During the upcoming trading week, the Non-farm payrolls job report and the release of the Reserve Bank of Australia interest rate decision takes centre stage, at a time when financial markets are throwing a tantrum over the rapid pace of shorter-dated bond yields rising in the United States and globally.

Other highlights on the economic calendar include the US ISM manufacturing, ADP private sector jobs report and the Federal Reserve’s Beige Book. The moves in the US dollar index will be of particular interest, given last week’s breakout.

The Australian economy also releases a slew of high-impacting data points this week, including retail sales and Gross Domestic Product numbers. Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde are also set to deliver scheduled speeches.

US Bonds & Equity Markets

The moves in the United States equity and bond markets are going to be a huge focus for stock traders this week. The recent move higher in bond yields has sparked a sea change in how investors are looking at the equity market now.

Financials, energy, industrial, and material stocks has shown the strongest positive correlation with the recent rise in bond yields, particularly the 5 and 10-year Treasury yields. This a massive shift away from the old normal, where tech-related stocks were the darling of Wall Street, and the old staples were shunned.

Should we continue to see rising bond yields again this week, then watch out for the S&P 500 and Nasdaq to come under further pressure, especially the technology heavyweights inside these particular index’s.

The ongoing rotation back into financials, energy, industrial, and material stocks could be just getting warmed-up, due to the notion that the COVID-19 virus is subsiding and the global economy is now in recovery mode.

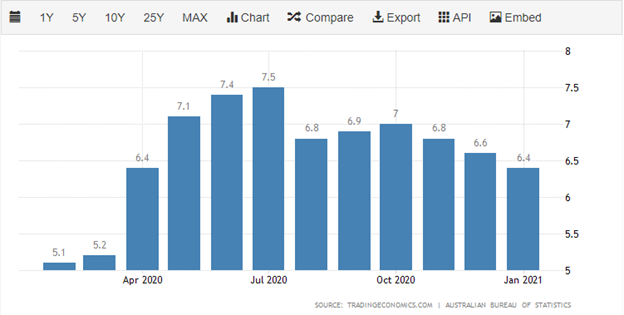

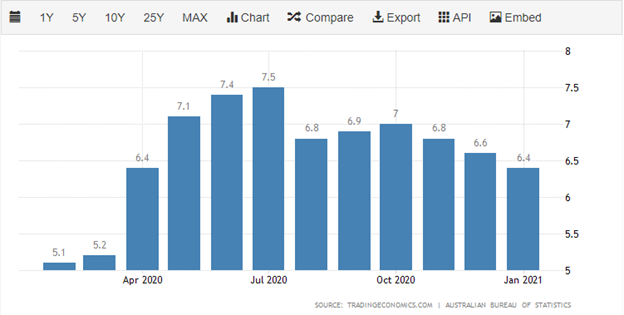

Reserve Bank of Australia

The Australian central bank is widely expected to keep interest rates unchanged at current levels. The central bank is unlikely to increase QE purchases, following the increase in bond buying from the RBA at the February meeting, however, they could become flexible in the number of daily purchases if bond yields start to rise.

Traders should remember that the central bank will not want to spook the Aussie bond market and sound too hawkish, given the major moves seen in United States bond yields last week. However, some talking up of the Australian job situation should be expected as will the central bank’s commitment to QE.

Some talk of the rapid appreciation of the Australian Dollar is likely to creep into the RBA policy statement as well. The RBA will be happy to jawbone the Australian dollar lower, even after Friday’s major pullback.

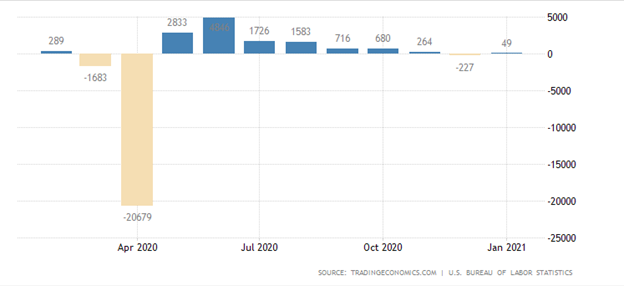

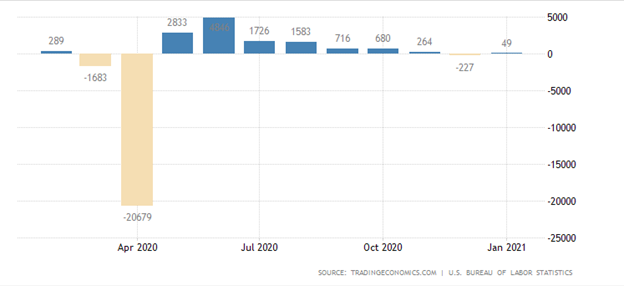

US Job Report

The February jobs report from the US economy is expected to show a solid improvement from the previous month, with most economists predicting that the US economy created +148,000 jobs during the month of February.

The US unemployment rate is expected to have ticked-up, while Average Earnings are widely tipped to have stayed the same. The headline number may carry some positive momentum here, but any revisions and signs of inflation will also be closely watched.

Something to watch out for is the strange dynamic that good numbers are bad for US stocks. This simply means that with continued good economic data the FED are more likely to be taking away the monetary methadone sometime this year, which could cause bond yields to rise again alongside interest rates.

ISM Manufacturing

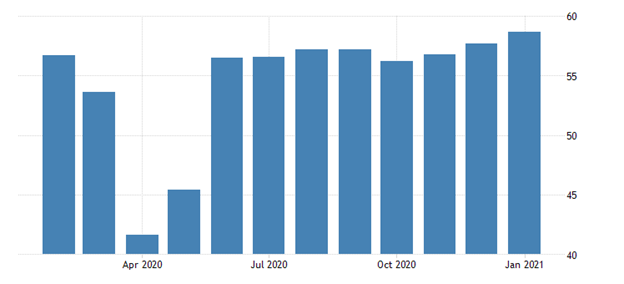

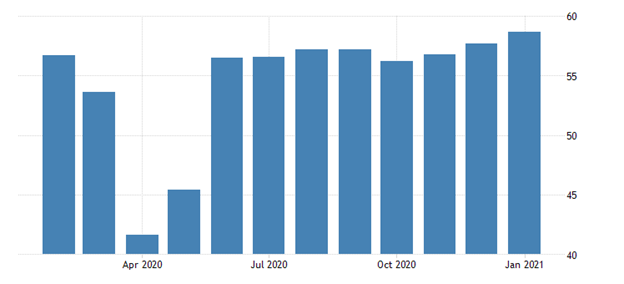

Aside from the moves in the bond market, the ISM manufacturing report is going to set the early-week tone for financial markets. Recent improvements in US data have set about the notion that a recovery is underway, and that things are looking up for the US economy.

Should we see the ISM February number outperform then we should market into a frenzy, and this is likely to be the catalyst for a rise in the value of the United States dollar, and a further steepening of US yields.

The ISM report is a big deal for traders and investors, so expect plenty of market action around the February release, and a potentially a big spike in the VIX volatility index if the ISM headline reading hits 60.