During the upcoming trading week, the release of the United States Non-farm payrolls job report is set to be the main focus for financial markets, following last month’s lacklustre headline number of 260,000.

Other key highlights on the economic docket this week include the Reserve Bank of Australia interest rate decision and monetary policy statement, and the ISM manufacturing report from the United States.

This week will also see retail sales and CPI inflation numbers from Europe, monthly jobs and Gross Domestic data from the Canadian economy, and retail sales figures from the Australian economy.

ISM Manufacturing Report

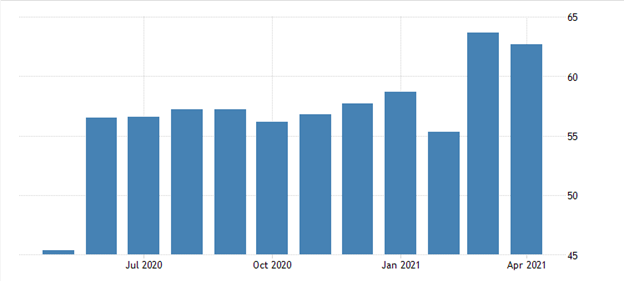

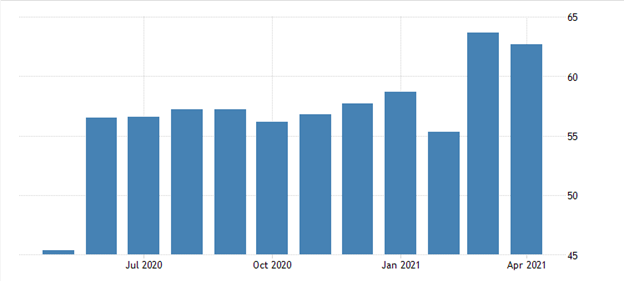

The ISM Non-Manufacturing PMI is expected to come in at 62.9 for the month of May, which would mean that manufacturing activity expected 0.2 more than the previous month.

Last month the ISM survey from the US dropped to 62.7 from an all-time high of 63.7 in the previous month, which was just below market expectations of 64.3, indicating slowing growth in the services sector.

The survey’s measure of prices paid by services industries rose to 76.8, which was in fact the highest reading since July 2008. Inflation will be closely scrutinized inside this report, and if we see more strong inflation then the greenback could surge against other currencies.

Non-farm Payrolls Job Report

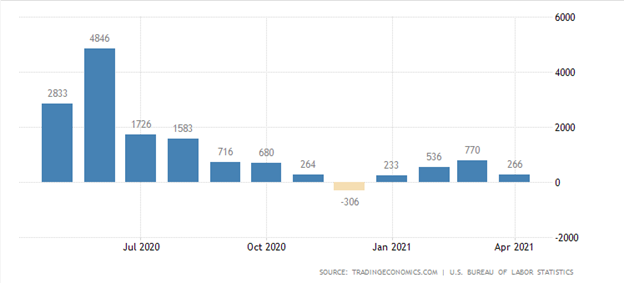

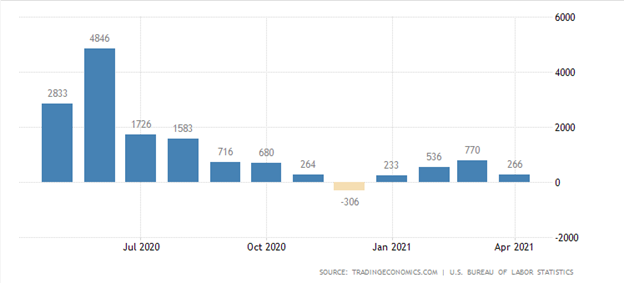

Traders will be highly anticipating the Non-farm payrolls job report this week, with many analysts predicting that the United States economy created 620,000 new jobs in April.

Investors will be nervous after last month’s sub-optimal job report, which showed a worrying decline in job activity in the United States from the previous month massive 900,000 number.

Should we see a 600,000 jobs number then the market reaction is likely to be positive for stocks and the greenback. A much weaker Non-farm payrolls headline number and the US dollar may go into meltdown mode as market pare back expectation of US rates rising any time soon.

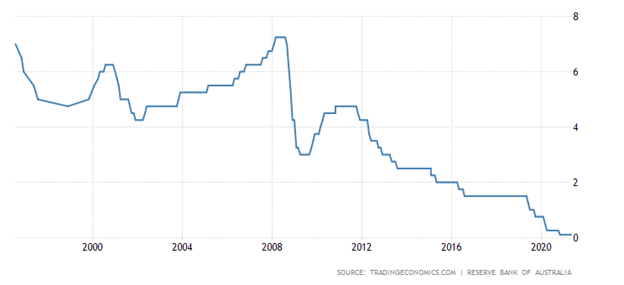

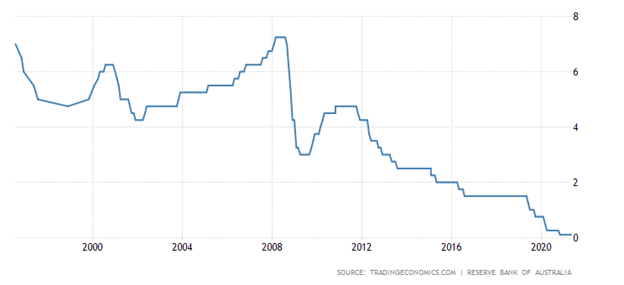

Reserve Bank of Australia Rate Decision

The Reserve Bank of Australia is likely to leave policy unchanged in terms of rates and QE this week, however, markets will be on guard after the New Zealand central bank struck a more hawkish tone last week.

The RBA left its cash rate unchanged in the May meeting, as policymakers reaffirmed their commitment to maintaining highly supportive monetary conditions until at least 2024 when actual inflation is within the 2 to 3% target of the central bank.

Policy makers noted that a gradual pick-up in inflation and wage growth is expected to remain the case as a reversal of some COVID-19-related price reductions kick-in.

Last month the RBA’s GDP forecast was revised up, with growth of 4.75% expected in 2021 and 3.5% in 2022 as business investment picked up and household spending strengthened. Any update commentary and expect the AUD/USD pair to surge.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.