Market Brief

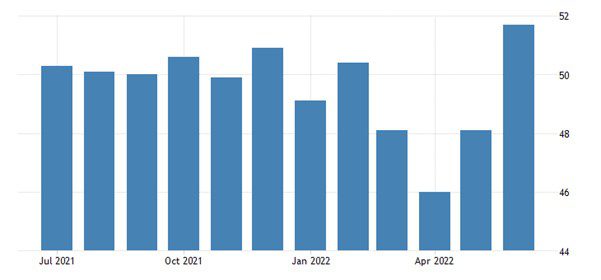

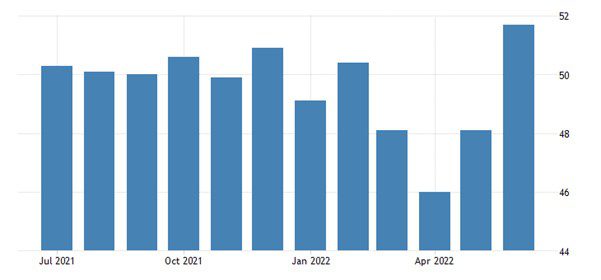

Caixin China’s general manufacturing PMI jumped to 51.7 in June, up 3.6 points from the previous month and its highest level in over a year. Recovery was a result of easing regional Covid-19 lockdowns and other restrictions. Manufacturing supply expanded and demand increased. Following the relaxation of Covid restrictions, manufacturing production gradually returned to normal. The output gauge jumped to its highest point since November 2020 after three months of contraction. Although manufacturing demand did not recover as strongly as supply, the subindex for total new orders rose above 50 for the first time in four months, and the index for new export orders again entered positive territory for the first time since this time last year. Today’s market focus will be on the US ISM Manufacturing data, which is expected to come in below the previous reading of 56.1.

See real-time quotes provided by our partner.

The USDCNH found the 61.8% retracement to be resistance at the first time of asking in May 2022. The month of June then proceeded to trade within May’s price range. This could be a bullish consolidation and July has opened more positively for the dollar against the Chinese yuan.

See real-time quotes provided by our partner.

The US dollar was also able to close above a significant resistance level with $103.80 now potentially significant support. June’s bullish close above the swing high from 2020 and 2017 is on any other timeframe seen as a clear breakout, so expectations are that the US dollar now goes higher against the euro, yen & pound. If the US dollar index were to close back below the $103.80 at the end of July, that signal would be very bearish and interpreted as a sweep of the resting orders at $105. Personally, I will be looking to sell the rips in EURUSD and buying the dips in the USDJPY, until proven otherwise.

See real-time quotes provided by our partner.

Rising energy costs have stalled since Brent peaked in March 2022. The $135.80 and $95.20 levels are significant resistance and support as the market has traded sideways for the last 3 months. We haven’t seen a new monthly low for 7 months, so if July can take out June’s low that would be an early significant bearish development.

This morning’s Eurozone S&P and UK S&P June manufacturing PMIs are final estimates, although we will get the first readings for Italy and Spain. The final PMIs are expected to confirm earlier flash estimates. The Eurozone survey was particularly weak with the composite index dropping to 51.9 in June, the weakest since early 2021, reflecting contraction in manufacturing and fading pent-up demand for services. There are also flash inflation readings to watch out for at 10am with HICP for June that is likely to come in hotter than the previous reading of 8.1%.

See real-time quotes provided by our partner.

The EURUSD is compressing at some significant lows and within the price range printed in May. A push lower beyond the 1.0349 is a very bearish signal and is highly dependent on the war in Ukraine, energy supply shocks, rising inflation, monetary policy transition and a whole host of other potential problems. Which could mean the price reverses higher and short squeezes everyone, as the sentiment around Europe is very low. Until we get a breakout of the May range, there is little to do.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.