During the upcoming trading week, the release of Core PCE and preliminary Gross Domestic Product from the United States economy is set to move the needle for financial markets and headline the economic docket.

US growth is predicted to come in red hot during the first fiscal quarter, with most economists predicting that the world’s largest economy is set to expand by around 6.5 percent or more.

Other key highlights on the economic docket this week include the Reserve Bank of New Zealand interest rate decision and policy decision, and the IFO monthly survey, Retail Sakes, and GDP data from the German economy.

Market participants will also be focused on the price movements of tech stocks, and the ongoing situation with rising COVID-19 infections in India, the spread of the COVID-19 variant globally.

US Annualized GDP & Core PCE

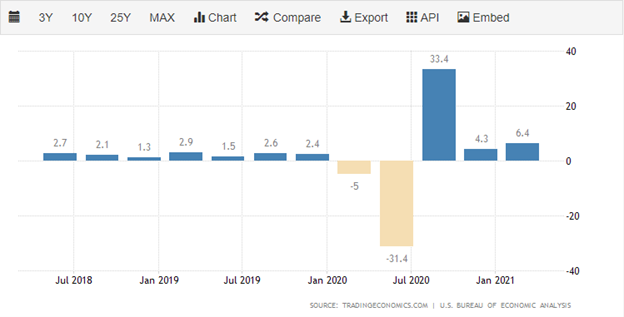

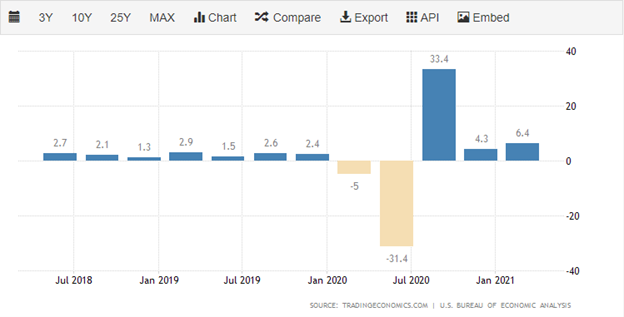

Traders and investors are largely expecting the US economy to have grown by around 6.5 percent in the first fiscal quarter, with a minority of economists predicting growth within the 6.6 range. Any beat on 6.6 percent should evoke a bullish market reaction.

It is important to note that annualized Gross Domestic Product is closely watched by the market as it gives a closes indication about the pace of growth or indeed declining growth.

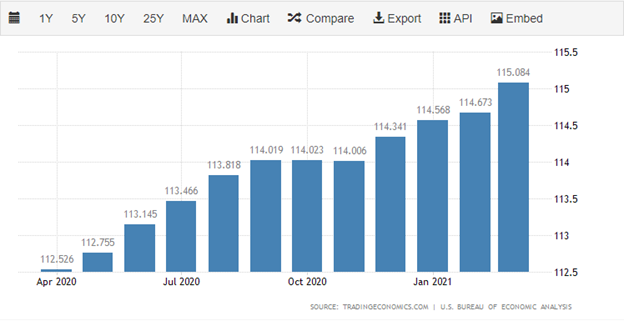

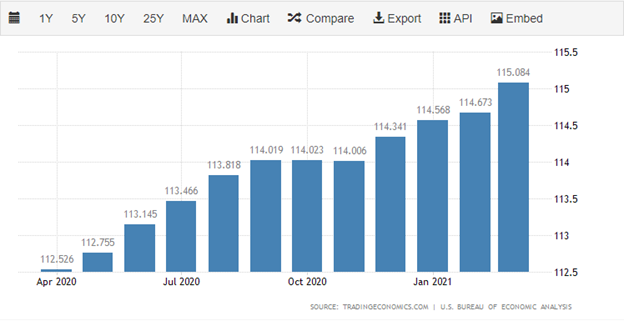

Market attention will also be focused on core PCE data from the US economy this week, as inflation remains the hot topic of the day after the previous months US CPI inflation number came in at a decade high.

More importantly, core PCE is the Federal Reserve’s preferred measure of inflation and if core PCE overshoots to the upside then the central bank may be more inclined to act in regard to policy and rates.

Reserve Bank of New Zealand

The Reserve Bank of New Zealand is not expected to act during this meeting, as most economists see very little case for the central bank attempting to raise interest at this stage in the recovery.

Recent steps to stop the domestic housing economy overheating, combined with fears about a lacklustre jobs market are even more reason why the Reserve Bank of New Zealand are tipped to keep policy unchanged.

Any mention of the New Zealand dollar exchange range being too strong against could of course have consequences for the kiwi. The NZDUSD, AUDNZD, and NZDJPY pairs are both ripe for a breakout right now, however, as risk appetite remains elevated the path of least resistance is currently to the upside.

German IFO

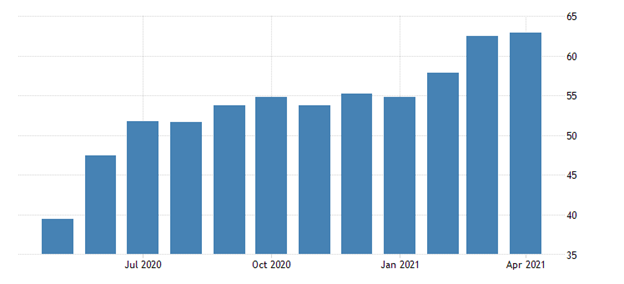

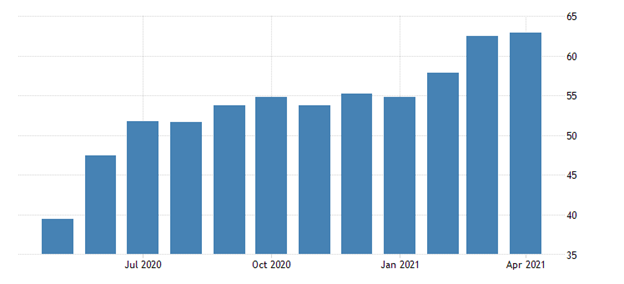

The IFO survey, which is a key Business Climate indicator for Germany, is expected to show a strong uptick in confidence this week, on all three components which make up the survey.

A rise in the IFO is typically bullish for the euro and European stocks. Last month in all three components of the IFO survey rose, which pointed to growing optimism in Europe’s largest economy.

In fact, the latest reading was the highest since June 2019 and signalled an improvement in business morale, as companies raised their assessments of the current business situation.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.