Market Brief

During the overnight session, we had the last of the central bank rate decisions as the Bank of Japan decided to keep rates held at -0.10%. The BoJ last changed its rate in February 2016 and today Kuroda said that upward pressure is seen in bond yields and that a rapid weakening of the yen is a weakness for the economy. There is also no decision to raise the yield curve control (YCC) cap as it could result in higher yields and a weakening of the effect of monetary easing.

See real-time quotes provided by our partner.

At the London open the USDJPY had pushed through the resistance level of 133.50 and is on track to make a new high for the week, as the currency pair resume its uptrend. For a new high to print and look like a continuation of a trend, we would be best seeing the US dollar rising from 104.420 up to the new high of 106. Currently, the US dollar index is being capped by Wednesday’s low.

According to the US 10-year yield, the price action on Wednesday also appears to be acting as a near-term barrier to the continuation of the uptrend. USDJPY is closely correlated with US benchmark yields, so a continuation of the correlation would be best. We will receive the Fed’s monetary policy report and hear a short speech from Fed Chair Powell. Until the market hears what is to be said, these data points may hold back the US dollar. Just in case Powell walks back some of what was said on Wednesday during the press conference.

See real-time quotes provided by our partner.

Following on from the Bank of England 25bps rate hike, which had a few of the MPC members calling for a more hawkish policy, the GBPUSD closed yesterday very bullish. We now wait to see if the not so aggressively bullish US dollar supports the GBPUSD in its quest to find a higher high today, and whether the high from Wednesday acts as support for cable. The pound is reliant on the greenback weakening as the UK economy is certainly not showing signs of growth or prosperity and the BoE seem reluctant to do what the Fed and SNB have done which is to attack inflation more aggressively. Inflation pushing double digits will erode the purchasing power of the pound.

See real-time quotes provided by our partner.

Brent continues to trade within a tight range and is hugging the daily 9-period EMA. This morning we learned that Australia has invoked measures to ban the export of coal if needed to avert the risk of blackouts. The Australian Energy Council said that coal fire generators restored 1900 megawatts of capacity to ease the power crisis. We also learned that French pipeline operator GRTgaz said that inbound gas flows from Germany have stopped amid reduced deliveries from Russia. As gas gets turned off energy companies will turn to alternative fuels like coal and oil. In the US President Biden is determined to punish the oil and energy industry with a windfall tax to try and ease inflation there. Whereas he could ban the export of oil and reduce the tariffs on Chinese goods and reduce the cost of petrol at the pump and consumer goods. Both of which were Trump ere ideas and therefore a political win for Biden if he reduced inflation.

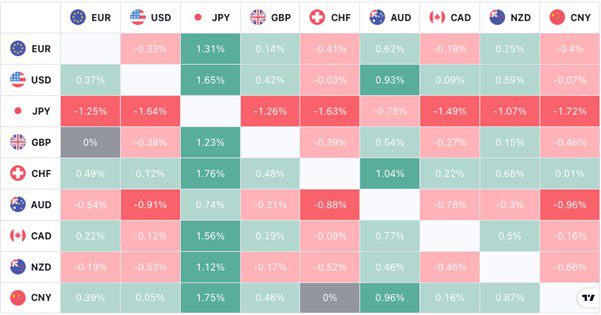

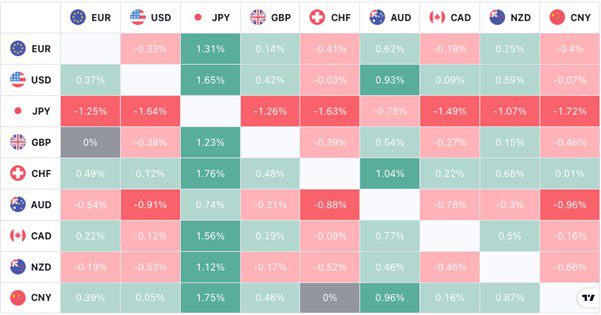

The forex heatmap shows the weakening Japanese yen and Australian dollar with the Swiss franc still strengthening after yesterdays SNB hawkish pivot. Overall, the markets are mixed, so no real risk-on or off direction. Maybe after we receive the European final CPI data we will have a better idea of which way the euro is going to go and that will help with the US dollar index direction.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.