The move higher in the German DAX is falling under the market’s radar at the moment, due to the fact the upside momentum in the index is relatively muted. However, it should be noted that the GER 30 is trading at new all-time highs and could start to aggressively breakout.

Make no mistake, the recent breakout above the former all-time high, around 13,795, is extremely bullish for the German DAX from a technical perspective. Not only did the index manage to hit a new record high, but buyers eroded all the COVID-19 inspired losses of 2020.

The technical picture is therefore extremely positive for the GER 30 while the price continues to hold above its former all-time high. A massive bullish reversal pattern has also formed during the recent recovery on the higher time frames, but more on that later.

From a fundamental perspective the German DAX is slightly more complicated. The recent appreciation of the euro currency has hurt manufacturers, especially at a time when the ongoing COVID-19 lockdown is hurting German business sentiment.

Should we see the European Central Bank talking down the euro currency, as they have recently done, then this will be seen as a positive for the German DAX. The inverse correlation between euro weakness and GER 30 strength is strong.

The drop in German GDP during 2020 was not as severe as many economists predicted, and the German economy continued to outperform most European nations. This is also bullish for the German DAX, especially if we consider that the Ger 30 would then remain more attractive to fund managers and pension funds.

Manufacturing activity in the German economy is positive, however, recent readings have shown signs of stagnation rather than stability. This Friday’s preliminary PMI manufacturing reading certainly has the ability to either boost or hurt the German DAX.

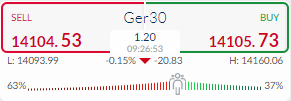

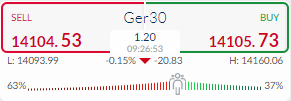

Looking at the ActivTrades Market Sentiment some 63% of traders are bearish towards the German DAX despite the index continuing to hit fresh record highs above the 14,000 level. I suspect the index will continue to head higher while sentiment remains negative, as retail traders lean against the prevailing bullish trend.

German DAX Short-Term Technical Analysis

The four-hour time frame shows that a bullish inverted head and shoulders pattern has recently formed and is projecting an upcoming move towards the 15,000-resistance level.

According to technical analysis buyers need to maintain the price above the 14,150 level to activate the bullish pattern. Key downside spots to buy into pullbacks in the index are located around the 14,000 and 13,950 levels.

Sustained weakness under the 13,780 level would invalidate the bullish pattern and would likely cause a sharp decline towards the 13,500 area.

Source By ActivTrader.

German DAX Medium-Term Technical Analysis

Looking at the higher time frames the daily chart shows plenty of scope for upside potential, due to the fact that the index is trading above the neckline of a bullish ascending triangle pattern.

As long as the price trades above the 13,780 level the pattern is in play, which has huge upside potential of nearly 5,000 points. This would imply that the long-term target for the German DAX is around 18,000.

Source By ActivTrader.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.