Market Brief

See real-time quotes provided by our partner.

Reserve Bank of Australia board minutes show the Australian economy has been resilient in the face of global and domestic supply shocks, including the Ukraine conflict, the Omicron outbreak, and floods on the country’s east coast.

The RBA noted the monetary policy settings continued to support the post-COVID recovery and that commodity price increases have significantly boosted national income. The members noted a recent increase in iron ore and metallurgical coal prices. The reason for this was mainly the easing of restrictions on steel production by the Chinese government. The Chinese authorities are also expected to ease fiscal settings over the course of the year to support GDP growth in 2022. The Australian economy also showed signs of strength in the labour market, with unemployment falling to a five-decade low of 4% in February.

In addition to raising the interest rate on new home loans and business loans, the RBA will stick to maintaining the cash rate target at 10 basis points.

The AUDUSD has bounced off the rising trend line and is about to push through yesterday’s highs, indicating there could be further upside and that the 50-period moving average is acting as dynamic support.

See real-time quotes provided by our partner.

Also in the Asia-Pac session, Japanese industrial production was revised much higher. This is seemingly very bearish the yen as the USDJPY continues to push at an exponential rate towards 130.00 having only dipped slightly back towards 120.00 to test for support during March. The monetary policy divergence between the BoJ and the Fed is the greatest driver of this meteoric rise as US bond yields push towards 3% and the BoJ are willing to keep intervening in their bond market so as not to allow the JGBs to go above 0.25%.

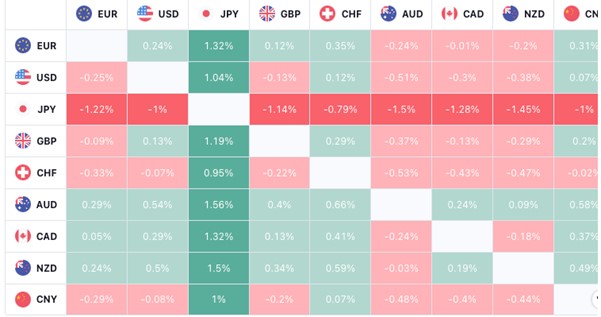

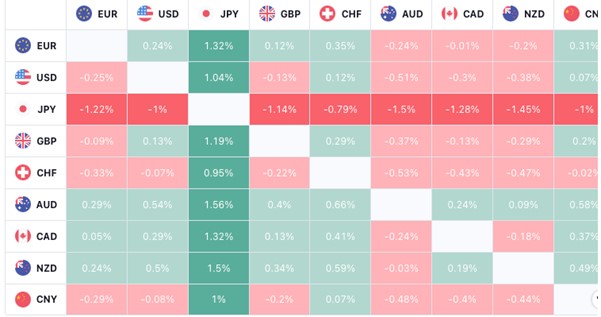

The YouTrading forex heatmap shows that the yen is current the weakest currency and that the Australian dollar is relatively the strongest. The bottom left corner is mainly green, which indicates that the commodity pairs are doing well this London session and that the flows out of the safe havens will encourage a more risk-on day today.

See real-time quotes provided by our partner.

Gold found the $2000/oz level to be a solid ceiling and then proceeded to fall back into the previous balance area, where we are now looking for buyers to step in and take the price back up to the swing highs. If the buyers fail to turn up the next stop will be the dynamic support from the moving averages.

The ActivTrader sentiment indicator shows that the traders in gold are fairly matched but the bias in the silver trade is still towards longs, which could indicate a squeeze is more likely to the downside.

See real-time quotes provided by our partner.

Brent has not managed to get back above yesterday’s highs, so this could signal a change in momentum and possible retrace back to value. $113.67 is the swing highs, daily low and this is the level I am using as a guide to whether resistance is holding or not. The target to the downside would be the highs from the 11th of April 2022.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.