Market Brief

See real-time quotes provided by our partner.

The GBPUSD has started the London session lower after this morning’s data from the Office of National Statistics (ONS). The pound had been trading within a tight range after last week’s big bullish reversal on the rate hike from the Bank of England. The subsequent inside day chart pattern has now started to break lower with the bears taking full control of this market should they get back below the 1.20399. There is a chance that as CPI data came in as expected that this break lower is a false break, and we trap short sellers. An acceleration through the 1.24060 level would be confirmation of that happening. Momentum is bearish currently and that tends to lead price action, so I do favour the short side of the market today. Especially as we have Fed Chair Powell’s first day of testimony later which will most probably indicate that the Fed will focus in on inflation, with rate hikes a plenty this year.

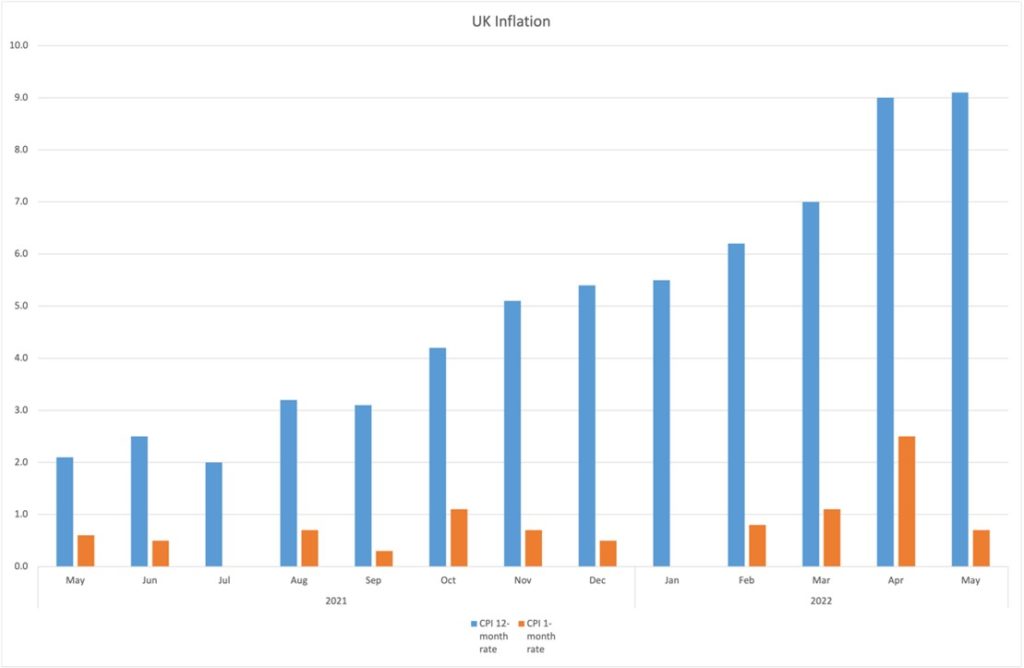

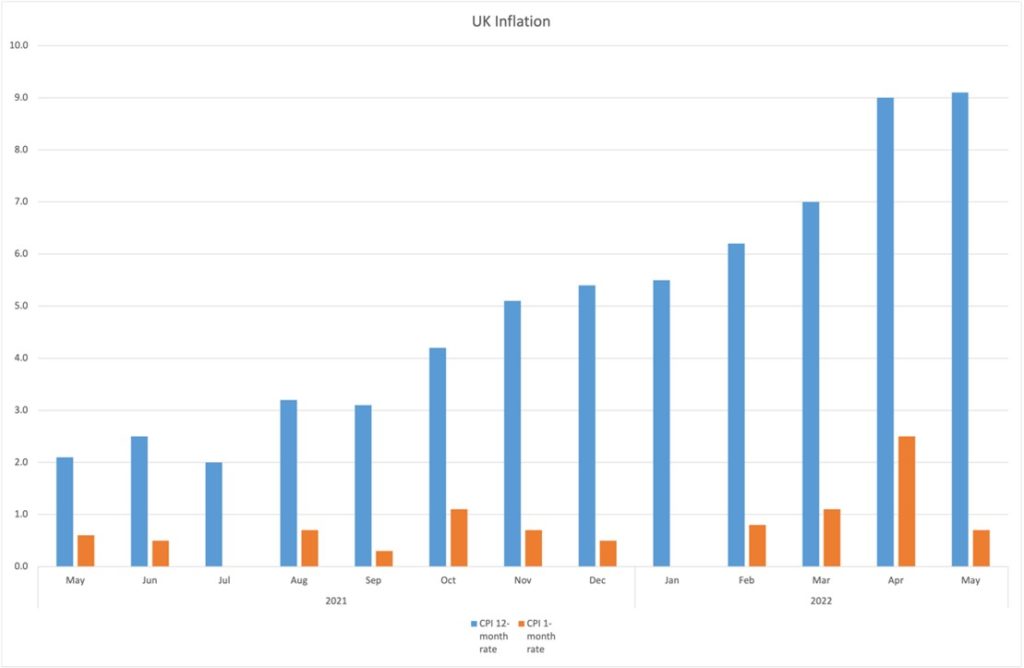

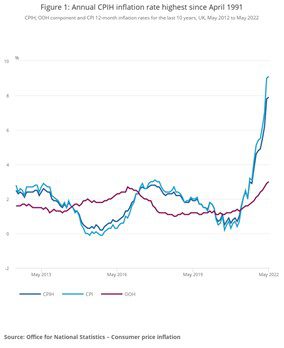

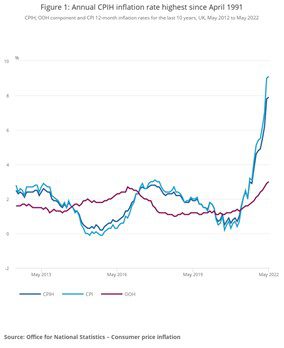

The headline Consumer Prices Index (CPI) rose by 9.1% in the 12 months to May 2022, up from 9.0% in April. On a monthly basis, CPI rose by 0.7% in May 2022, compared with a rise of 0.6% in May 2021.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.9% in the 12 months to May 2022, up from 7.8% in April. The largest upward contributions to the annual CPIH inflation rate in May 2022 came from housing and household services (2.79 percentage points, principally from electricity, gas and other fuels, and owner occupiers’ housing costs) and transport (1.50 percentage points, principally from motor fuels and second-hand cars).

See real-time quotes provided by our partner.

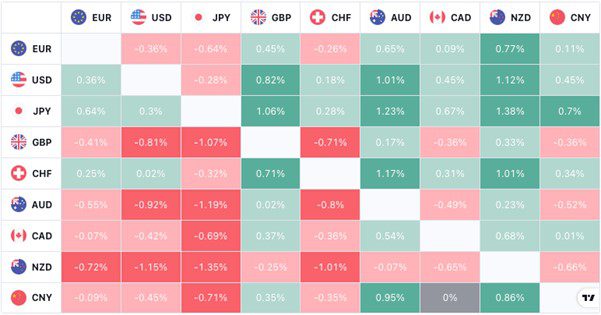

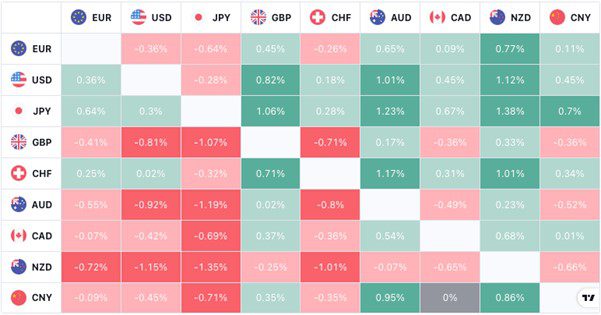

The pound is competing with the New Zealand dollar for the weakest currency this morning. The commodity pairs are weaker as the US dollar finds a bid even as the US 10-year yields continue to struggle getting past the 3.25% price level. The yen and Swiss franc are also higher indicating that the flows are going into the safe haven currencies, which means that today is starting with a risk-off sentiment and that we should expect commodities and equities to come lower.

See real-time quotes provided by our partner.

Brent has accelerated lower after finding the daily low from the 16th of June to be resistance. Looking left there are no other gaps or imbalances below these recent prices so we could be on our way to test the $95 per barrel level and possibly the daily 200-period moving average. There was talk of Germany upping their warnings on the use of gas as supplies from Russia have dropped over 60% and the European gas hubs are seeing prices rise. Gazprom are still pumping gas through the Ukraine but as we pass through the longest day the need for heating gas is lower, it’s just whether the Europeans and especially Germany can retain enough reserves to get through the winter months. Lower energy prices will encourage producers to hedge more aggressively, especially if the worry is more about demand due to recessionary pressures.

See real-time quotes provided by our partner.

With lower energy prices the yen is being supported against the major crosses. The USDJPY surged higher yesterday, and I am expecting a retest of the breakout level, but not a lot more. Momentum and price action are pointing to further gains and as 79% of traders on the ActivTrader platform are trying to short the top, I also expect this cohort to get stopped out before we have a meaningful correction. 138.80 is my upside target based on the monthly lows from August 1998.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.