections it will be more likely than not good for the US dollar currency and stock markets. The bond market reaction is likely to be mixed.

Bank of Japan Rate Decision

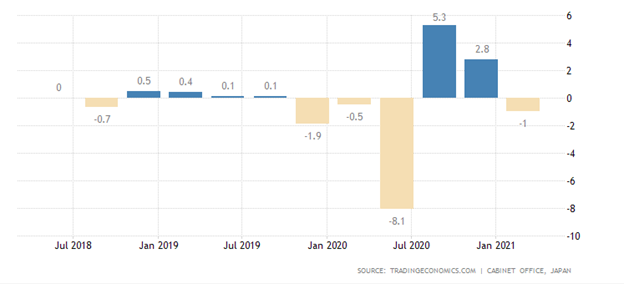

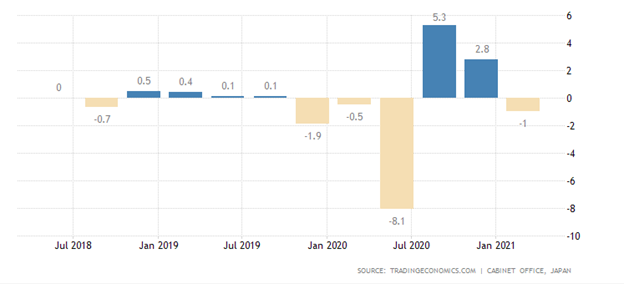

The Bank of Japan will be keen to discuss inflation and growth during the upcoming policy address, however, any notion of tapering or raising rates is likely to be off the table this week.

Last quarter’s dismal economic contraction does not bode well for the Japanese economy, considering that both the United States and China posted strong economic rebounds.

Fear of a double-dip recession will be high as COVID-19 continues to weigh on the economy. Overall, more QE, and more mention of weak inflation should see the USDJPY pair on a moderate price path between 105.00 and 110.00 this year, particularly with taper talk off the table in Japan.

US Retail Sales

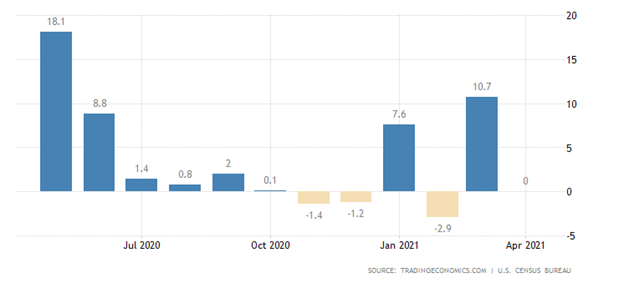

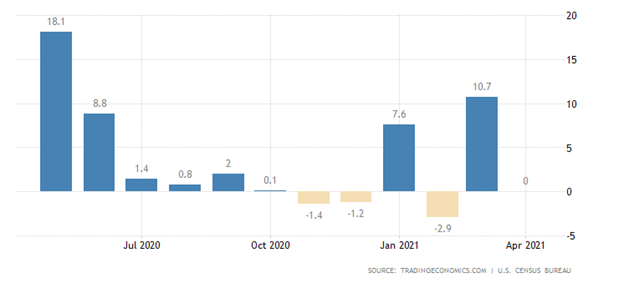

Market experts are expecting that the United States retail sales number remained volatile in May, and actually went into a state of contraction by some 0.4 percent during the month of May.

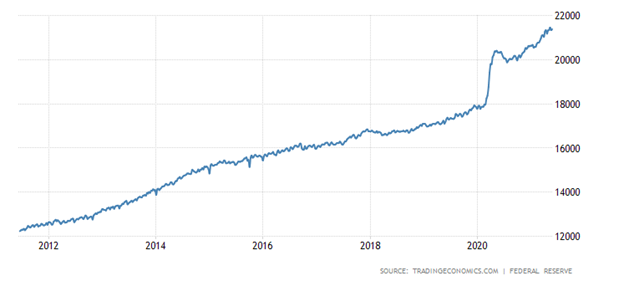

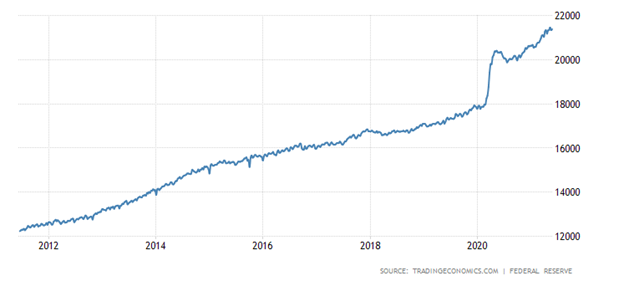

As you can see by the chart below retail sales are highly volatile. The volatility in this number is due to a number of ongoing factors, and if we throw COVID-19 into the mix, then it becomes even more difficult to draw hard and fats conclusion on a regular basis.

Still, US retail sales always have the potential to move the market and they do play an important role of assessing the overall health of the US consumer, which is generally a bellwether for the global economy.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.