Morning Brief: 05/03/2021

The US dollar is firming broadly on the foreign exchange market in early Friday trade, after Federal Reserve Chair Jerome Powell’s lack of concern towards the ongoing moves in the US bond market during his scheduled speech on Thursday caused a major market tantrum in a spectrum of asset classes.

Stock and metals markets sold-off, bond yields and the VIX volatility both spiked, and the US dollar index broke to a new multi-month high. The US dollar index staged a major range breakout as well, and this has translated into a big directional move in a number of the FX majors.

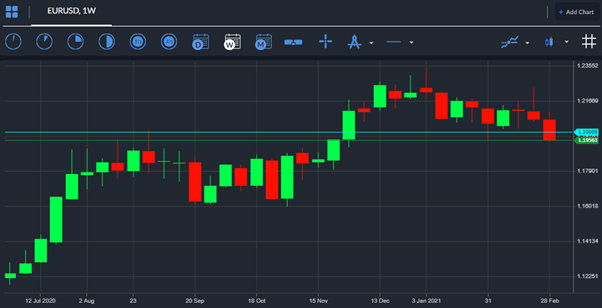

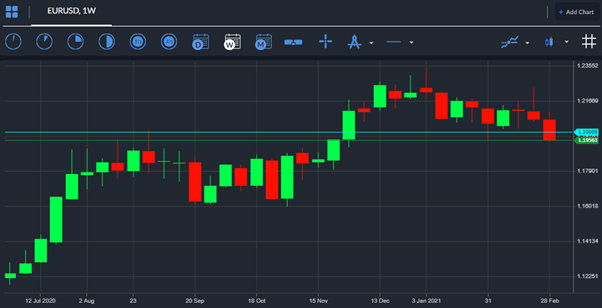

The euro currency has seen a sustained breakout against the US dollar and has dropped below the 1.2000 support level. The downside in the EURUSD pair is now quickly breaking down and is fast approaching the February low, around the 1.1950 level. Below 1.1950 the 1.1900 and 1.1860 levels offer critical support.

It is similar story with the USDJPY pair, following the recent breakout above the 107.00 handle. The USDJPY pair has gone from strength-to-strength and is now making traction above the 108.00 level, with the 108.60 and 109.00 levels the next upside levels to watch.

The USDCAD pair is largely mixed, due to the major breakout in oil, following yesterday’s OPEC meeting. A multi-year trendline breakout above the $63.00 level took place in WTI oil after OPEC agreed to keep oil production steady through April.

Saudi Arabia also agreed to extend its one million barrels per days voluntary production cut into April. However, Russia and Kazakhstan were allowed to increase oil production to 130,000 and 20,000 barrels per days.

Gold and silver have continued to drop as the move higher in the greenback has caused the non-yielding metals to fall to fresh monthly lows. The yellow metal has tumbled under the $1,700 support level, while the price of silver is dropping and pressing against the $25.00 support handle.

Bitcoin has also got in on the act alongside a number of other top cryptos and has fallen close to $3,000 since Federal Reserve Chair Jerome Powell’s speech yesterday. Ethereum and Litecoin are both in freefall alongside the top digital asset.

Data Watch

German Factory Orders data for the month of January beat expectations this morning, with a +0.7 percent gain. The economic calendar is very light today during the European session so the market focus will shift towards the Non-farm payrolls job report and the moves in the bond market.

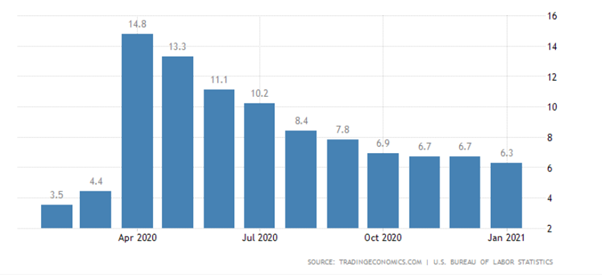

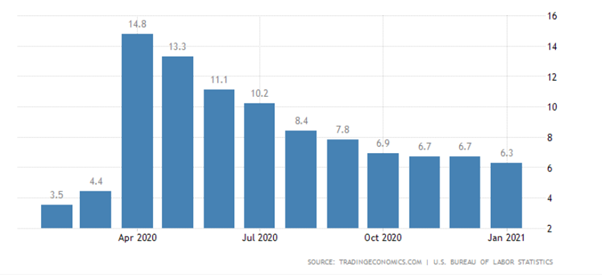

Moving into the US trading session the Non-farm payrolls job report is expected to show that the American economy created 180,000 jobs during the month of February, while the US unemployment rate is expected to come in at 6.3 percent.

The ongoing market themes are expected to stay in place if the February jobs report comes in as expected. Traders and investors will pay close attention to what to the signals from the US bond market, and the ongoing rise in oil prices, which will translate into more inflation if the rally in oil continues.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.