Market Brief

Yesterday’s trading was very subdued due to the market waiting for a possible surprise in tone from the FOMC meeting minutes. As it turns out, the market had priced in all the data and didn’t have to reconsider its positioning, as all the members were in favour of the last rate hike, and most are expecting the Fed to keep raising by 50bps over the next 2 meetings.

The major indices are mixed as the London session begins after the Wall St. rally into the close last night. The Nasdaq is up 1.48% in after-hours trading, whereas the FTSE100 initially softened by -0.20% before reversing to trade 1.12% higher at the time of writing.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

Out of the major forex pairs, the USDJPY has moved the most at the London open with a break of the rising channel and a push below yesterday’s lows. The daily chart shows price action consolidating around the previous daily support and market structure and has broken lower than the inside candle pattern. A break lower than Tuesdays low and we could be pushing again towards the 120-124 consolidation area. We often get moves at the London open like this as traders do a lot of the days business within the first 15 minutes of the session. It’s obvious to see that there was a real need to buy some yen or sell some US dollars.

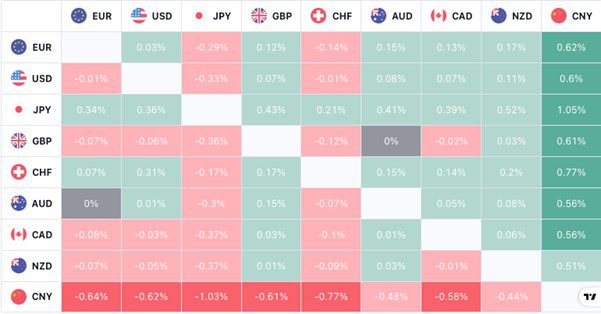

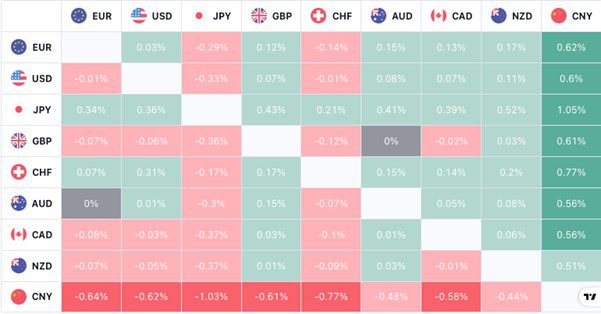

The forex heatmap shows the US dollar mixed across the board whereas the yen is strong against the rest of the currencies. The only fundamental catalyst I could find for such a move was at 8.01am the Bank of Japan’s Kuroda said when “exiting easy policy, they will combine rate hike and balance sheet reduction through specific means, timing to be dependent on developments at that point”. Which may be the first time the market has heard him talk of anything but easy monetary policy. This morning the BoJ offered to buy an unlimited amount of government bonds once again.

I am not sure how long the drop in price will last, as the ActivTrader sentiment indicator shows an extreme level of traders are shorting the USDJPY. At 74% I would be looking for reasons to fade this, so if we get back above the reaction level at 8.00am this morning, I’ll go long, with a stop below the nearest swing low.

See real-time quotes provided by our partner.

The US dollar index continues to trade below the old market structure and as the FOMC didn’t mention the 75bps rate hikes, we could get a move lower in the greenback today. There won’t be any influence from the Europeans though as the major financial districts are on a bank holiday.

See real-time quotes provided by our partner.

In the overnight session the PBOC set the USDCNH mid-point at 6.6766 which was higher than the previous day and analysts’ expectations. They also continue to inject CNY10bln into the monetary system via 7-day reverse repos, which has been a daily occurrence and relatively low compared to when the house builder Evergrande liquidity crisis was raging at the end of 2021. The main difference today was the PBoC’s notice to promote credit lending to small firms with the idea of boosting financial institutions confidence when lending to small firms. A report today details how China’s property market is weakening sharply in the wake of the Evergrande situation and the Chinese authorities clamp down on excessive borrowing. The recent COVID lockdowns are also dampening economic activity and growth, so I would expect more stimuli to come soon.

See real-time quotes provided by our partner.

The AUDJPY is also trading within a daily consolidation pattern with price action falling against the long-term momentum.

The ActivTrader sentiment tool is bearish and moving to the extremes. The relative sideways price action since the big drop on the 12th of May around the 90.0 level is annoying but I will continue to hold out for a close above the 9-period EMA with a risk:reward ratio of 1:2 trading to the long side, when the signals come.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.