Copper broke above the $400.00 benchmark level on Monday, as the metal reached its highest level in nearly a decade as traders and investors continued to bet that supply tightness for the increasingly popular metal would increase as the world comes out of lockdown.

The price of copper had been threatening to break into a much higher trading range over recent weeks. A notable inverted head and shoulders pattern has been unfolding on the daily and weekly time frame as copper bulls continue to take out big technical levels.

Market participants have turned increasingly bullish towards commodities this month, with iron ore and oil posting massive gains on a yearly basis already as the so-called commodity super cycle goes into overdrive in 2021.

Copper has been rallying due to the belief that the bellwether industrial metal will benefit from increased demand once developed and emerging economies come out of lockdown, and fear of supply tightness in the physical market.

Another factor in play is the reflation trade. Following years of low inflation traders and investors are predicting that inflation will return due to the massive amount of government and central bank spending during the pandemic.

Financial markets are typically forward-looking, hence why copper is rising on the prospect of increased consumption and a return to some type of normality. Additionally, the Chinese economy is continuing to perform well and is widely tipped to remain the engine of growth for the world this year.

At the start of the week, the SHFE contract in China hit its upper trading band or daily limit as metals posted blockbuster gains. Silver more than recovered last week’s losses, and the price if tin rose to its highest level since 2011.

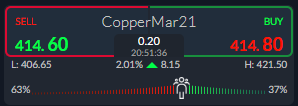

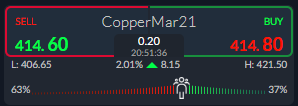

The ActivTrader Sentiment Tool is calling the current move higher in Copper. Usually, the best way to trade this great indicator is to look for one-way sentiment skews that are going in the opposite direction of price.

The ActivTrader Sentiment Tool is currently showing that some 63 percent of traders are leaning against the current move higher. The skew is not massive but certainly shows that the majority of traders are still on the wrong side of this move.

Copper Short-term Technical Analysis

Looking at the lower time frame, a bearish head and shoulders pattern that was invalidated earlier this month has reached its bullish target. The $400.00 level now becomes former key resistance now turned support.

Something to note about commodities is the power of the trends they form. Once they start to break out and form new trends, they tend to stick to that designated price direction, and quickly take out big psychological numbers. The $450.00 level is therefore the next short-term resistance area to watch.

Source by ActivTrader.

Copper Medium-term Technical Analysis

Looking at the weekly time frames, a massive inverted head and shoulders pattern has formed and been activated, now that copper has the reach and surpassed the $400.00 benchmark level.

According to the overall size of the bullish reversal pattern, copper prices could rise towards the $600.00 level if bulls start to take control above the $400.00 level, which they are now.

As previously noted, copper could soon start to take out big psychological levels on the chart, such as $450.00, $500.00, and $600.00.

Source by ActivTrader.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.