Market Brief

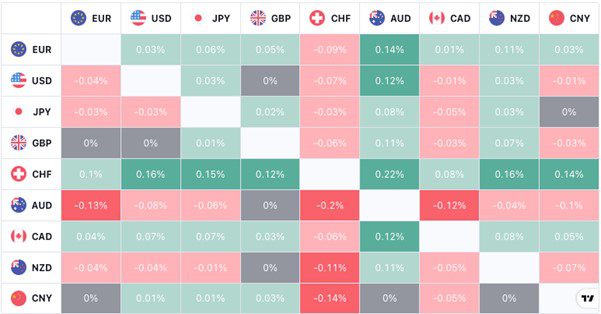

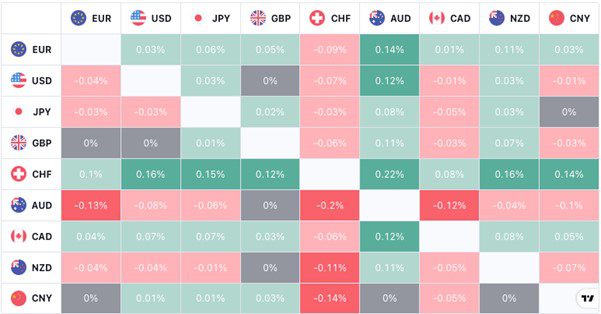

When it doubts, it is best to stay out. And the forex heatmap is showing no sign of direction for the wider market. At the start of the London session the USD and yen crosses have traded withing a tight range and show no signs of wanting to leave them ahead of the US non-farm payrolls number this afternoon.

See real-time quotes provided by our partner.

The Australian dollar closed above the daily 200-period EMA yesterday and is currently finding support at the 0.7250 level, which is confluent with the 50% retracement level from the recent significant high to the most recent significant low. The good news about China reopening cities after lockdown had encouraged commodities higher which is good for the Aussie and Kiwi.

See real-time quotes provided by our partner.

The euro is also gaining on the greenback and is approaching the resistance level of 1.0800. The lower time frame shows that the EURUSD has compressed between 1.07630-1.07320 and the longer the compression lasts the more the pop is likely to lead a greater expansion.

Volatility as expressed by the VIX has come down to 25 and the daily 200-period EMA which indicates that the market ranges are less likely to expand as much as they did in April to May when the VIX was rising towards and then breached the 30 level.

See real-time quotes provided by our partner.

The UK is on the 2nd day of the Queens Platinum Jubilee bank holiday, so UK equities are closed. However, the pound is rising against the dollar at the start of the London session on no scheduled news and very little headline news during the London session. The sleepy markets across the forex pairs does feel that those traders that are at their desk are waiting for the US average hourly earnings, NFP and Unemployment rate data, so they can get a better idea of how well the jobs market is going, after the Fed moved rates up.

See real-time quotes provided by our partner.

Consumers, governments, and central banks are all keen to see the price of energy come lower, to ease the increasing burden of rising inflation. Central banks are doing their best to destroy demand and have now started to worry CEO’s with regards to the recessionary period that is being proposed. Whether you’re the top banker and calling impending economic conditions a Hurricane or an electric car maker calling for a 10% reduction in the work force as Jamie Dimon and Elon Musk have stated respectively, the warnings are being put out there for us all to get into the brace position. Luckily the economic data like the recent US ISM Manufacturing PMIs have not yet confirmed these fears. OPEC+ yesterday agreed to increase production to help fill the hole in the supply to Europe, which could lead to oversupply, if Russia can sell all its oil to China, India and the other friendly countries.

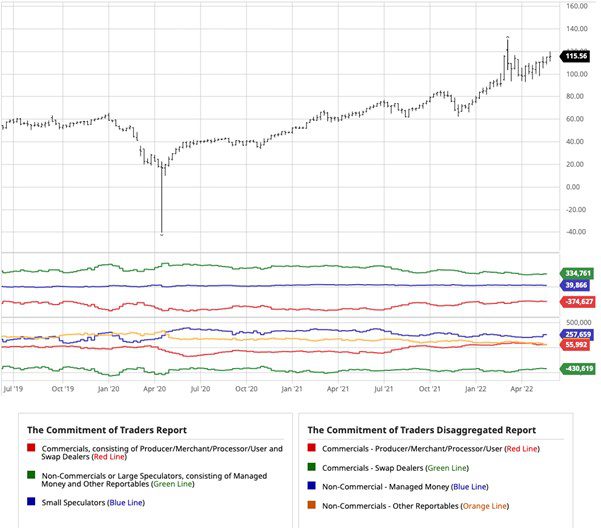

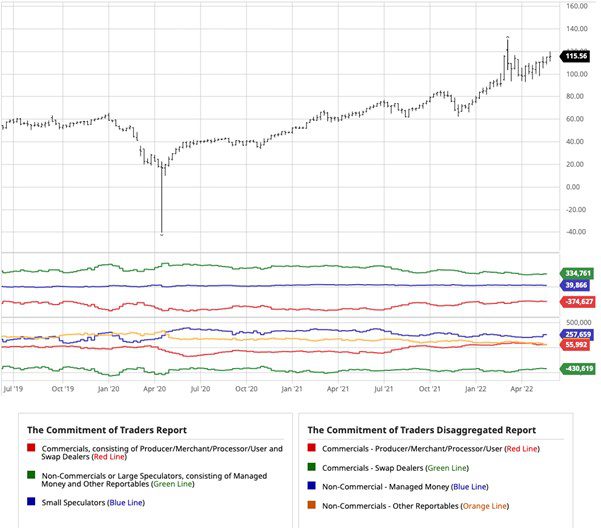

For refiners or producers of oil, the recent years have been good, and although the price of oil may be high, the amount of drilling and exports have helped the US at least, since they are net exporters and have received more cash for their product. In the Commitment of Traders report, we have started to see red lines edging down, which means that Commercials are adding to their short positions, which locks in these higher prices and puts more selling pressure on the market, which speculators who are long would be required to absorb to keep prices up. If the speculators decide to ease off, the price of crude will come lower, especially if the central banks cause a recession and destroy demand for commodities.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.