Sentiment towards a number of key commodities is starting to turn overly bullish according to the ActivTrader platform Market Sentiment tool this week. This interesting sentiment dynamic should be watched closely, as it potentially hints that certain key market trends in the commodity space may be about to reverse.

The ActivTrader platform Market Sentiment tool offers a key insight into how retail traders are currently positioned and thinking in real-time from a sentiment perspective. This can be particularly useful for identifying new trends and for potential trend reversals.

Typically, Market sentiment readings for an instrument that have reached around 75 to 80 percent are considered to be at an extreme level, while market sentiment over 90 percent is often an indication that the trade could be peaking, and about to reverse at any time.

Sentiment reading above 60 percent should be watch closely, especially if the market is moving in the opposite direction to Market Sentiment, and sentiment is rapidly increasing. Neutral readings on the Market Sentiment tool typically suggests range bound conditions.

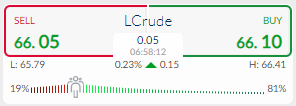

Crude Oil – Overly bullish

According to the ActivTrader Market Sentiment tool some 81 percent of traders are currently bullish towards the Crude oil. This is interesting as the increasingly popular commodity since late 2020 and early 2021 has posted five months of straight trading gains and is in the midst of a powerful bullish trend.

This bullish sentiment skew shows that traders are on the correct side of the trend and expect oil prices to rise this week. It should be noted that retail traders typically have poor market timing and exit trends too early or enter prevailing trends towards the end of the established trend.

Whether retail traders are correct remains to be seen, however, it is extremely worrying that 81 percent of traders expect more upside since the retail crowd have been bearish towards crude oil during its record run higher.

Source By ActivTrader.

Silver – One-way skew

The market sentiment tool shows that some 84 percent of traders are bullish towards the shiny-metal metal right now. This is the largest one-way sentiment skew in the commodity space right now and highlights that retail traders believe silver is going to rise from current levels.

It should be noted that the retail crowd have been extremely bullish towards the price of silver during the metals heavy decline from $28.40 to $24.80 over recent weeks.

If history repeats itself then now may not be the time to buy silver. Typically, we need to sentiment neutralize amongst the retail crowd, or even a slight negative skew for the price of silver to begin to recover.

Source By ActivTrader.

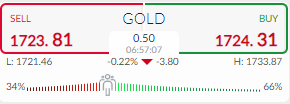

Gold – Turning bullish

Market sentiment on the ActivTrader platform currently shows that 66 percent of traders are bullish towards gold right now, following last week’s strong technical bounce from the $1,670 support zone.

This is not an extremely large sentiment extreme, however, it should be watched closely if the sentiment remains at elevated levels, and the price of gold start to falter below the $1,700 level once again.

It could be interpreted, that yellow-metal bulls are starting to get too confident about last week’s recovery back above the $1,700 level. The metal broke its three-week losing streak last week; however, gold is still heavily under water on a monthly and annual basis.

Source By ActivTrader.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.