Morning Brief: 15/04/2021

The Australian dollar popped and then dropped against the US dollar this morning, despite a stellar monthly jobs report from the Australian economy. The March jobs report almost doubled what the market was officially expecting, sending the AUDUSD towards the 0.7750 level, before the pair pulled back towards the 0.7700 handle.

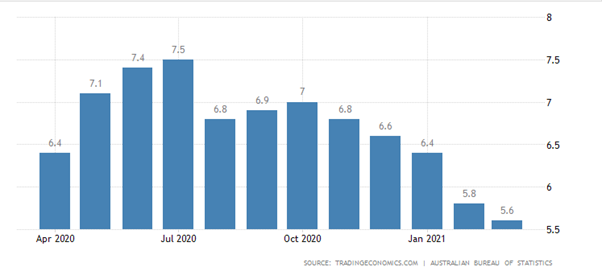

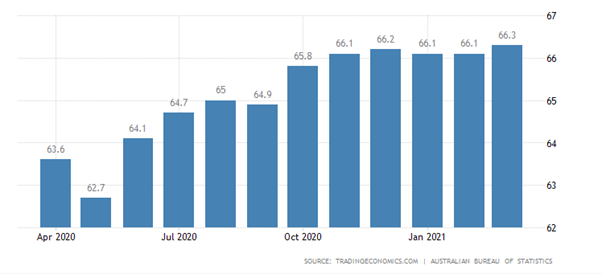

Data from the Australian Bureau of Statistics showed that the Australian economy created over 71,000 new jobs in the month of March. The official Australian unemployment rate dropped 0.2 percent, to 5.6 percent, while the labour participation rate increased to 66.3 percent.

March’s jobs report from the Australian economy also racked up some impressive records. The labour participation rate hit a new all-time high, while aggregated work hours hit a fresh all-time high as well. The unemployment rate was also at its lowest in a year.

The greenback is starting to firm slightly this morning, after the Beige Book revealed a more optimistic outlook towards the US economy and price. Although, on a weekly basis the US dollar index is still heavily in the red on the week.

In terms of other market news this morning, the People’s Bank of China drained one-year funds from its banking system. The PBOC conducted a 1-year MLF, raising fears that the central bank is pulling back on stimulus.

The Russian ruble currency is tumbling today against the euro and the US dollar this morning, as the United States is expected to place very severe economic sanctions on Russia in response to recent cyber hacks.

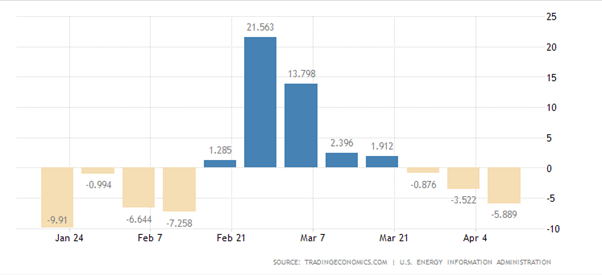

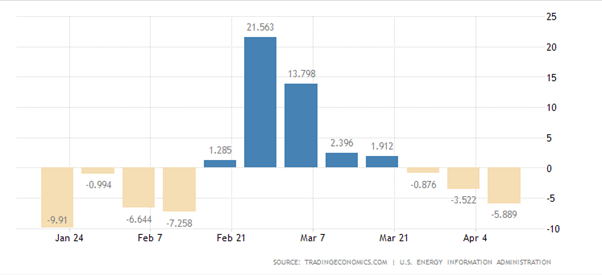

WTI Oil has moved back the $63.00 level, following yesterday news that US crude oil stockpiles are tightening. The EIA stockpile change report revealed a draw of -5.988 million barrels, with east coast oil inventories at a 30-year low.

Gold and silver prices are still trading in no-mans land this morning, as precious metals search for a new short-term price trend. Both the yellow, and the shiny metal, are trapped in a narrow range, and are poised to breakout at any time.

Coinbase’s IPO appeared to go smoothly, with the leading US crypto exchange spiking towards the $428.00 level, after having an IPO listing opening price of $250.00. Coinbase closed the day around the $320.00 level.

Data Watch

The economic calendar in the European session is focused on consumer price index inflation numbers from the French and the German economies. The German DAX and the CAC40 are both trading sideways this morning.

See real-time quotes provided by our partner.

During the US session financial markets will be closely focused on the release of US retail sales and US weekly jobs data. Retail sales are expected to come in very strong, while weekly jobless data is expected to show an improvement after recent weekly rises this month.

In terms of market themes, traders are likely to fixate on the bond market, particularly the 10-year yield, and whether this week’s strong CPI inflation number, and potentially today’s impressive retail sales number can change how the Federal Reserve feel about the US economy.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.