Market Brief

The news that Russia has announced a partial pullback of troops near the Ukrainian border has helped to boost risk sentiment. At the London open the global equity indices are all positive today bar the Australian ASX, which is -0.51% lower than the open.

See real-time quotes provided by our partner.

Japan’s Nikkei index is trading over 2% higher this morning, while US Nasdaq futures are trading +2% higher in the out-of-hours market. As a result of softer-than-expected inflation data for January, stocks across China are also benefiting from calls for further new monetary stimulus.

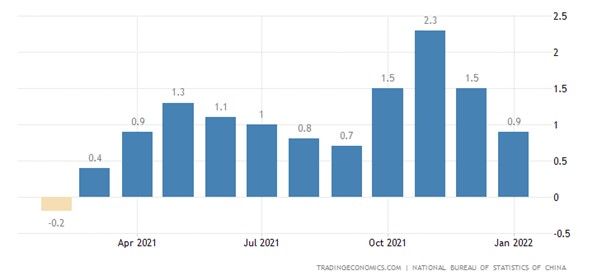

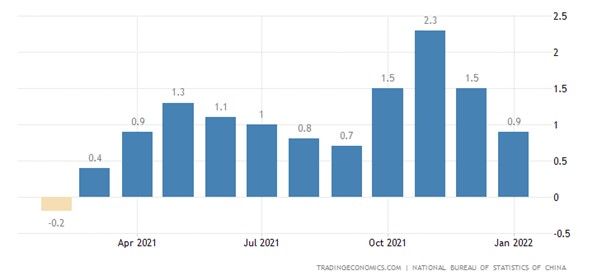

China’s consumer price index eased to 0.9% y/y from 1.5% in December, while producer price inflation eased to 9.1% y/y from 10.3%. This is the second consecutive month of decreased inflation. Which to my understanding means that they can export deflation back to the USA over the long term should this trend continue.

The US PPI All Commodities index shows a decline in the rate of change from a year ago, so this could signal the start of a deflationary cycle.

See real-time quotes provided by our partner.

The UK’s inflation data showed yet another unexpected jump in the headline rate of annual CPI, increasing to 5.5% from 5.4% in December. There are signs of fewer discounts at clothing and footwear stores as well as furniture and furnishing shops driving the increase.

Further interest rate hikes are likely because of the upside surprise. The pound is trading within a range against the US dollar but is on the upward swing. A test of the 1.3600 is highly likely and if we get a decent drop in the US dollar after the FOMC we could be at 1.3630 for GBPUSD by the end of the day.

With the talk around rate hikes in the USA the focus is on whether the market feels 25bps or 50bps is the way to go. We’ll have to wait for the reaction to fully understand what they are pricing in.

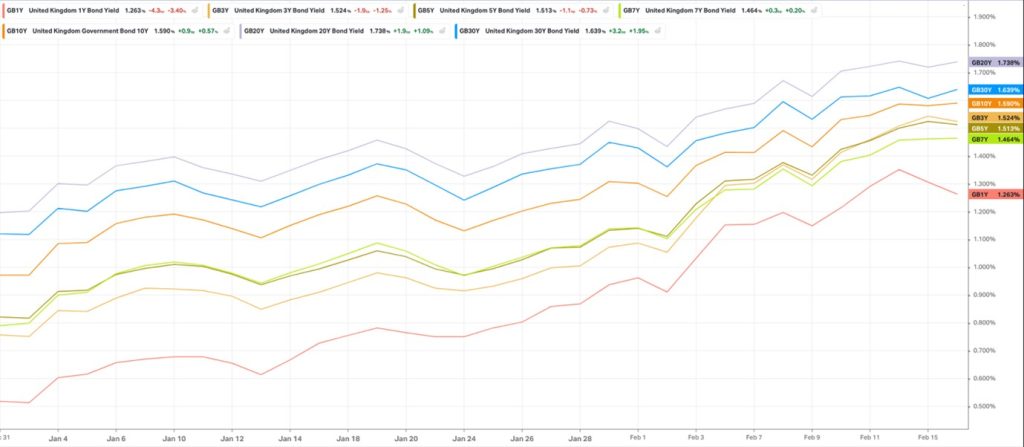

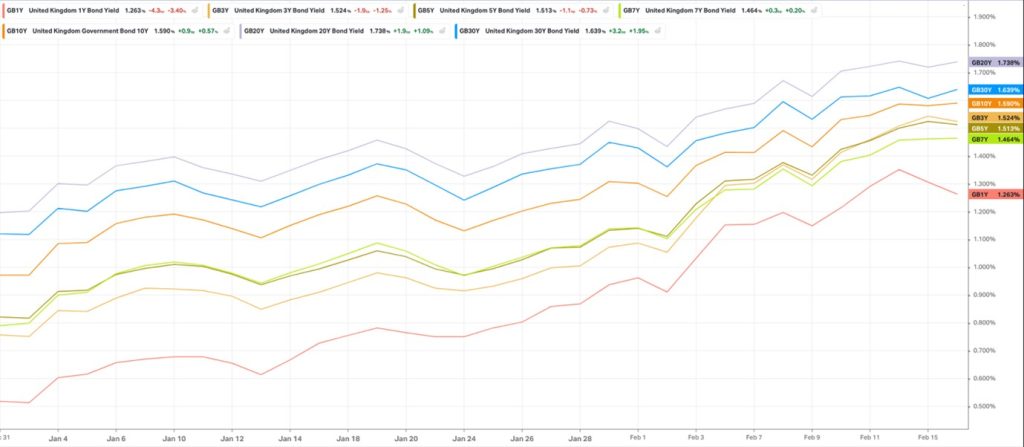

Additionally, following today’s beat on UK inflation, 3yr UK bond yields have risen marginally, and are currently trading above 1.52%. Looking at the curves, we see 3,5, & 7yr stacked on top of each other which is not a good sign for the overall economy, but this could be just signalling the next rate hike is expected soon. What we don’t want to see is the short-term yields above the long term.

In the US session we will be waiting for the US retail sales data. Following a 1.9% month-over-month slump in December, retailers will be closely watching for signs of a post-Omicron rebound. We saw a build in inventories and bank credit during this period, so if we get good retail sales too that will be very bullish for the corporate profits this quarter. Also in January, US industrial production is expected to have risen by 0.5% after falling by 0.1% in December.

See real-time quotes provided by our partner.

While tensions between Russia and Ukraine seem to be easing, oil prices remain elevated, hovering around $93 per barrel in Brent. There has been an intraday break of the market structure, which is showing an element of weakness. Profit-taking is likely the cause, but momentum could now build to the downside assuming the $94 level acts as solid resistance.

See real-time quotes provided by our partner.

The USDCAD is coming down to test the bottom of the recent range. I can see this following through to the downside stopping out anyone who is long currently.

The ActivTrader sentiment indicator is showing an extreme number of traders on the platform are bullish and as a contrarian signal, we can be short until they ease up on that position or get stopped out.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.