In trading, market sentiment can be a key tool for traders looking to identify overcrowded trades. One of the best features of using this strategy is the historical success of fading what the retail crowd are currently doing and being a market contrarian.

The ActivTrader platform Market Sentiment tool offers traders to do just that and get a key insight into how retail traders are currently positioned in real-time. This can be particularly useful for fading sentiment extremes.

Regularly checking the Market Sentiment tool can enhance your trading decision, increase your accuracy, and can also be used in conjunction with other indicators for identify overbought and oversold conditions such as the Relative Strength Indicator and other stochastic based indicators.

Typically, retail traders tend to lean against prevailing market trends and have poor market timing. Overcrowded sentiment from the retail crowd in one-direction combined with a trading assets classes going in the opposite direction of sentiment can be a major sign that the prevailing trend could be set continue, this makes market sentiment an important leading indicator for traders to follow.

Additionally, if a trade is going in the same direction as retail traders are predicting, and the trade is getting too crowded, then this may be a good time to look to fade this trade, and indeed what retail traders are currently doing.

In terms of sentiment readings, anything over 70 percent should start to raise some red flags for traders. This may not indicate that the trade has reached peak euphoria, however, it is certainly time to pay attention.

Market sentiment readings for an instrument that has reached over 80 percent is certainly at the extreme level, while market sentiment over 90 percent is often an indication that the trade could be peaking, and about to reverse at any time.

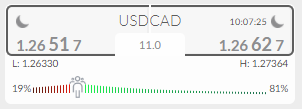

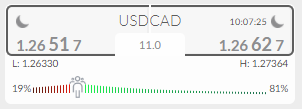

USDCAD- FX Sentiment Positioning

According to the ActivTrader Market Sentiment tool some 81 percent of traders are currently bullish towards the USDCAD at the moment, despite the Canadian dollar retaining its strength against the greenback.

This bullish sentiment skew suggests that traders may be wasting their time in this pair, and that the USDCAD pair could even continue its downward trajectory as oil prices continue to surge.

What I find interesting is that the US dollar is breaking higher across almost every major pair, but the retail crowd is most bullish towards the USDCAD, which is basically still confined to the bottom of the yearly range.

Personally, I think it may be better to look for other opportunities in pair’s like the USDJPY and USDCHF if you are bullish towards the US dollar currency.

Source By ActivTrader.

EuroStoxx 50 – Indices sentiment extreme

The market sentiment tool shows that some 81 percent of traders are bearish towards the EuroStoxx 50 right now, this could mean that the index is at serious risk of popping higher in early week trade and triggering massive amount of stop losses.

Source By ActivTrader.

Another phenomenon we are seeing this morning is the sentiment-based rally in broader financial markets is fading already from the announcement that the US Senate has approved the $1.9 trillion stimulus bill.

Those traders who are bearish towards the index are currently enjoying strong gains on Monday but do be aware that the trade is looking overcrowded and could reverse at any time.

Silver – Commodity Sentiment Watch

Market sentiment on the ActivTrader platform currently shows that over 77 percent of traders are bullish towards silver right now, despite the massive downside move in the metal last week.

Source By ActivTrader.

Now may not be the time to take a look at buying silver, as the retail crowd are apparently under the impression that silver will recover higher on pullbacks, no matter what the price of gold does.

Going forward, if traders continue to remain overly bullish towards silver at these levels then we could further losses towards $24.00 and even $22.00.