Copper is holding above the $400.00 benchmark level this week, despite the continuation of last week price slump in the value of gold and silver. The trend of industrial metals outperforming gold and silver looks set to remain in place in the short-term, which bodes well for the price of copper.

From a technical perspective, it is extremely positive that copper is holding the $400.00 level, despite the rout in the precious metals space. The $400.00 level has effective become former key resistance turned key support on the price chart.

Analysts have raised some concerns about copper at current levels. Speculation about the end to the supply glut in the red metal is one reason why metal analysts are expressing doubts that copper can hold at current levels in the next quarter.

When looking at seasonality trends, copper tends to peak around May time on the calendar, meaning that copper still has plenty of time to run to the upside over the next few weeks and months. A lot will depend on the US and global economic story to keep the ongoing reflation trade going.

Signs of inflation in the US economy and rising bond yields could be extremely bullish for copper prices over the medium to long-term, meaning that the copper trade is still getting warmed-up and could still be in its infancy.

The London Metal Exchange has also said that demand for copper is recovering outside of China. This is surely a positive sign, as demand from the Chinese economy has been a major tailwind for copper prices over recent months.

Going forward, the big test is going to be whether copper can hold the $400.00 support level during periods of further price depreciation and down moves in gold and silver prices. Copper will look even more bullish if the key $400.00 level holds, and bulls take-out the February high.

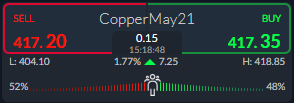

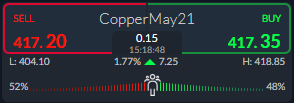

The ActivTrader Sentiment Tool is currently showing that only 52 percent of traders are bearish towards copper, this has come down from last week when 63 percent of traders were leaning against the up move.

This could imply neutral or range-bound conditions over the coming week, and an end to the blockbuster move higher, for now. For example, copper may need to correct lower before it moves higher again.

Copper Short-term Technical Analysis

Looking at the lower time frames, a bearish head and shoulders pattern has started to form, following the strong rejection from the $437.00 resistance level last week.

The neckline of the pattern is located around the pivotal $400.00 level. This now becomes former key resistance now turned support.

A break under this level exposes a potential drop towards the $370.00 level, while a break above $437.00 level could see copper surging towards the $475.00, and potential the key $500.00 resistance level.

Source by ActivTrader.

Copper Medium-term Technical Analysis

Looking at the weekly time frames, the big picture for copper prices still shows a massive inverted head and shoulders pattern, which is activated while the red metal trades above the $400.00 benchmark level.

According to the overall size of the bullish reversal pattern, copper prices could rise towards the $600.00 level if bulls can continue to hold the price above the $400.00 level.

Source by ActivTrader.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.