Market Brief

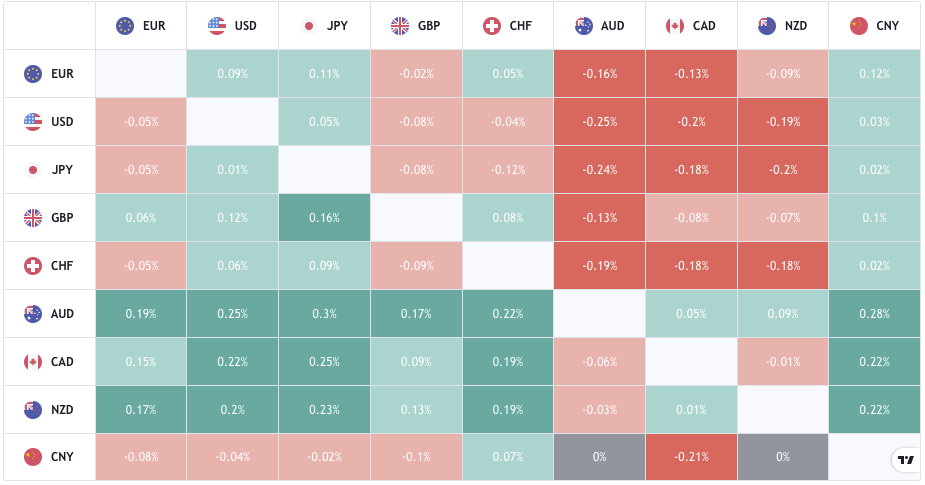

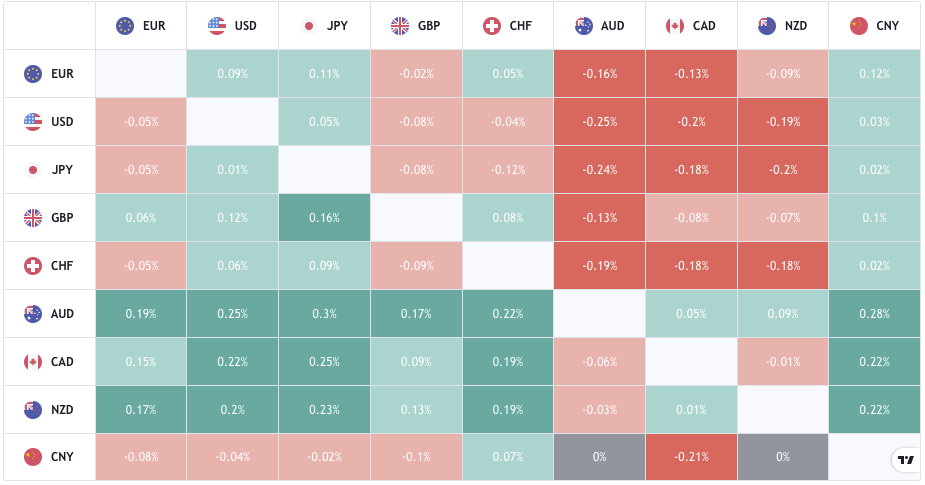

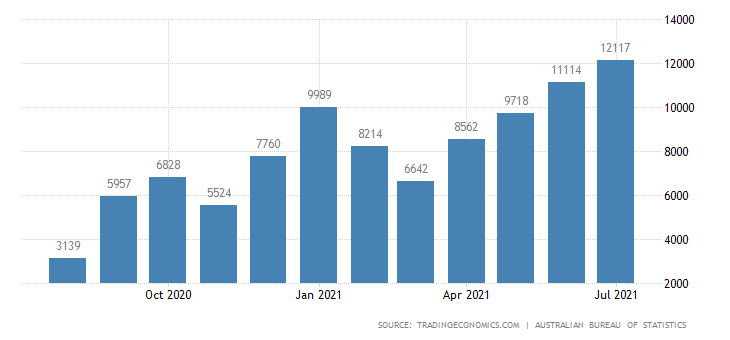

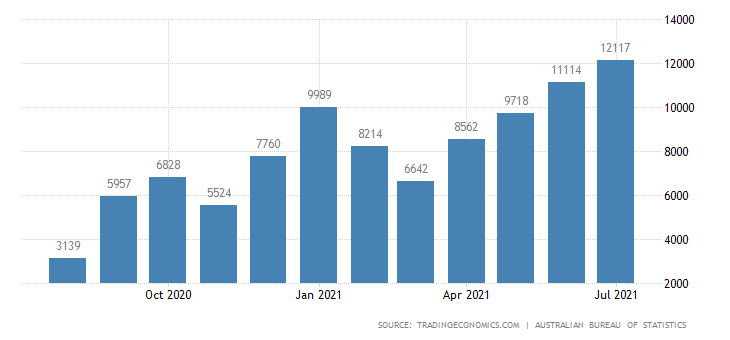

The forex heatmap at the London session open shows that the Antipodean currencies are bullish again with the largest relative strength in the Australian dollar. In the Asia-Pac session the Australian Balance of Trade data showed an increase for the fourth consecutive month which comes on the back of good GDP growth YoY.

The good news out of Australia surrounding covid is less forthcoming but one positive is that the New South Wales authorities reported that 70% of eligible persons have had their first jab. Infection rates continue to rise, and this will dent the economy if it persists to cause lockdowns and disruptions to business.

See real-time quotes provided by our partner.

For now, the AUDUSD is climbing off a decent demand level on the weekly chart and is set to keep rising on the back of a weaker greenback.

See real-time quotes provided by our partner.

The Nikkei 225 has risen on talks around new monetary easing measures being proposed by the Bank of Japan as Japan’s former foreign minister Fumio Kishida urged the government to come up with a new stimulus package to help the fight against the pandemic. The Shanghai Stock Exchange, Nifty 50 and Nikkei had all risen following on from the US new all-time highs as the mood remains risk-on for equities.

Today the US initial jobless claims data could be a turning point in the markets but the focus this week is still the NFP data tomorrow. This morning there will be PPI data out of the Euro Area with producers’ prices YoY expected to rise to 10.9%.

See real-time quotes provided by our partner.

The EURUSD is still pushing on the 1.1850 level of resistance and a break above this falling wedge pattern should result in a rise higher in the single currency. Maybe we must wait for the 20 and 50 ema to get above the 200 ema before getting a clear momentum break. A big move in the nonfarm payrolls tomorrow will be the decider for a move in the EURUSD direction up to the September FOMC meeting at least.

See real-time quotes provided by our partner.

For today I see the US dollar index testing towards the 200-period moving average on the back of an increased number of Initial Jobless Claims. A figure above 353k and an upwardly revised number from last week would be bearish the US dollar. Other negatives to watch out for are the end of moratoriums for evictions, which could see families struggling soon. As low-income and unemployed people will be losing their supplementary income of $300 per week as of next week. Positives to watch for would be an increase in stimulus from the $3.5trl spending bill but that requires the debt ceiling to be suspended or raised.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.