Throughout history, the stock market has consistently anticipated the future of the American economy, whether it be six, twelve months or sometimes a little longer, there are rare cases in which the behaviour of Wall Street has not revealed the future of companies, namely at times of economic recovery, given that at the top of the cycles, the dynamics tend to be much more sudden, with investors moving out of positions more quickly and visibly. This comes from another market maxim that is, fear is stronger than greed, that is, when it is falling and there is a rhetoric of panic in the market, it sells first and asks itself later.

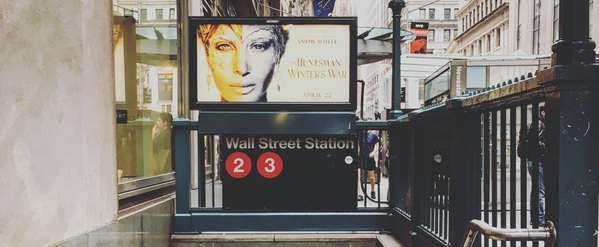

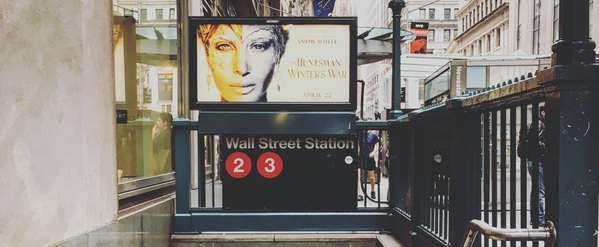

Photo by Karen Uppal.

When it comes to going up, the process is slower, something that despite the rapid rise since March was also validated this year since the fall was ultra-fast, the most expeditious in history. And there was some magic on Friday, with the numbers of the non-farm payrolls painting a scenario of a possible recovery in V, which would give justification for the meteoric rise seen in just over a month and against all common sense. , given that the more optimistic forecasts would hardly place the contraction and recovery in such a short period of time, since the characteristics of this crisis did not favour it, such as the effect that the stop could have on the solvency of a good part of the business fabric . However, if this turnaround is true, we must give credit to the American authorities, FED and Government, who were very quick to act and perhaps even managed to avoid the medium-term economic debacle, something that Europe is unlikely to achieve, since it hasn’t even approved a stimulus package worthy of the name.

Marco Silva is a Financial Market Specialist with 20 years of experience, with transactions in 12 different countries, involving numerous financial instruments, Specialist in Technical Analysis, Capital Manager, Investment Advisor, Financial Hedging Operations and Algorithm trading developer. Economic Commentator TV and RTP Information for the Financial Markets, Responsible for the Department of Economy / Markets of TVL.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.